Hedge funds share a few bets. These crowded systematic and idiosyncratic exposures are the main sources of the industry’s relative performance and of many firms’ returns. Two factors and three stocks were behind most herding of hedge fund long U.S. equity positions in Q2 2015.

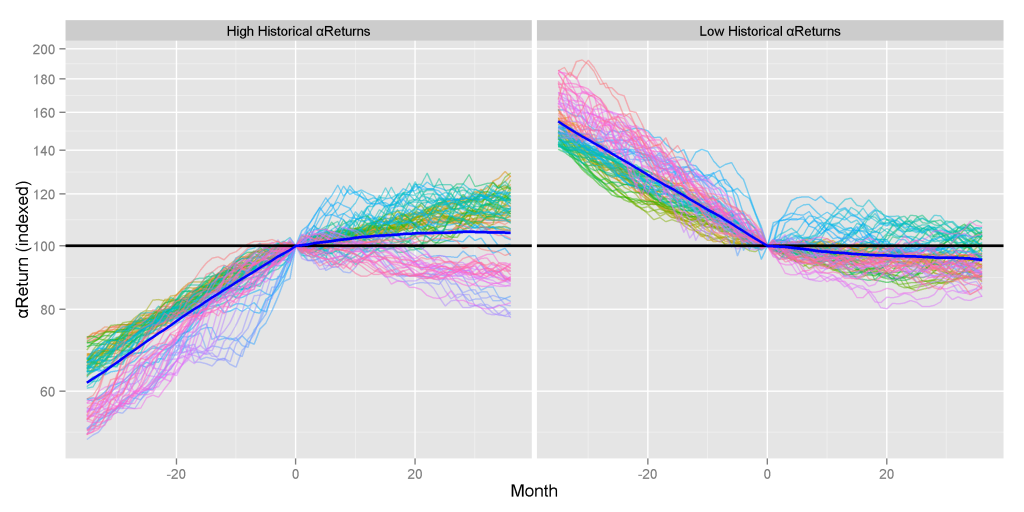

Investors should treat consensus ideas with caution: Crowded stocks are prone to mass liquidation. Crowded hedge fund bets tend to do poorly in most sectors, though there are some exceptions.

Identifying Hedge Fund Crowding

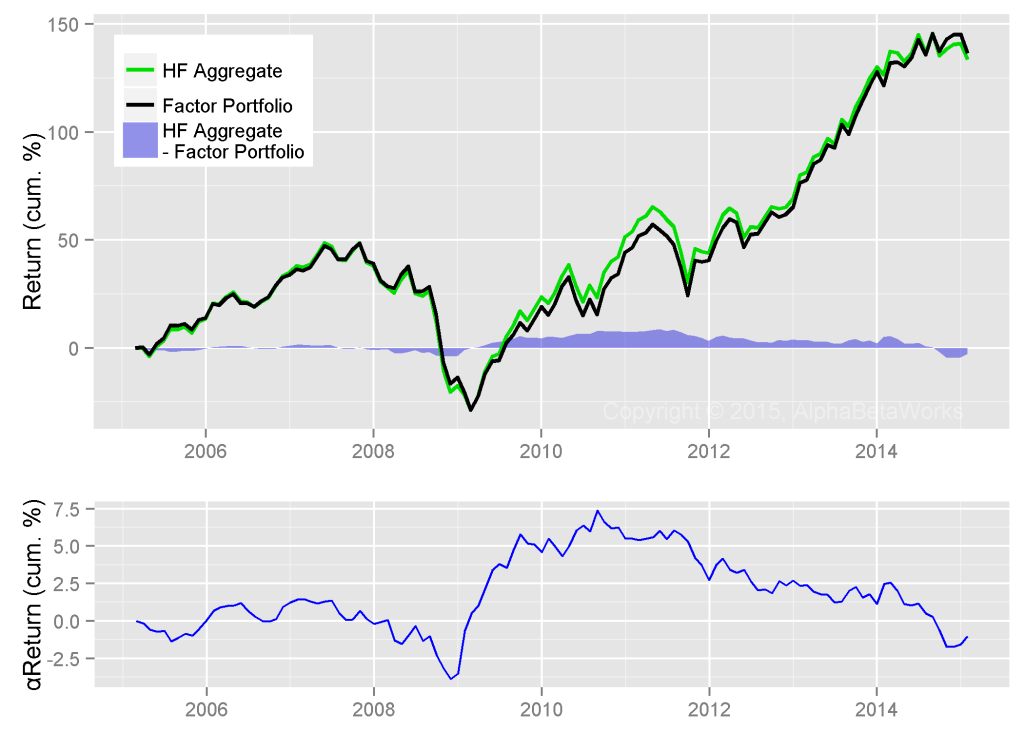

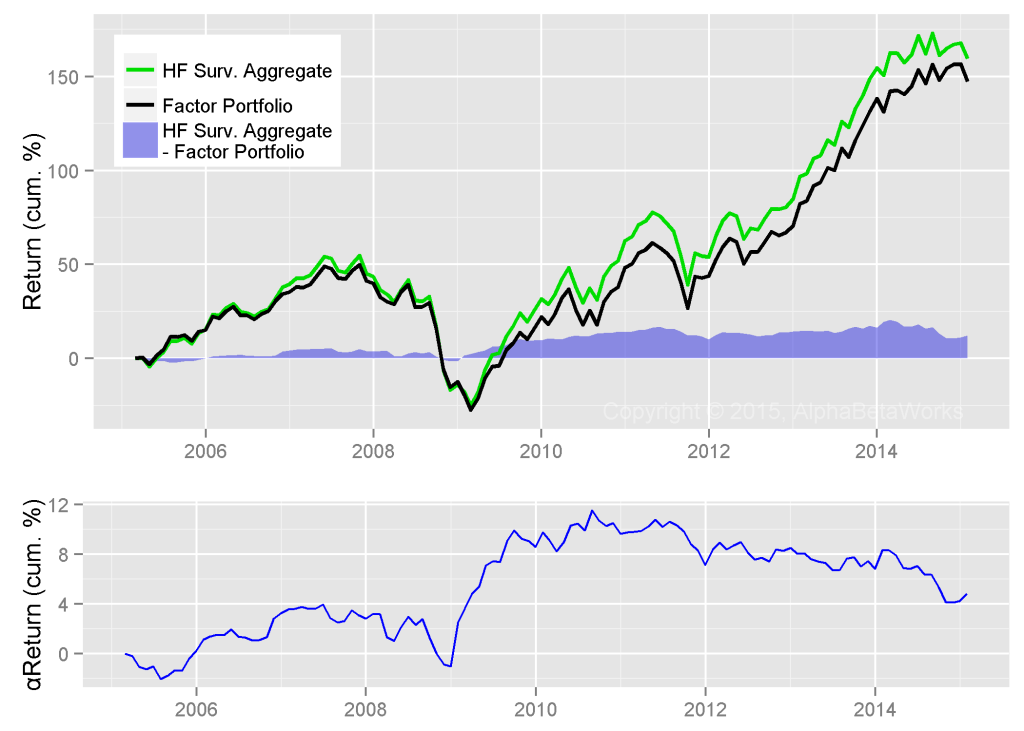

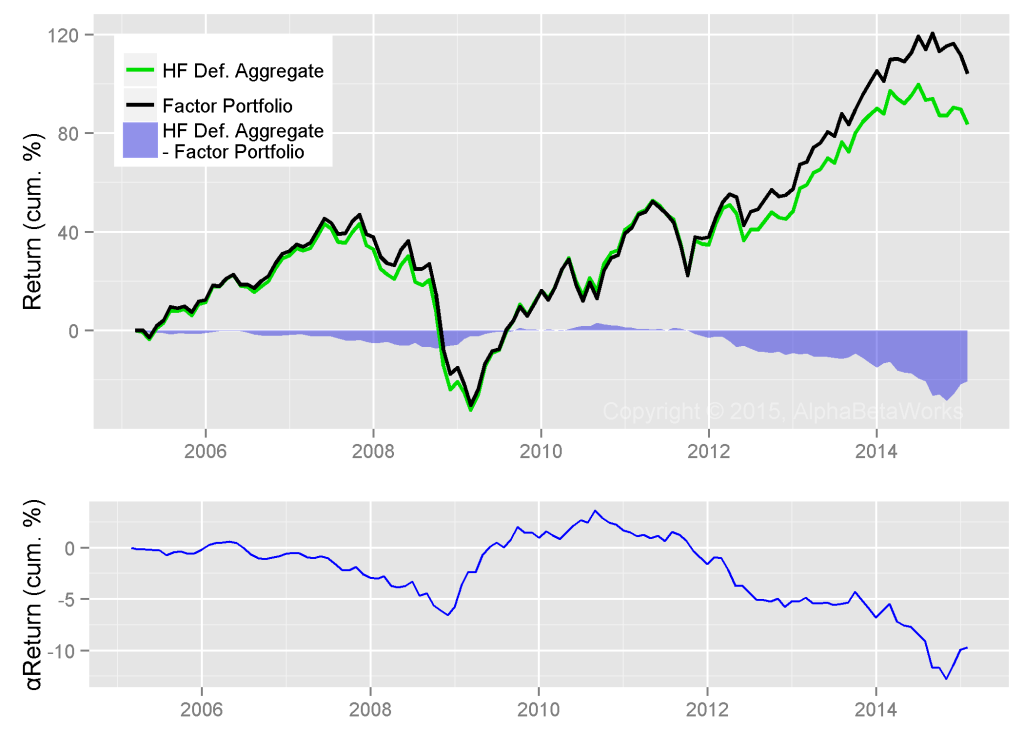

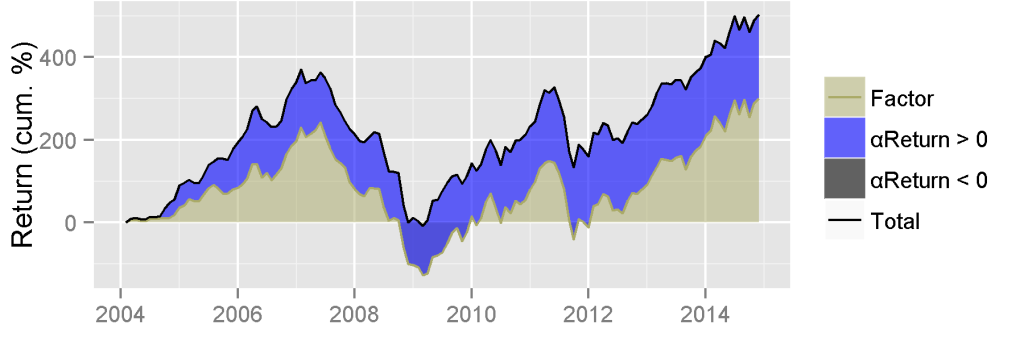

This piece follows the approach of our earlier articles on crowding: We created a position-weighted portfolio (HF Aggregate) consisting of the popular U.S. equity holdings of all long hedge fund portfolios tractable from regulatory filings. We then analyzed HF Aggregate’s risk relative to U.S. Market Aggregate (similar to the Russell 3000 index) using AlphaBetaWorks’ Statistical Equity Risk Model to identify sources of crowding.

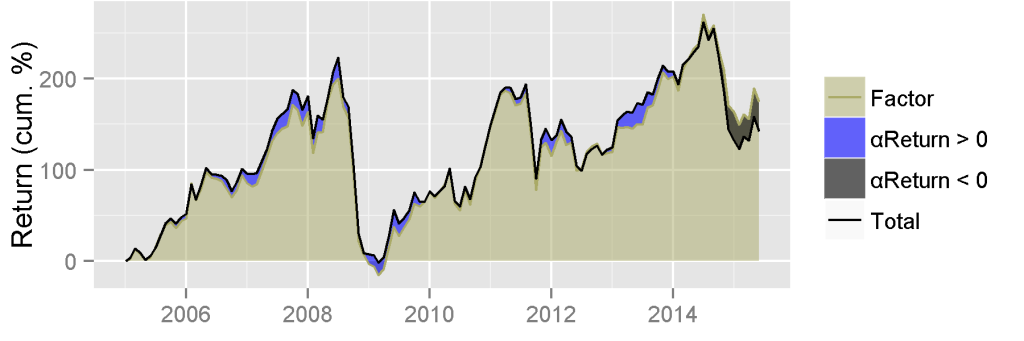

Hedge Fund Aggregate’s Risk

The Q2 2015 HF Aggregate had 3.2% estimated future tracking error relative to U.S. Market. Factor (systematic) bets were the primary source of risk and systematic crowding increased slightly from prior quarters:

The components of HF Aggregate’s relative risk on 6/30/2015 were the following:

| Source | Volatility (%) | Share of Variance (%) |

| Factor | 2.46 | 60.01 |

| Residual | 2.01 | 39.99 |

| Total | 3.17 | 100.00 |

Because of the close relationship between active risk and active performance, the low estimated future volatility (tracking error) indicates that the long book of a diversified portfolio of hedge funds will behave similarly to a passive factor portfolio. Even if its active bets pay off, HF Aggregate will have a hard time earning a typical fee. Consequently, the long portion of highly diversified hedge fund portfolios will struggle to outperform a passive alternative.

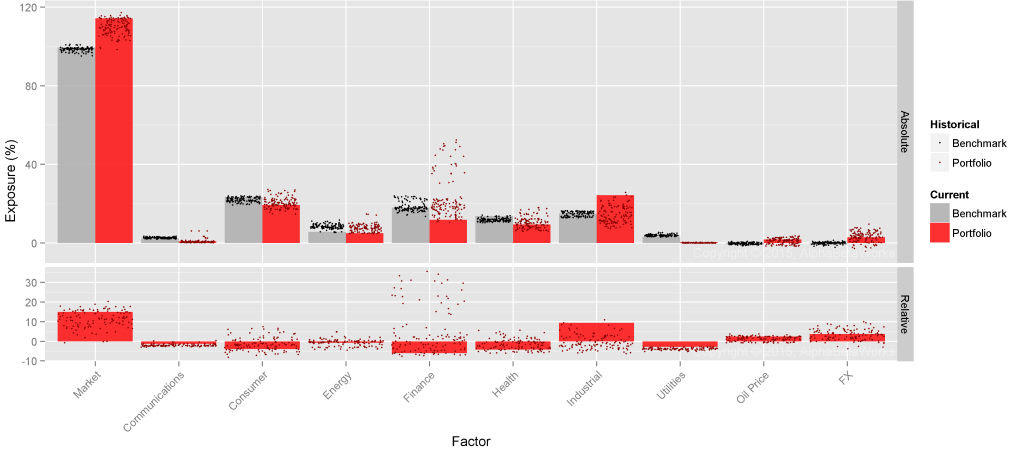

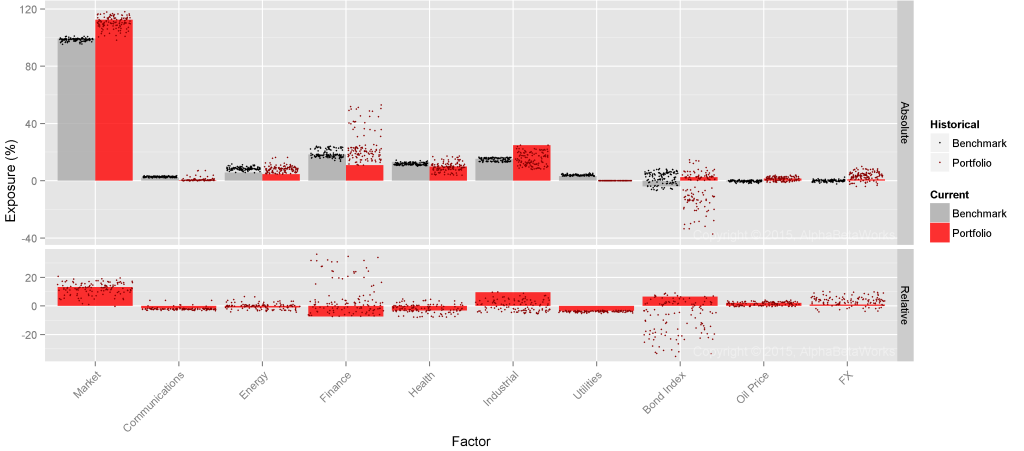

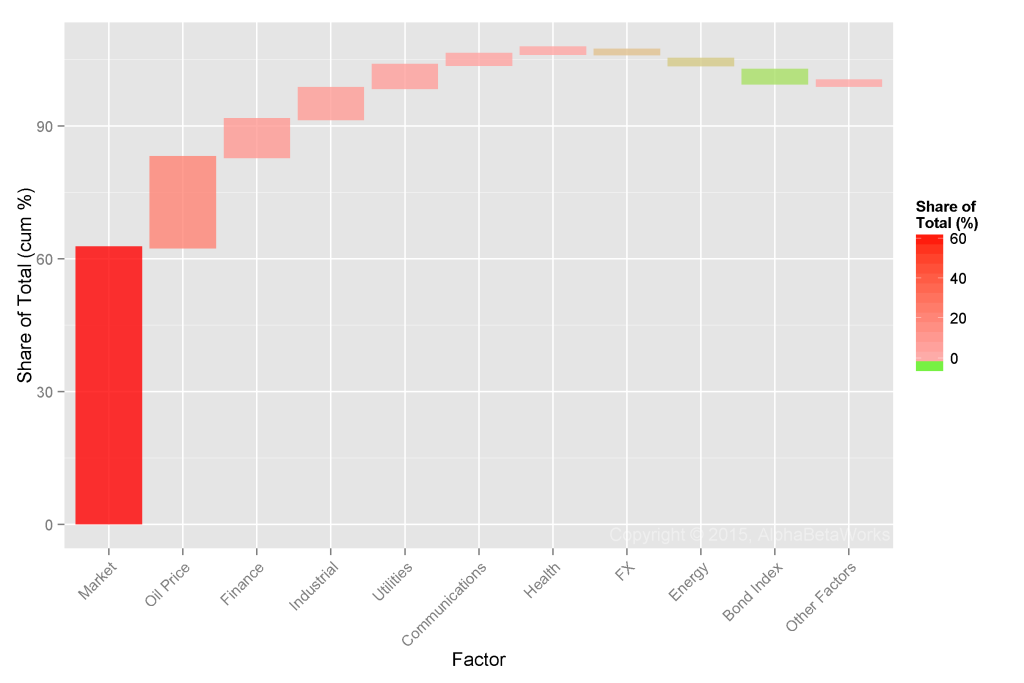

Hedge Fund Factor (Systematic) Crowding

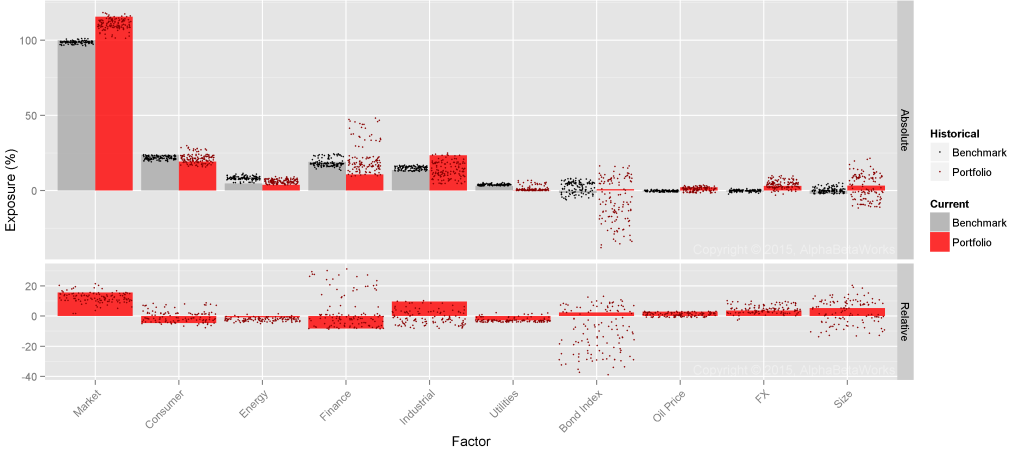

Below are HF Aggregate’s principal factor exposures (in red) relative to U.S. Market’s (in gray) as of 6/30/2015:

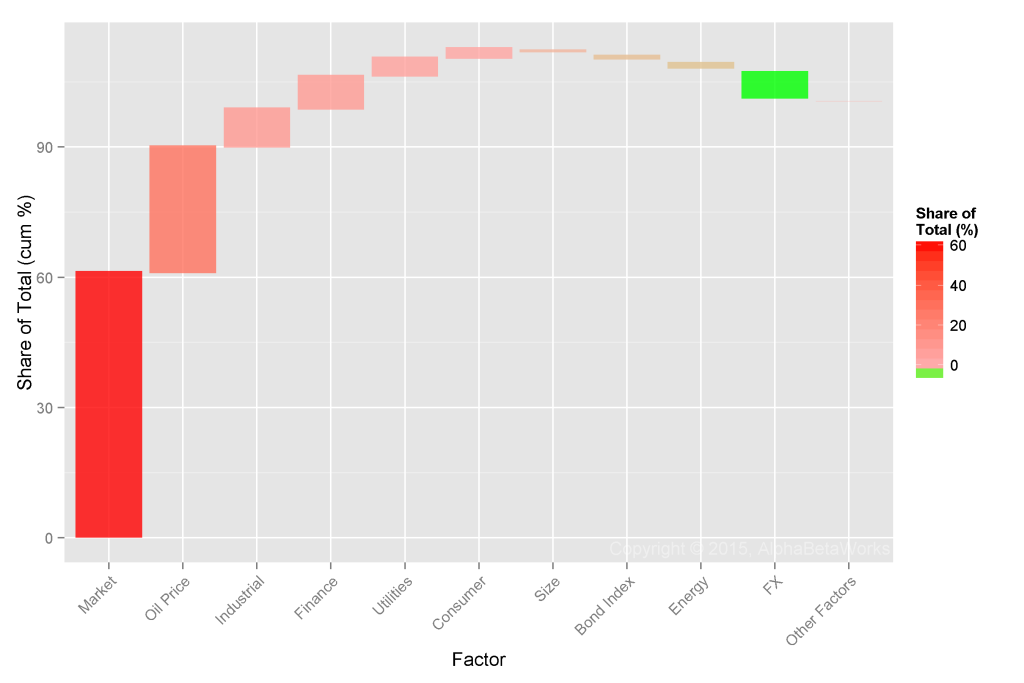

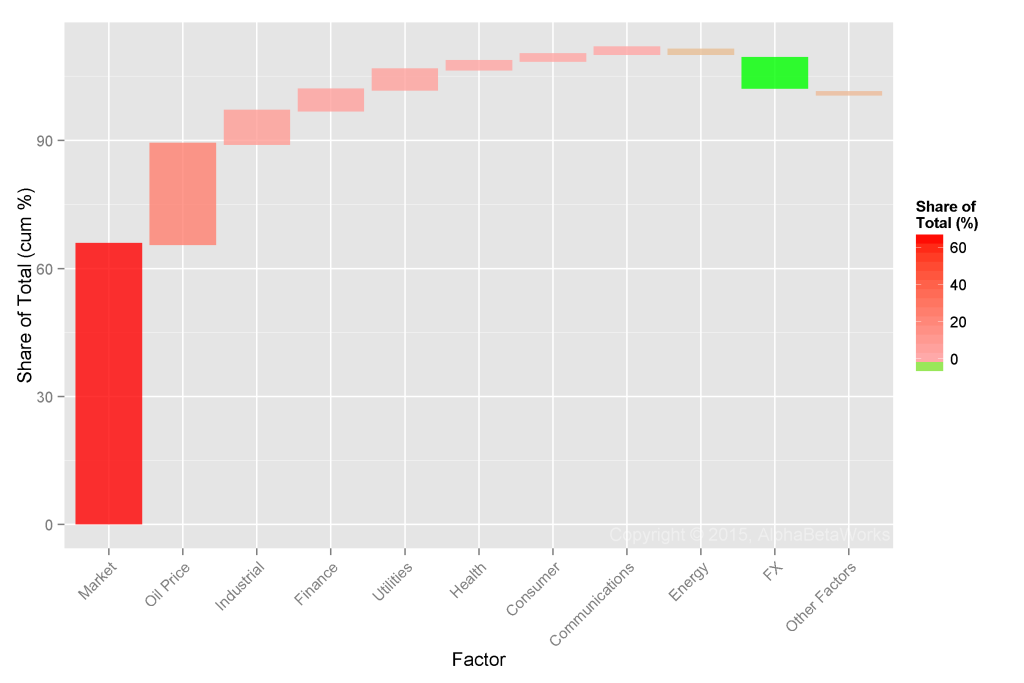

Of these bets, Market (Beta) and Oil are responsible for 90% of the relative factor risk. These are the components of the 2.46% Factor Volatility in the first table:

| Factor | Relative Exposure (%) | Portfolio Variance (%²) | Share of Systematic Variance (%) |

| Market | 15.76 | 3.68 | 60.91 |

| Oil Price | 2.93 | 1.75 | 28.94 |

| Industrial | 9.72 | 0.53 | 8.72 |

| Finance | -8.36 | 0.46 | 7.58 |

| Utilities | -2.78 | 0.25 | 4.13 |

| Other Factors | -0.62 | -10.28 | |

| Total | 6.04 | 100.00 |

Exposures to the three main factor bets are near 10-year highs.

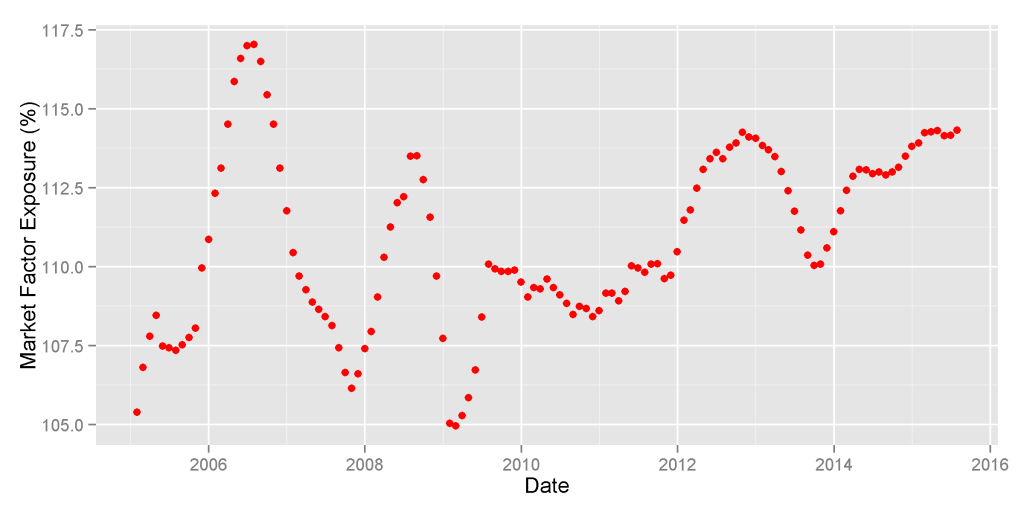

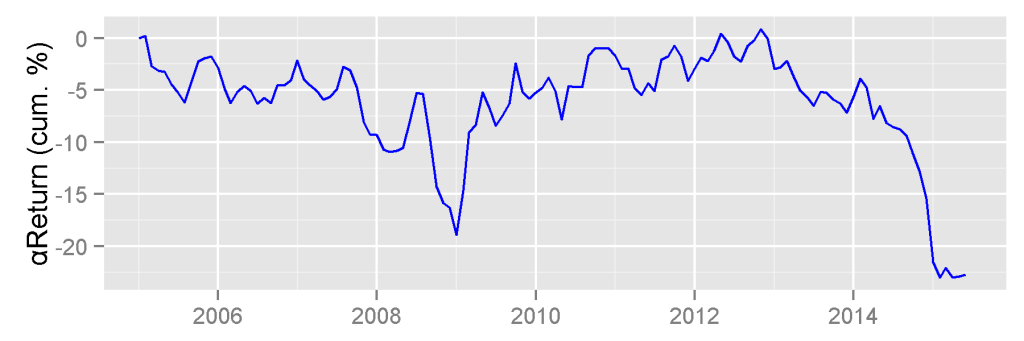

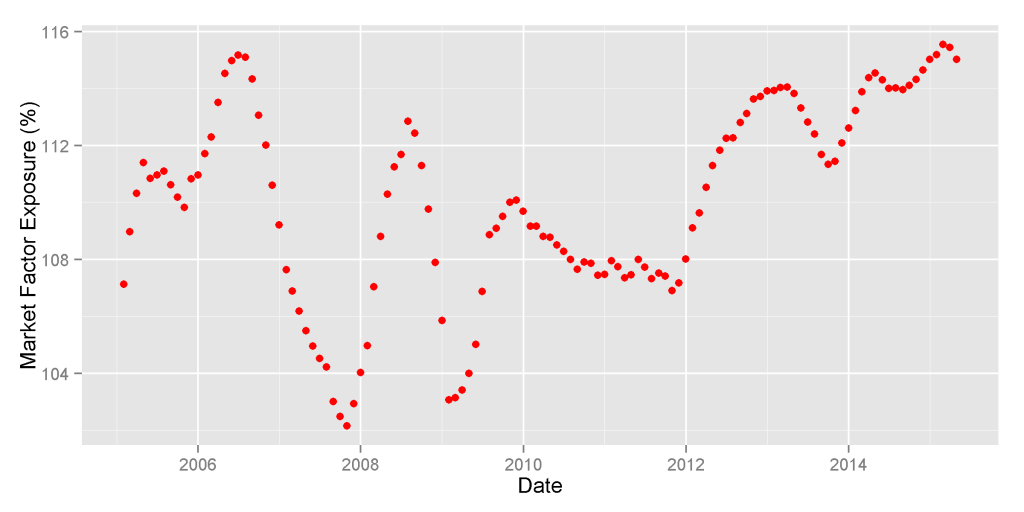

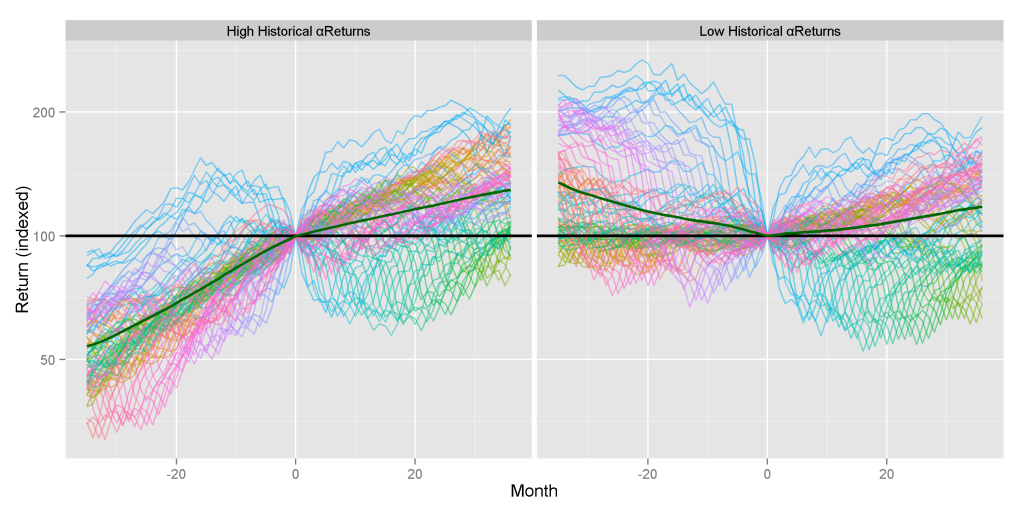

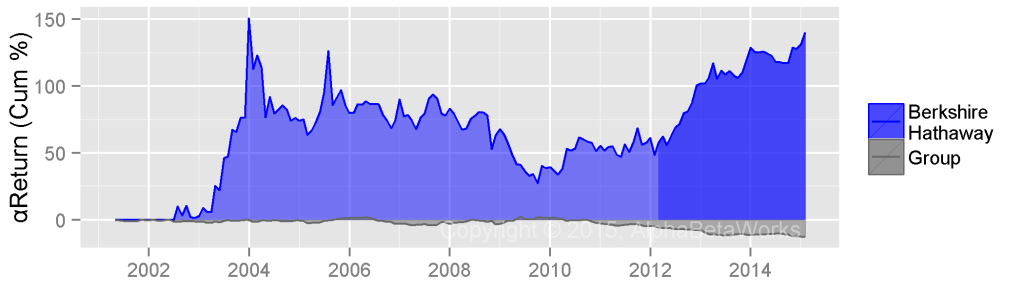

Hedge Fund U.S. Market Factor Exposure History

HF Aggregate’s market exposure is approximately 115% (its Market Beta is approximately 1.15). Hedge fund’s long books are taking approximately 15% more market risk than U.S. equities and approximately 20% more market risk than S&P 500. This bet has proven costly in August of 2015:

Also note that long hedge fund portfolios consistently take 5-15% more market risk than S&P500 and other broad benchmarks. This is why simple comparison of long hedge fund portfolio performance to market indices is misleading.

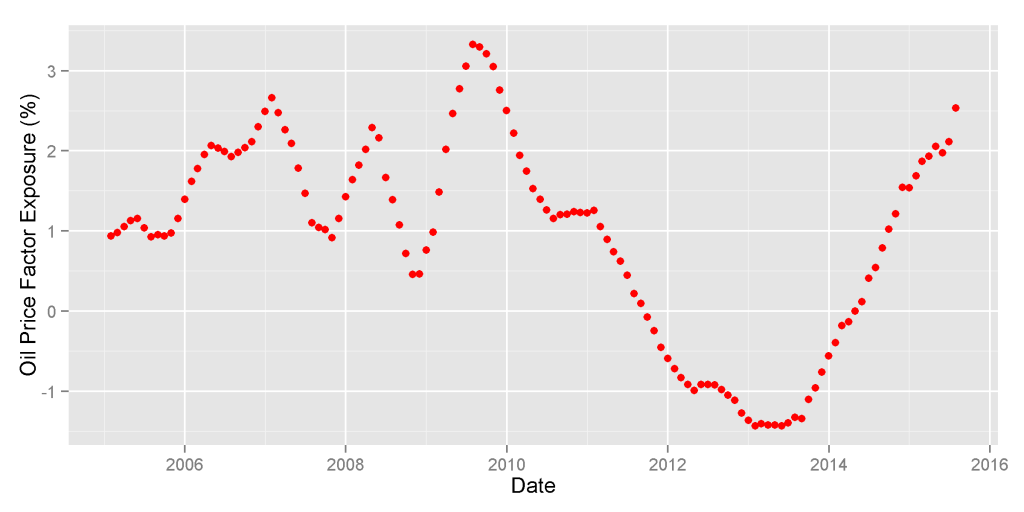

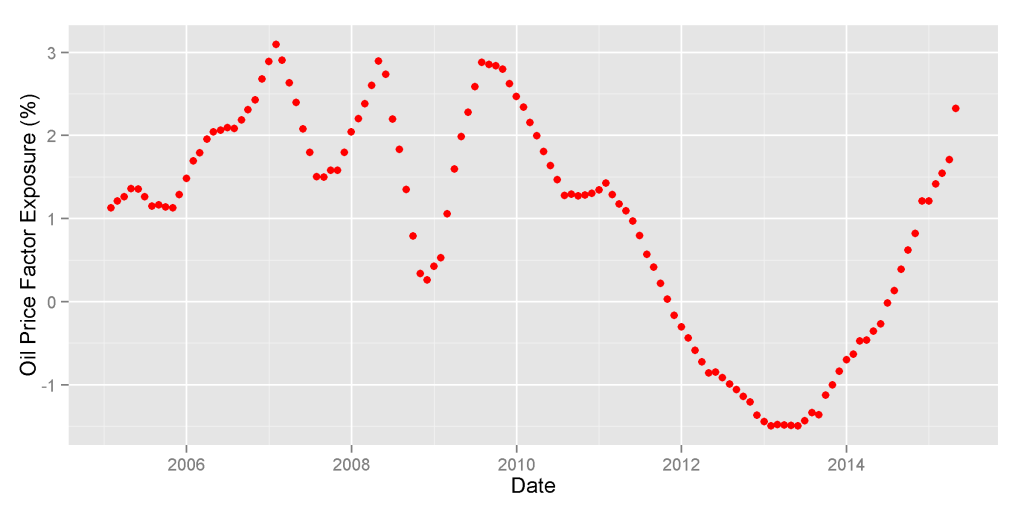

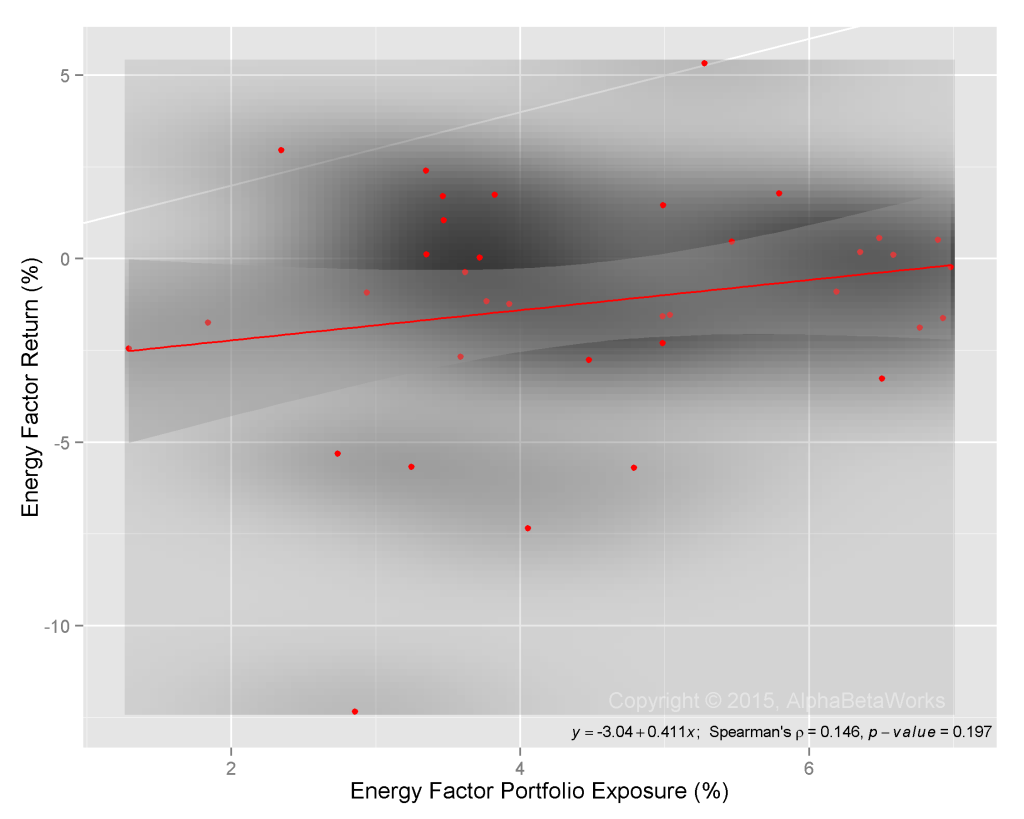

Hedge Fund Oil Price Exposure History

HF Aggregate’s oil exposure, near 3%, is also close to the 10-year highs last reached in 2009:

As oil prices collapsed in 2014, hedge funds rapidly boosted oil exposure. This contrarian bet is a weak bullish indicator for the commodity.

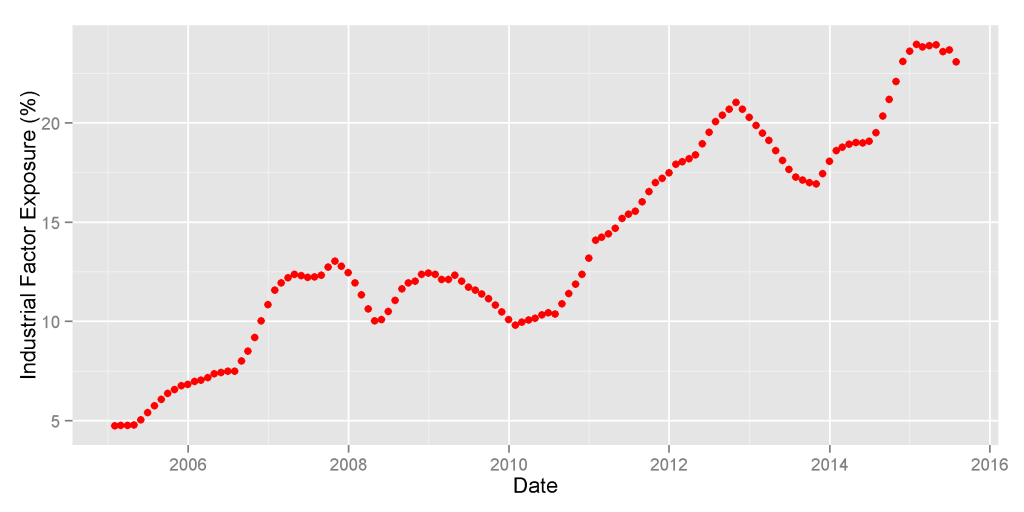

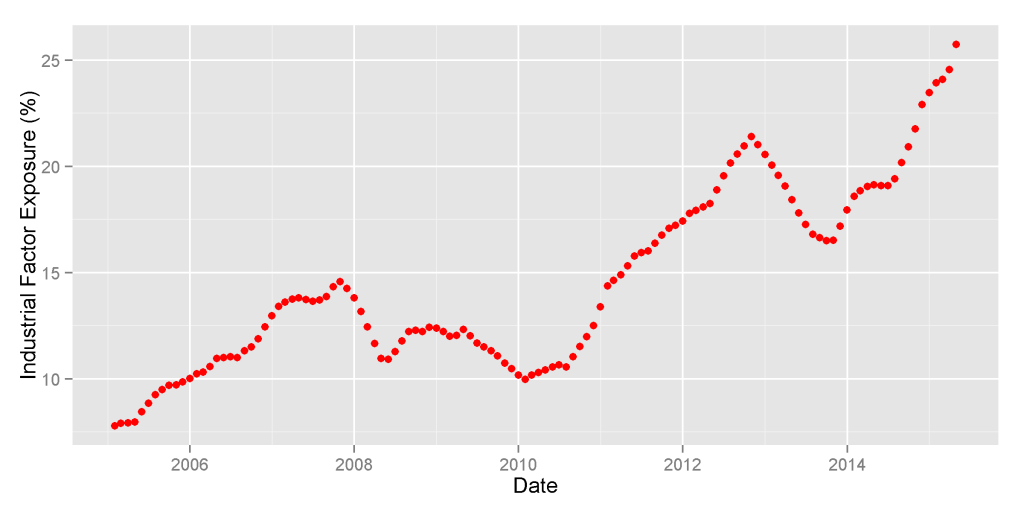

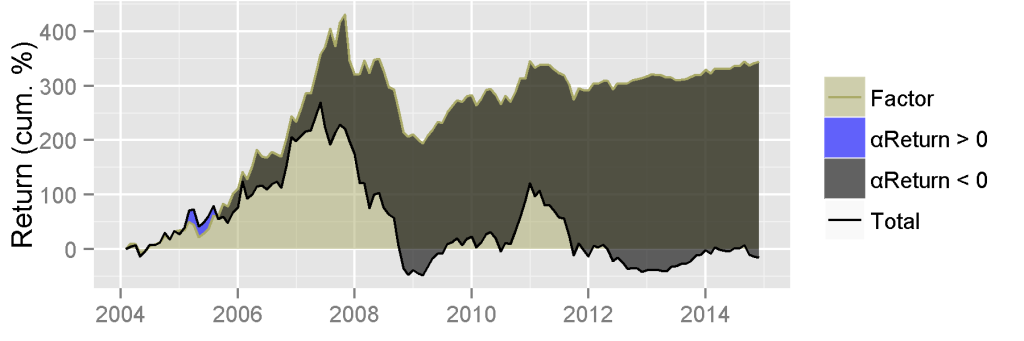

Hedge Fund Industrial Factor Exposure History

HF Aggregate’s industrials factor exposure remained near the all-time high:

This has been a losing contrarian bet since 2014 and it is a weak bearish indicator for the sector.

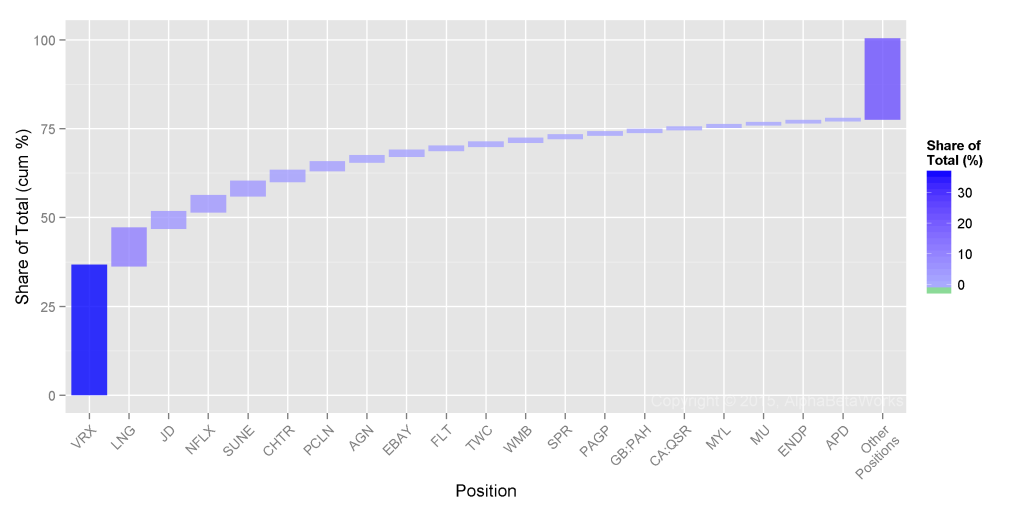

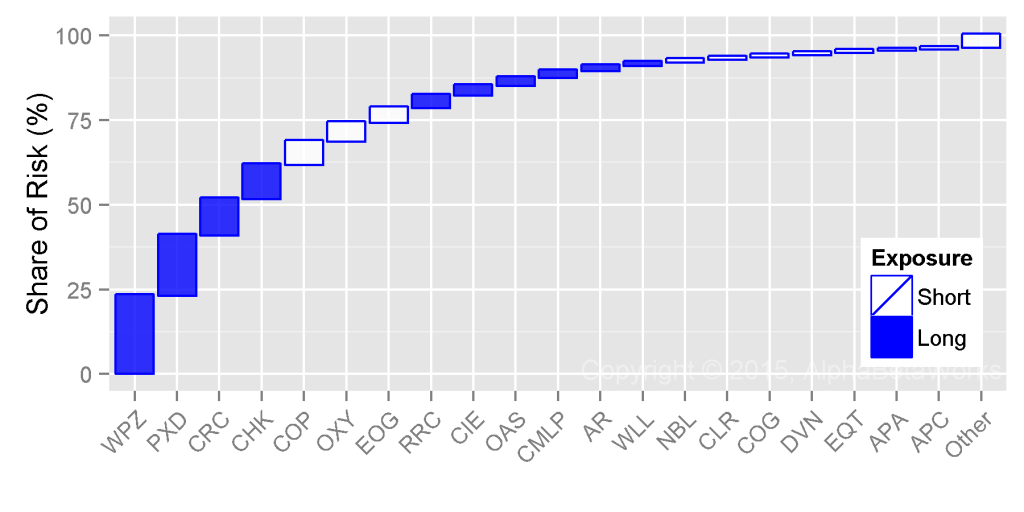

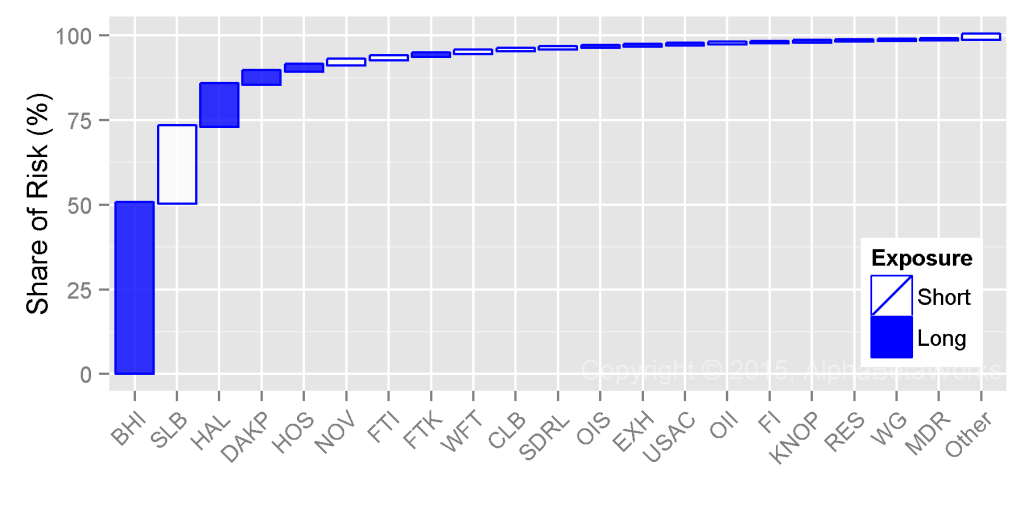

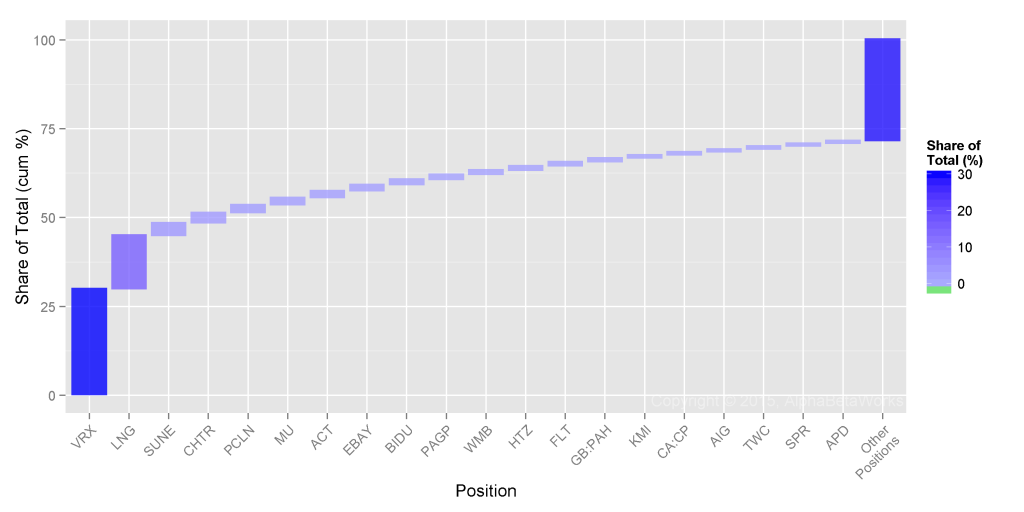

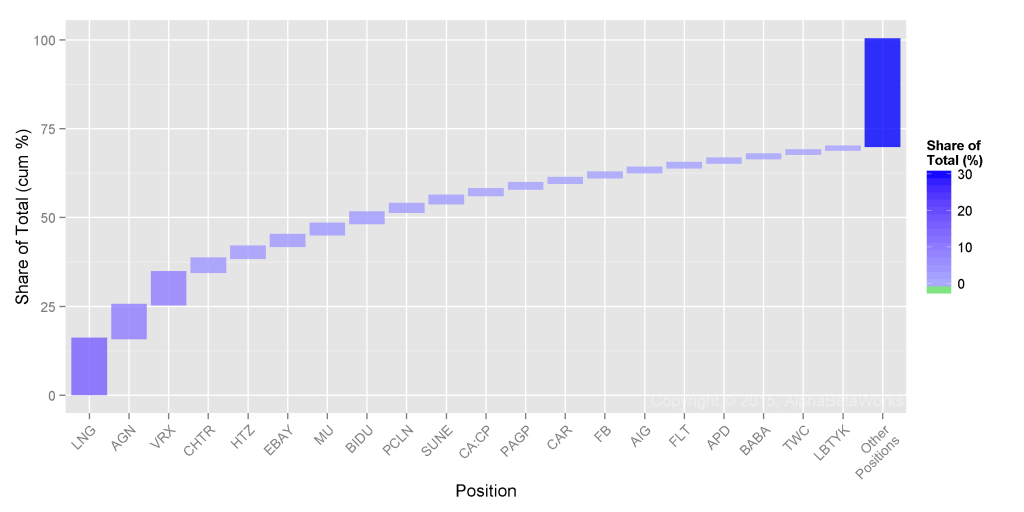

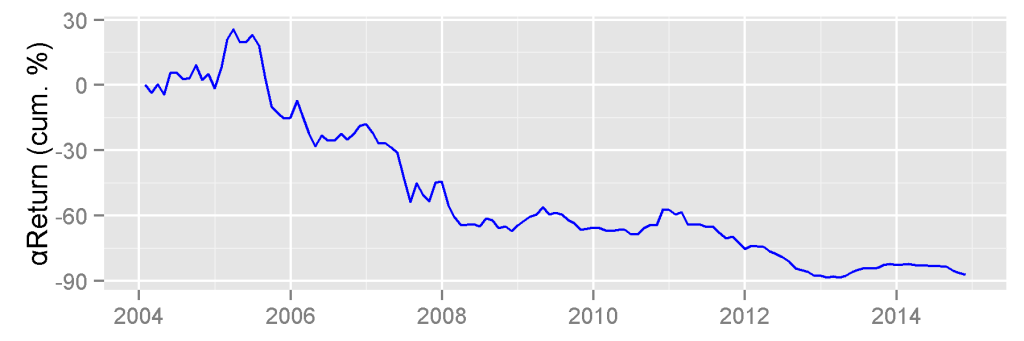

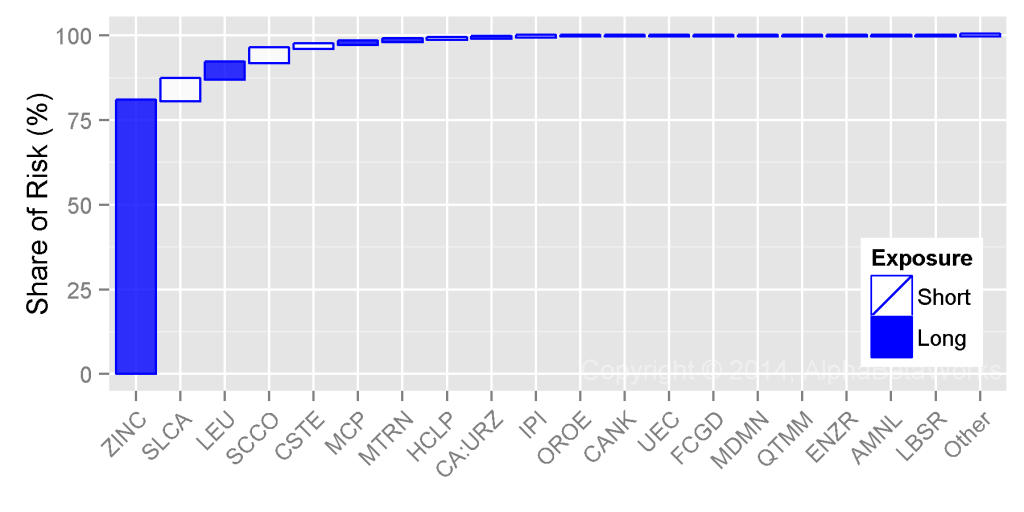

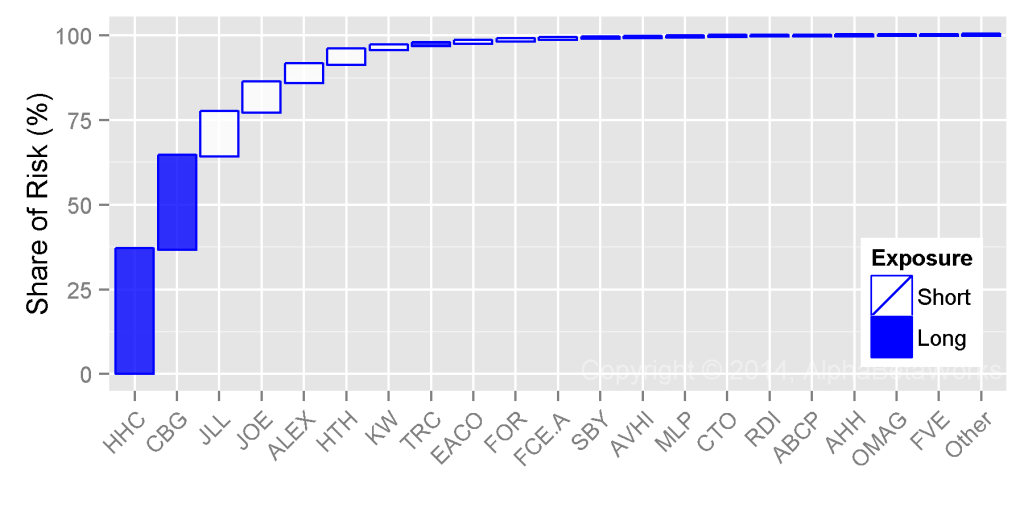

Hedge Fund Residual (Idiosyncratic) Crowding

About 40% of hedge fund crowding is due to residual (idiosyncratic, stock-specific) risk. Just three names are responsible for over half of it:

These stocks will be primary drivers of HF Aggregate’s and of the most crowded firms’ stock-specific performance. Investors should be ready for seemingly inexplicable volatility due to portfolio liquidation and rebalancing. Though individual crowded names may be wonderful investments, they have tended to underperform:

| Symbol | Name | Exposure (%) | Share of Idiosyncratic Variance (%) | |

| VRX | Valeant Pharmaceuticals International, Inc. | 4.78 | 36.25 | |

| LNG | Cheniere Energy, Inc. | 1.58 | 10.53 | |

| JD | JD.com, Inc. Sponsored ADR Class A | 1.59 | 4.60 | |

| NFLX | Netflix, Inc. | 0.74 | 4.55 | |

| SUNE | SunEdison, Inc. | 0.92 | 4.03 | |

| CHTR | Charter Communications, Inc. Class A | 1.55 | 3.04 | |

| PCLN | Priceline Group Inc | 1.36 | 2.37 | |

| EBAY | eBay Inc. | 1.47 | 1.58 | |

| FLT | FleetCor Technologies, Inc. | 1.10 | 1.17 | |

| TWC | Time Warner Cable Inc. | 1.27 | 1.17 | |

Investors drawn to these names should not use hedge fund ownership as a plus. Instead, this ownership should trigger particularly thorough due-diligence. Any company slip-ups will be magnified as impatient investors stampede out of positions.

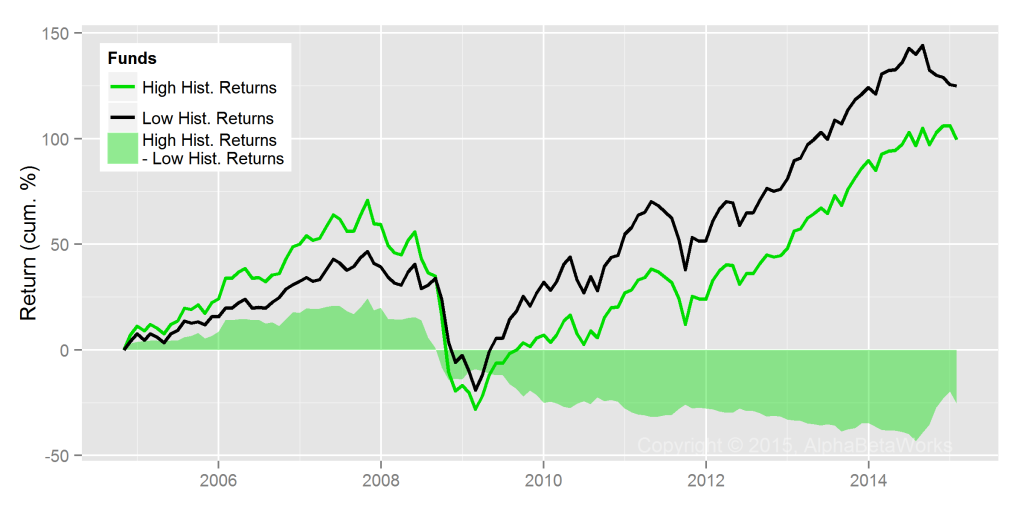

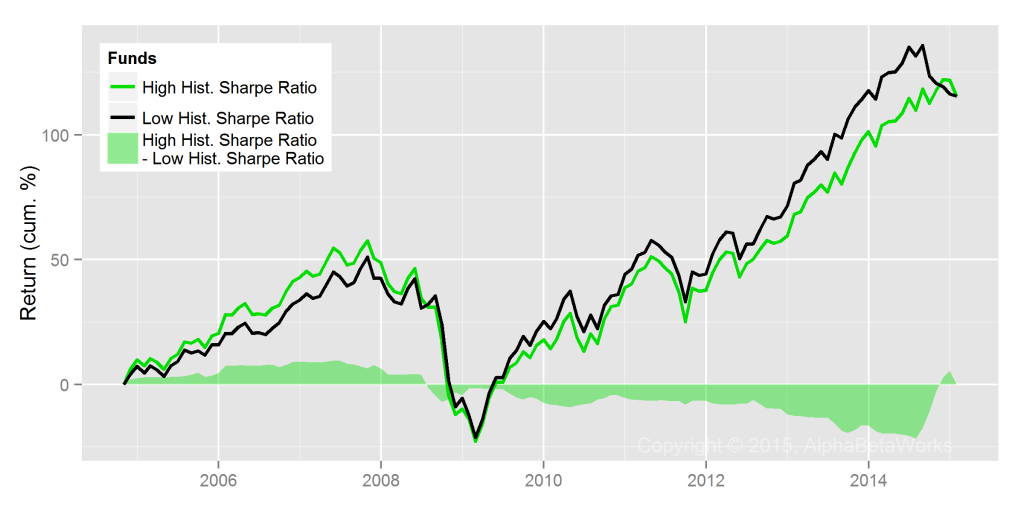

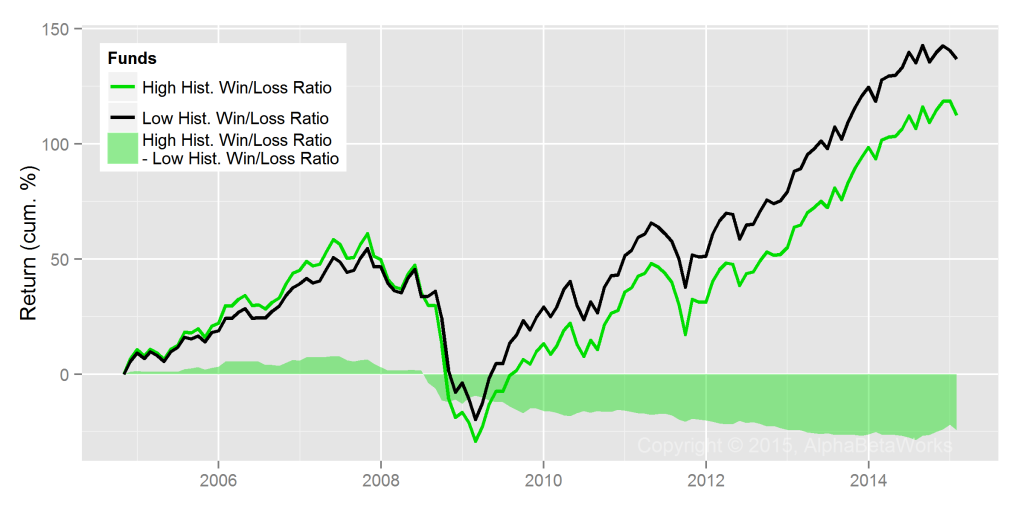

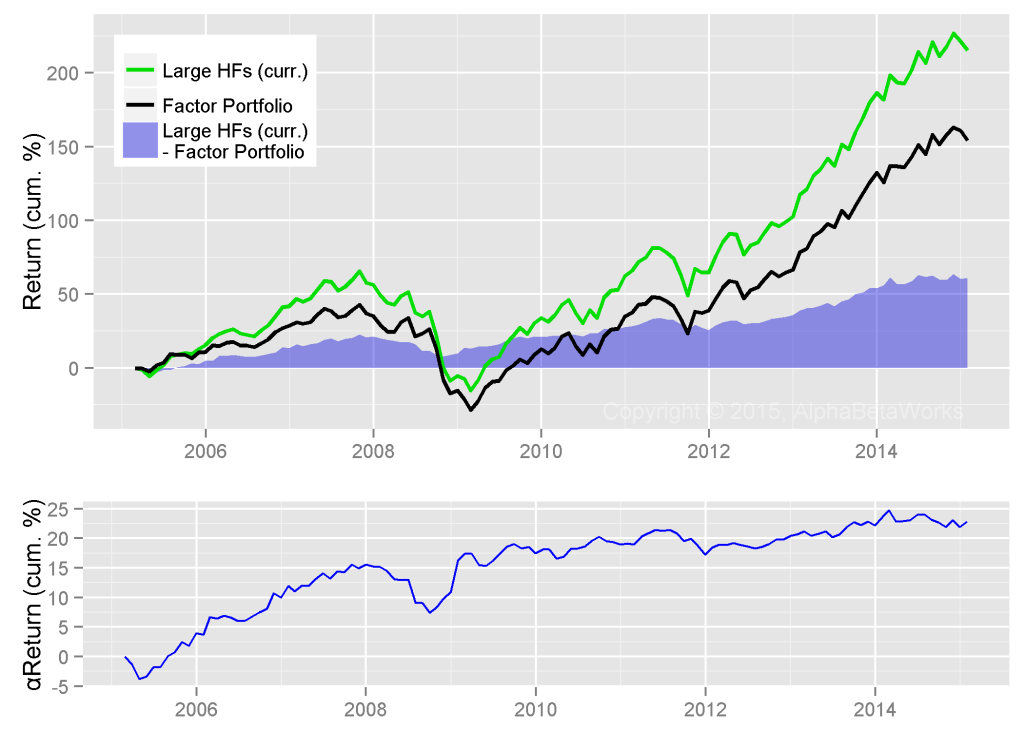

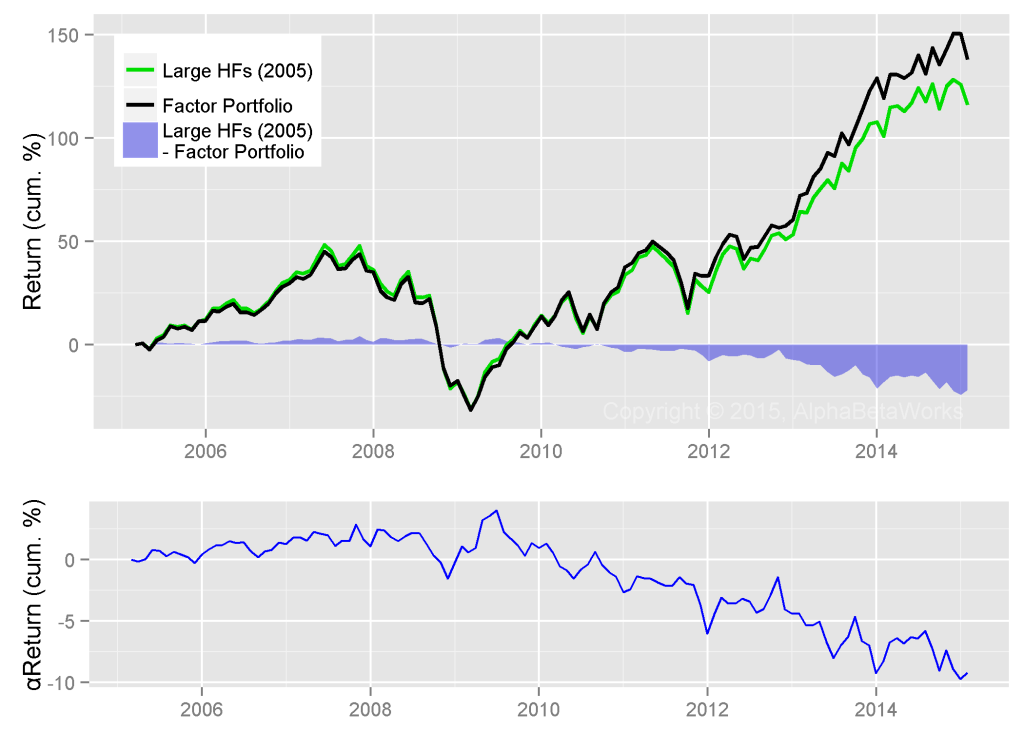

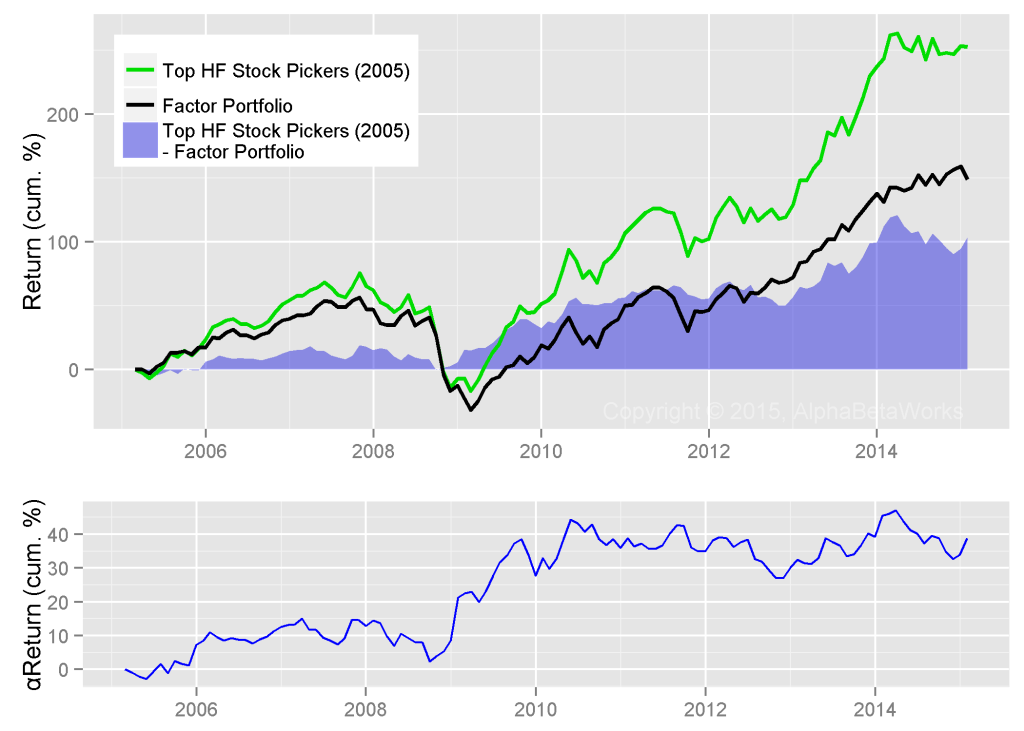

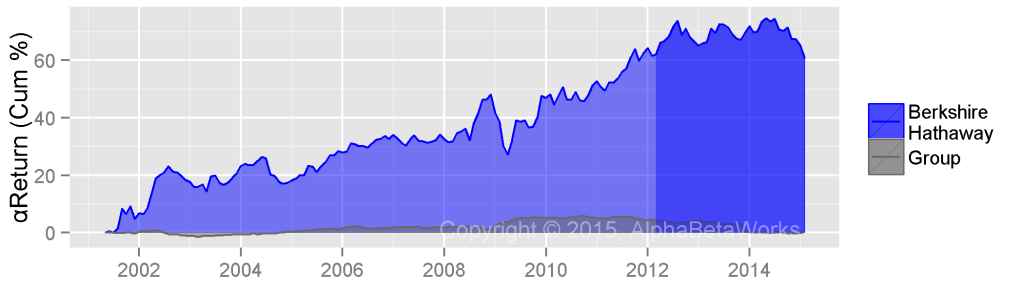

Fund allocators should also pay attention to crowding: Historically, consensus bets have done worse than a passive portfolio with the same risk. Investing in crowded books is investing in a pool of undifferentiated bets destined to disappoint.

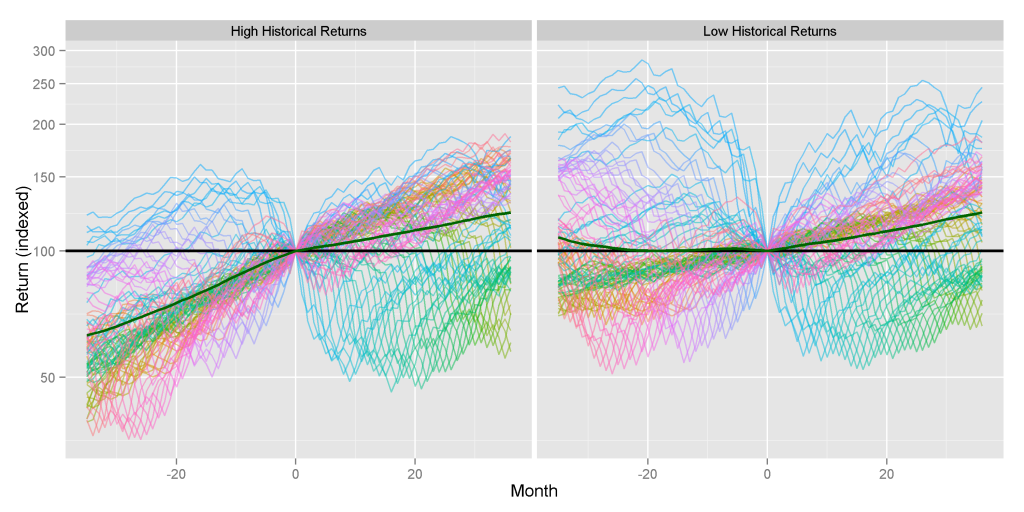

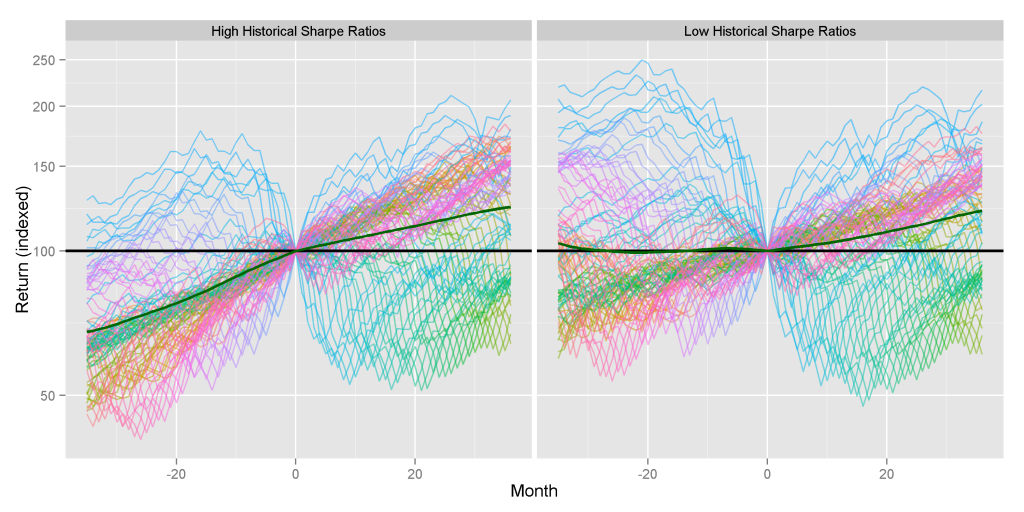

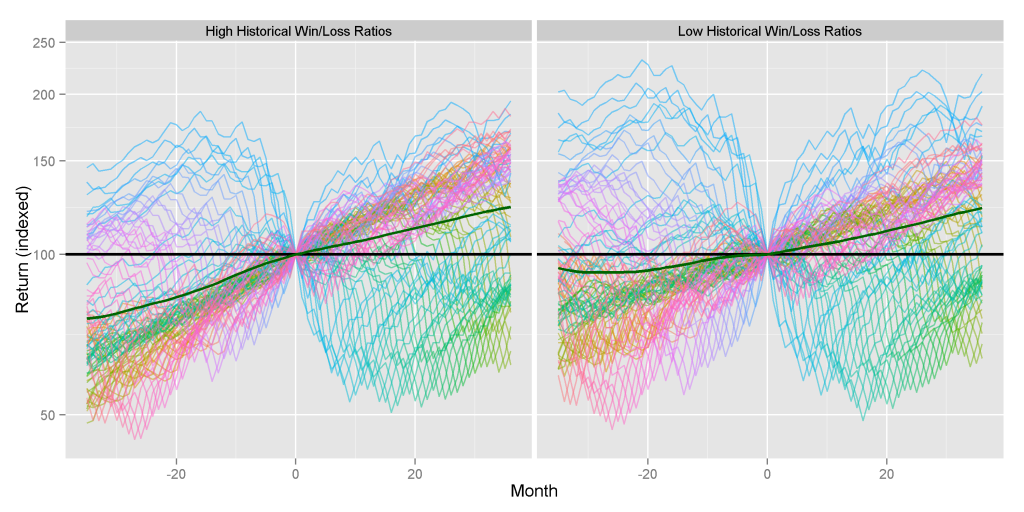

AlphaBetaWorks’ analytics identify hedge fund herding in each equity sector. Our fund analytics measure hedge fund differentiation and identify specific skills in each sector that are strongly predictive of future performance.

Summary

- There is both factor (systematic/market) and residual (idiosyncratic/security-specific) crowding of hedge funds’ long U.S. equity portfolios.

- Hedge fund crowding is approximately 60% systematic and 40% idiosyncratic.

- The main sources of systematic crowding are Market (Beta) and Oil.

- The main sources of idiosyncratic crowding are VRX, LNG, JD, NFLX, and SUNE.

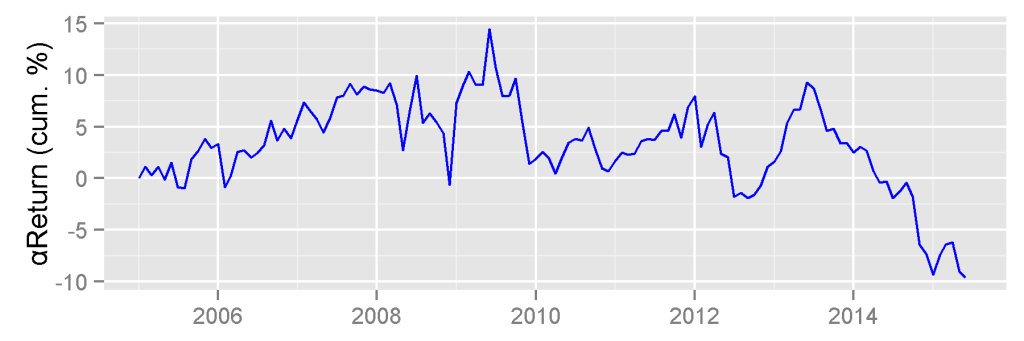

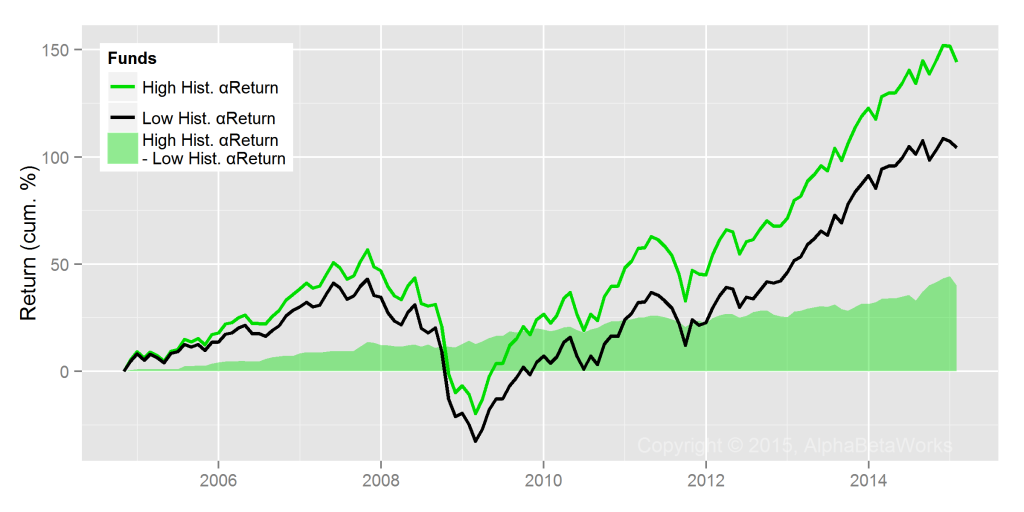

- The crowded hedge fund portfolio has historically underperformed its passive alternative – allocators and fund followers should pay close attention to these consensus bets.