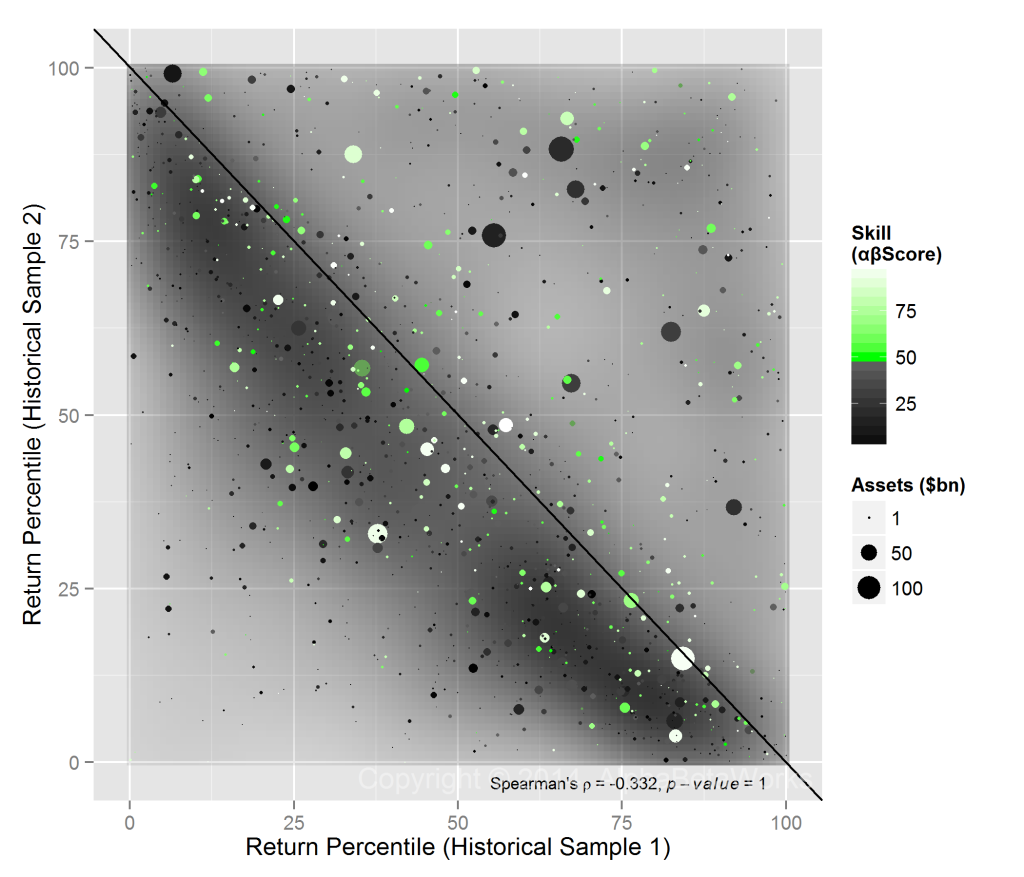

If a fund posts returns that beat the indices, with moderate volatility and low benchmark correlation, there is no guarantee that such performance will continue. Comparable results might have been achievable with a passive portfolio. The fund could have taken hidden systematic risks or it may have been lucky. This happens often. Among Medium Turnover U.S. Mutual Funds, the relative ranking of a fund’s returns in one sample of history is negatively correlated to its relative ranking in the other. When “skill” is evaluated naively, “the best” funds in one period tend to become “the “worst” in another and vice versa:

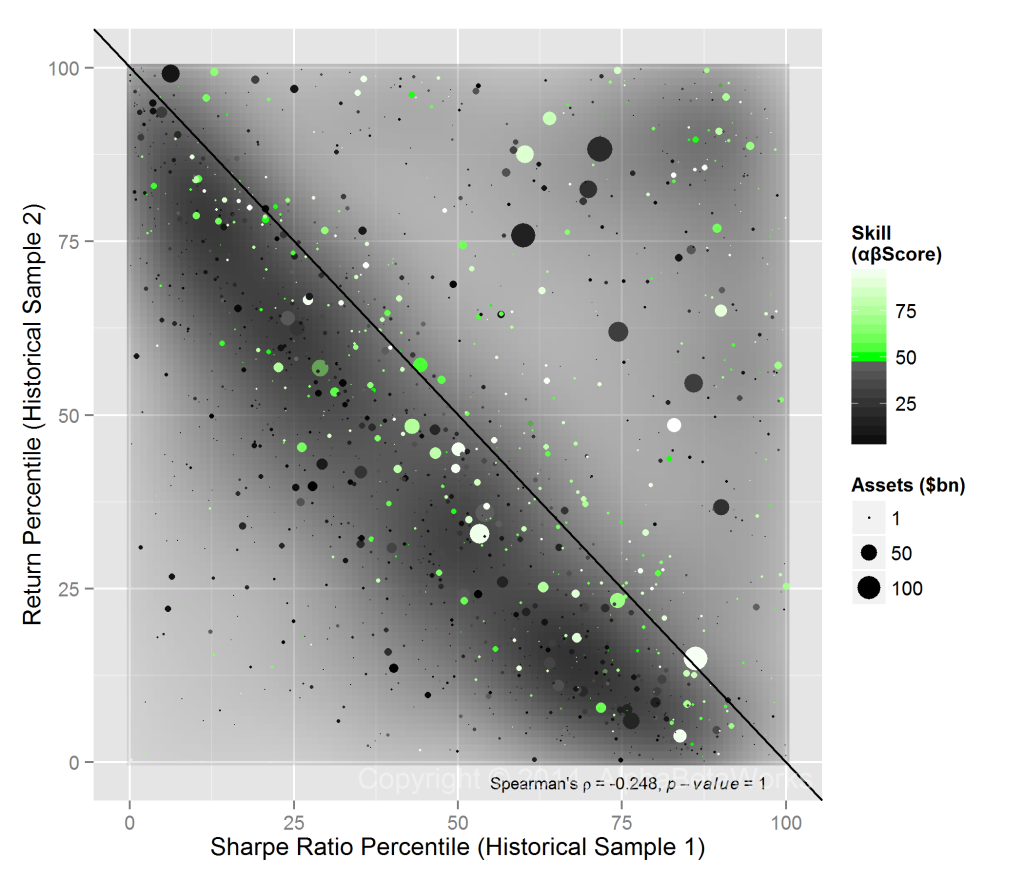

The Sharpe Ratio and similar metrics simply re-process the same return data, presenting it in a different form. They too suffer from the same problems as simple return ranking:

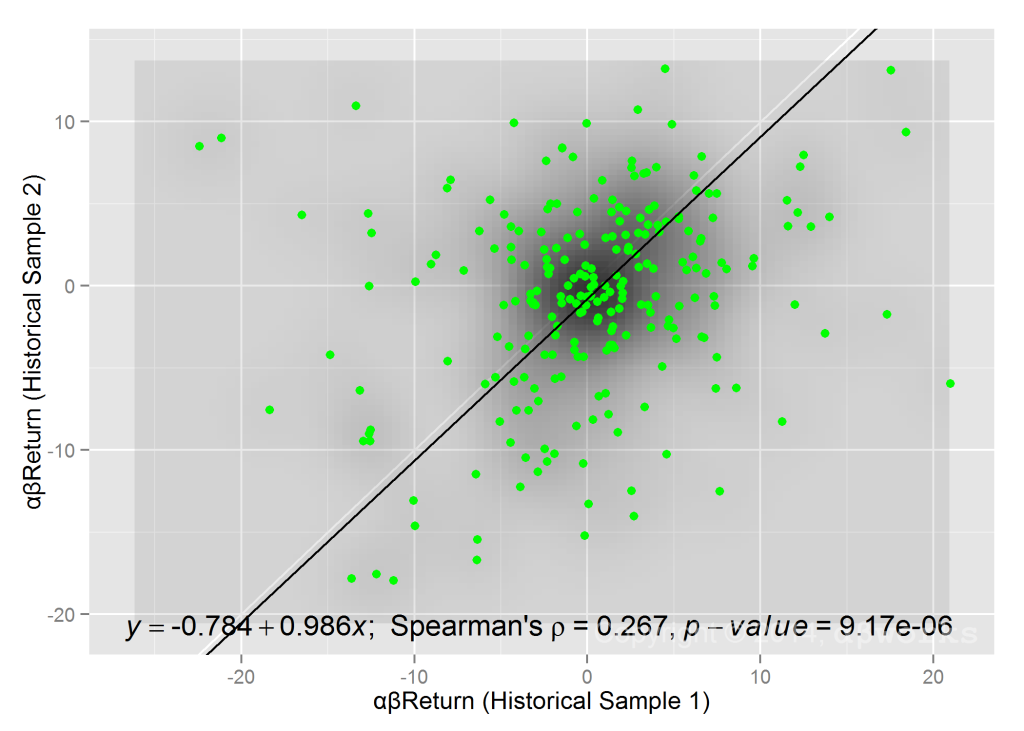

The challenge is to look beneath the surface to determine whether the true source of returns is investment skill (stock picking, market timing, etc.), or some combination of luck, high beta, and outsized risk. Investment skills, when properly measured, are significant predictors of future performance.

Properly-designed risk models can be used to filter out the effects of systematic risk, exotic market bets, and luck. When these models are designed from the ground-up to evaluate skill, and are combined with robust statistical techniques, the result is predictive analytics. The best funds in one period tend to remain the best in another. Same for the worst:

AlphaBetaWorks focuses on the development of robust risk models that result in the evaluation of investment risk and predictive investment skills.

Copyright © 2012-2014, AlphaBetaWorks, a division of Alpha Beta Analytics, LLC. All rights reserved.

Content may not be republished without express written consent.