U.S. hedge funds share a few systematic and idiosyncratic long bets – a phenomenon called “crowding.” Crowding exists within aggregate portfolios and within specific sectors. Energy bets are particularly crowded and are the subject of this article. Crowded bets are the main sources of hedge funds’ collective and many individual funds’ energy sector returns. Four risk factors (systematic bets) and six stocks (idiosyncratic bets) are behind three quarters of the herding.

Systematic (factor) hedge fund energy crowding primarily consists of:

- A bet against integrated energy companies;

- A bet on oil refiners;

- A bet on cheap international and against expensive U.S. producers;

- A bet on independent oil and gas producers.

Idiosyncratic (residual) hedge fund energy sector crowding primarily consist of exposures to CVI, XOM, CHK, ATHL, CVX, and

Combined, these bets account for three quarters of aggregate hedge fund long energy sector risk (tracking error) relative to the overall energy equity market.

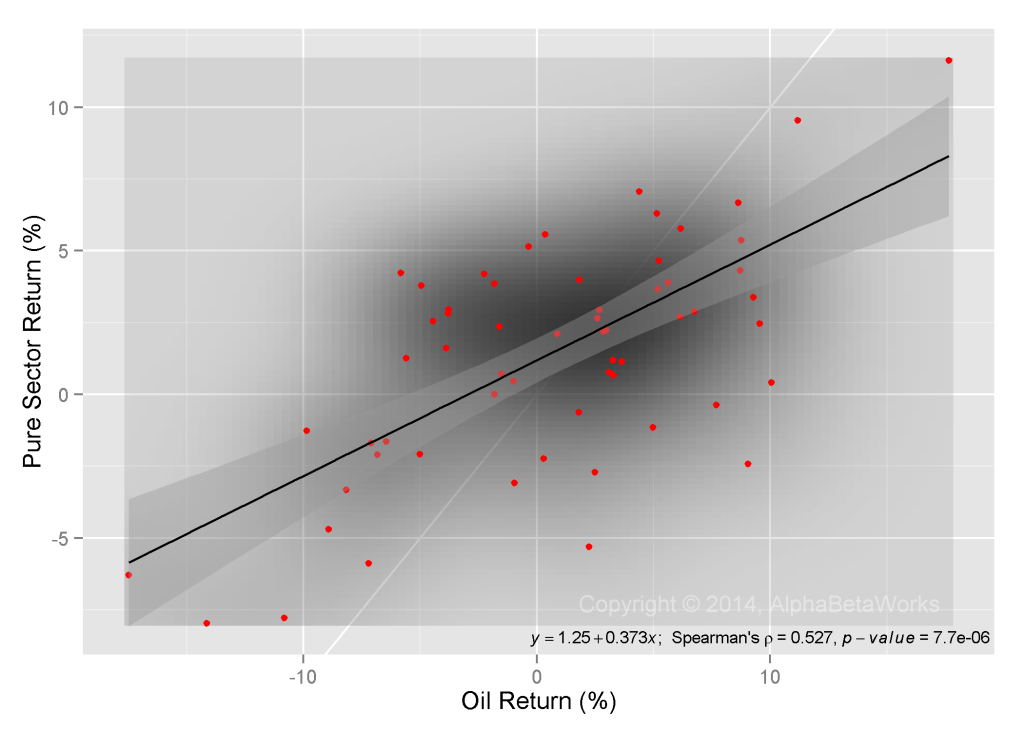

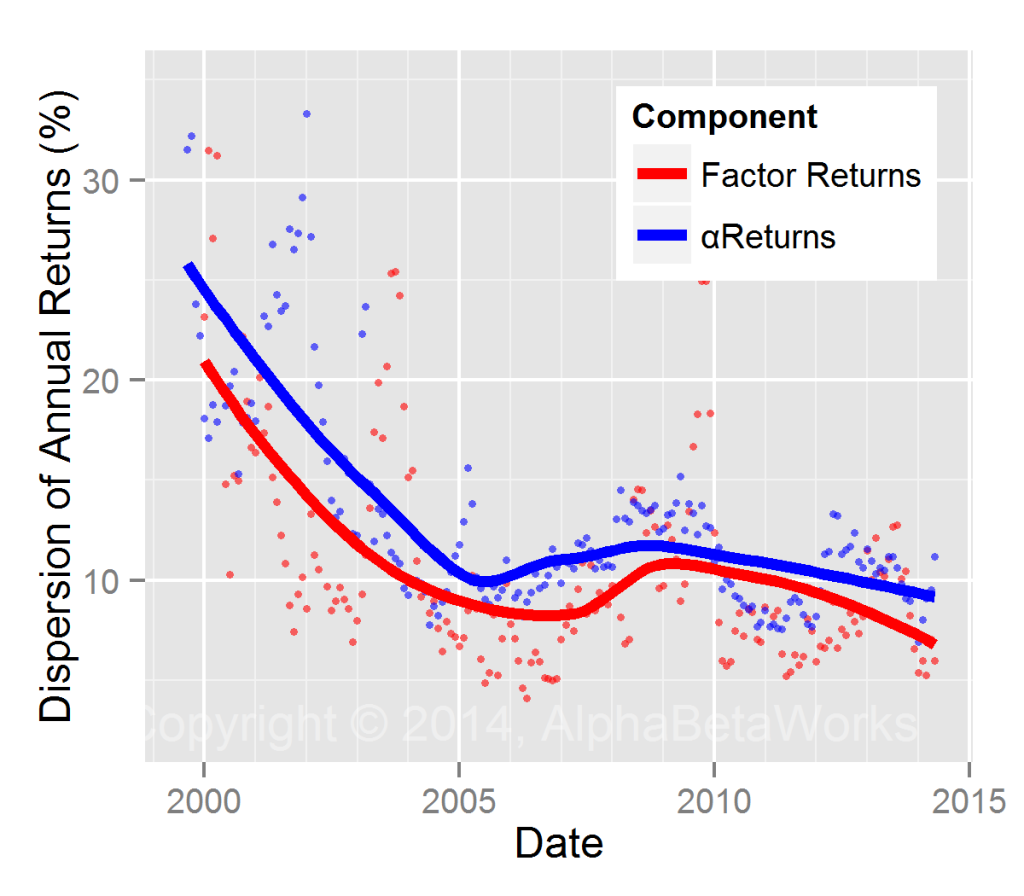

Crowding has two vital implications: First, hedge fund impatience contributes to greater volatility in crowded bets. Second, hedge fund long energy equity portfolios tend to generate negative risk-adjusted returns. Thus, consensus stock and factor picks are likely to disappoint.

Identifying Hedge Fund Energy Crowding

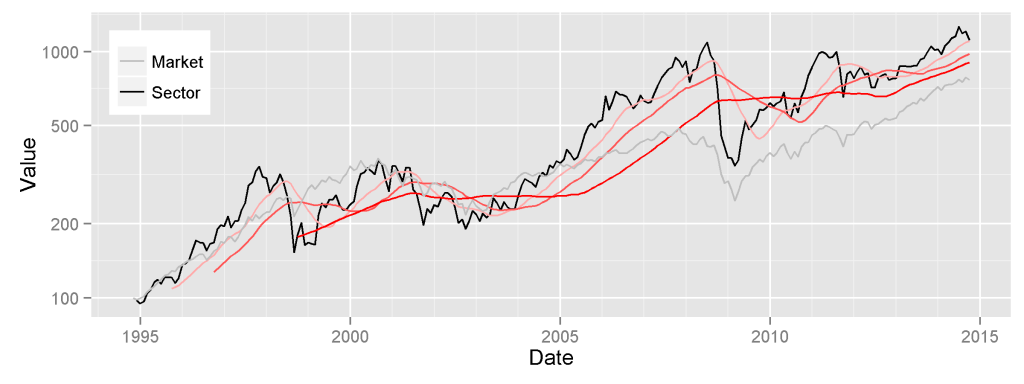

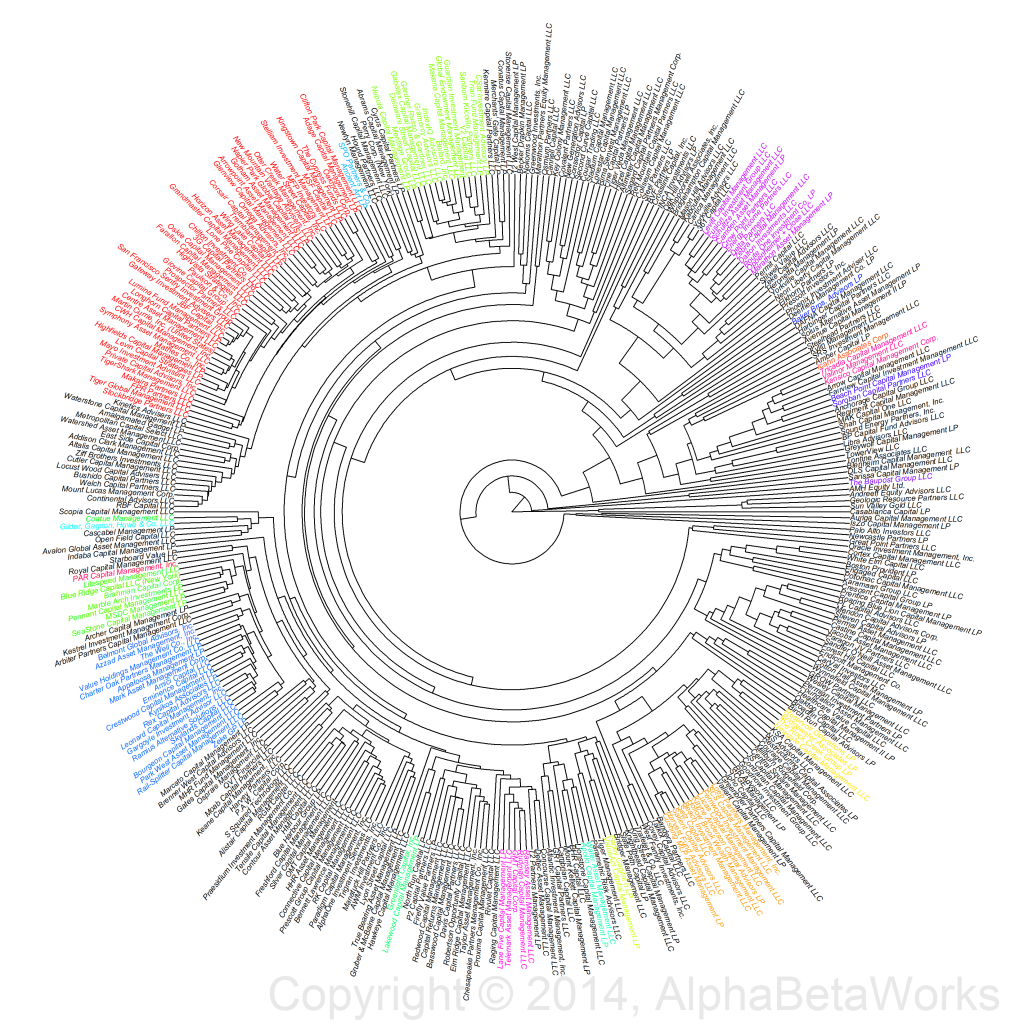

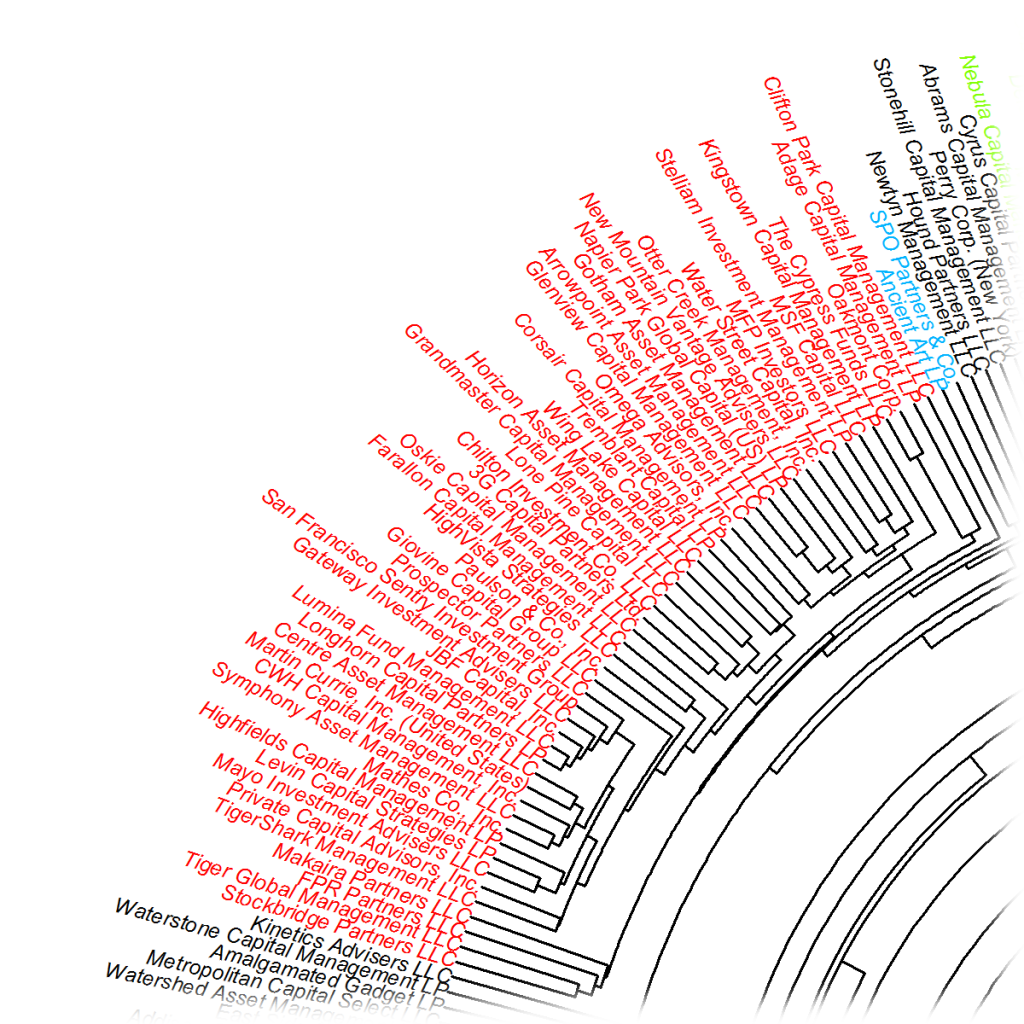

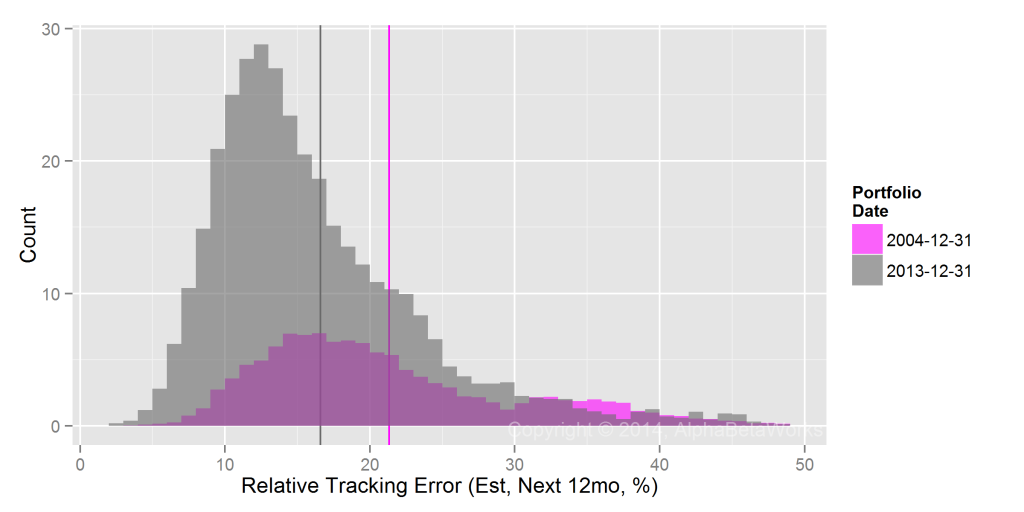

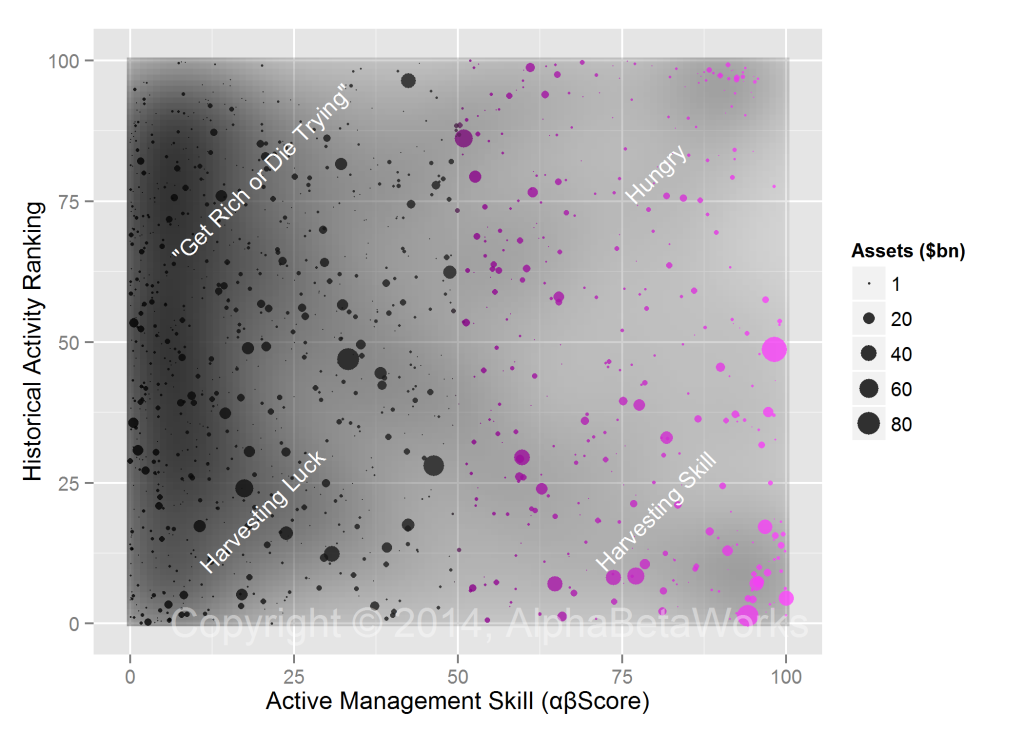

We created an aggregate position-weighted portfolio (HF Energy Aggregate) consisting of all energy sector equities held by over 400 U.S. hedge funds with medium to low turnover. The size of each position is the dollar value of its ownership by hedge funds. This process is similar to our earlier analysis of aggregate long hedge fund crowding.

We then evaluated HF Energy Aggregate’s risk relative to the capitalization-weighted portfolio of U.S. energy equities (Market Energy Aggregate) using AlphaBetaWorks’ Statistical Equity Risk Model. Finally, we analyzed HF Energy Aggregate’s systematic and idiosyncratic bets and looked for evidence of crowding.

Hedge Fund Energy Risk

HF Energy Aggregate has a 7.8% estimated future tracking error relative to Market Energy Aggregate, mostly due to factor bets:

| Source | Volatility (%) | Share of Variance (%) |

| Factor | 6.55 | 70.10 |

| Residual | 4.28 | 29.90 |

| Total | 7.83 | 100.00 |

HF Energy Aggregate’s annual return will differ from Market Energy Aggregate’s by more than 7.8% about one third of the time. Combined, hedge funds’ energy portfolios are active, and closet indexing is not a concern.

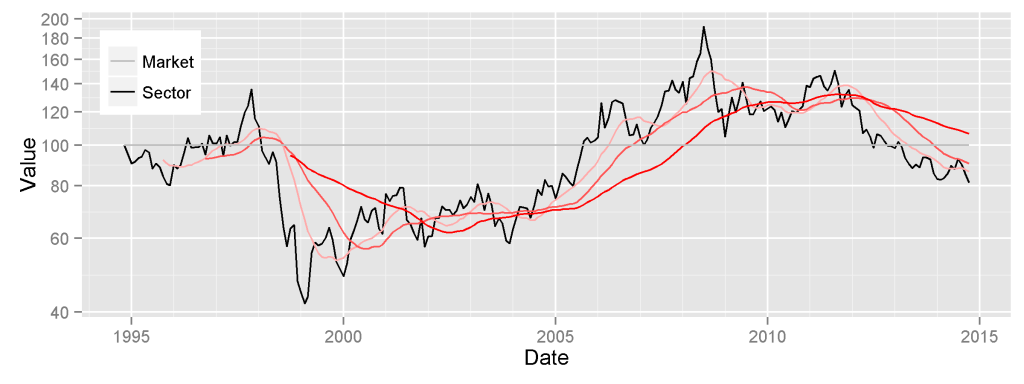

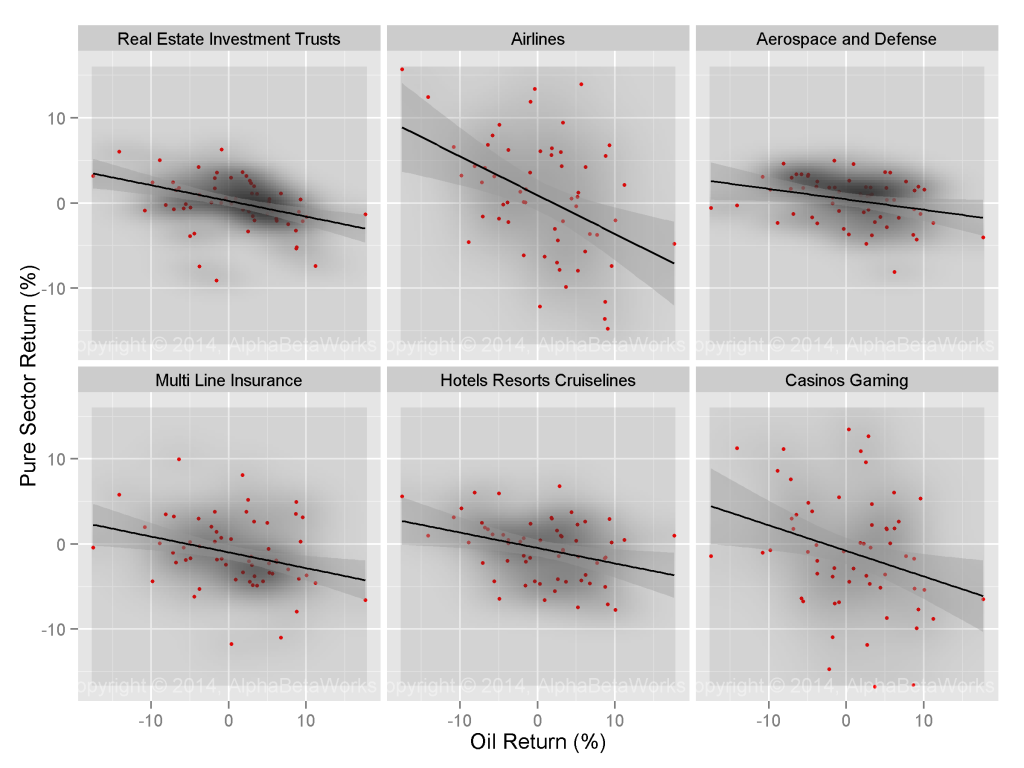

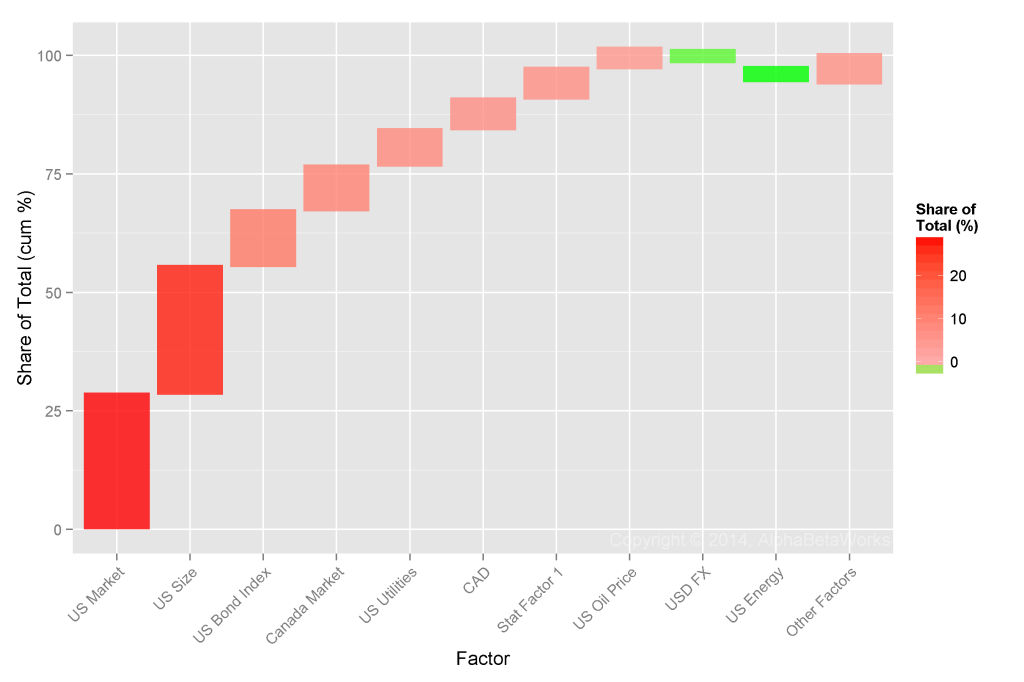

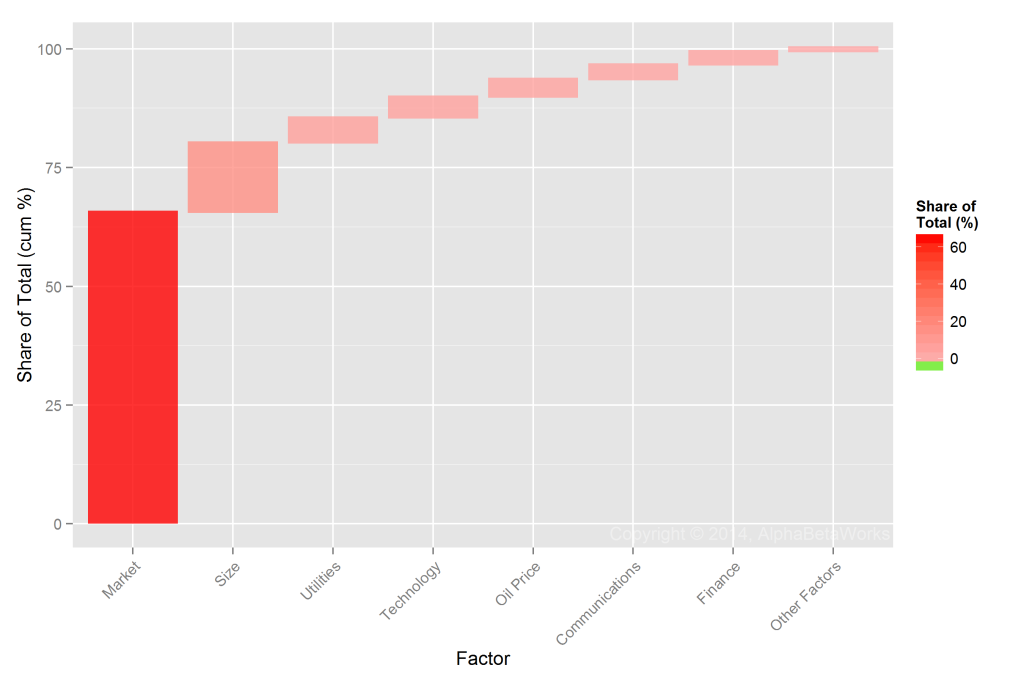

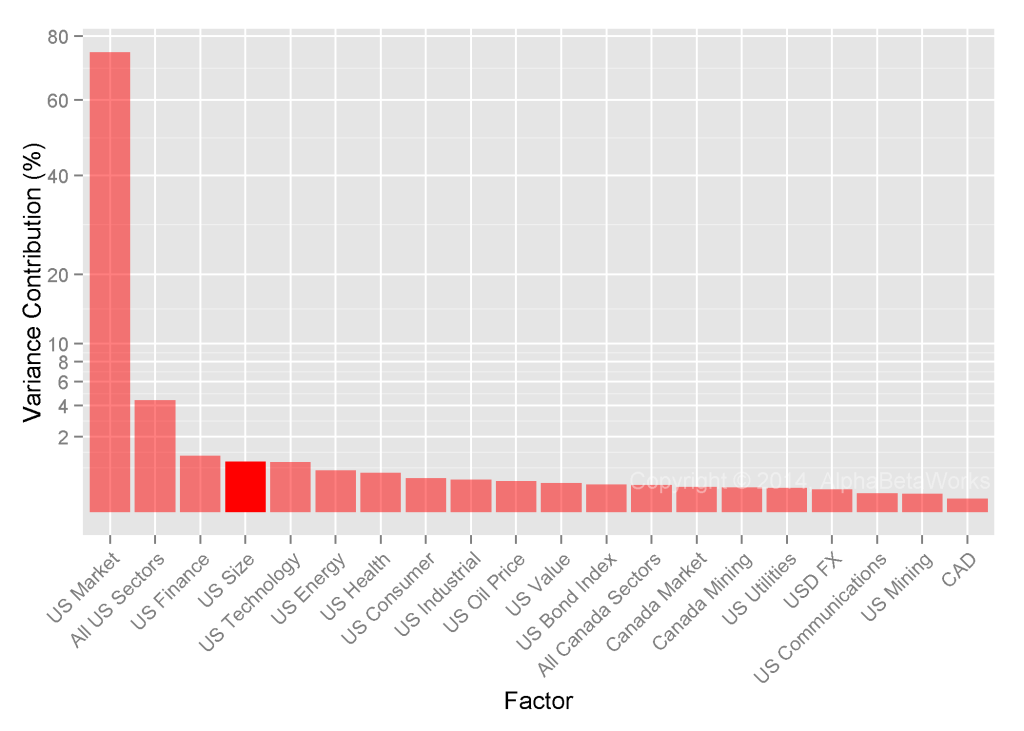

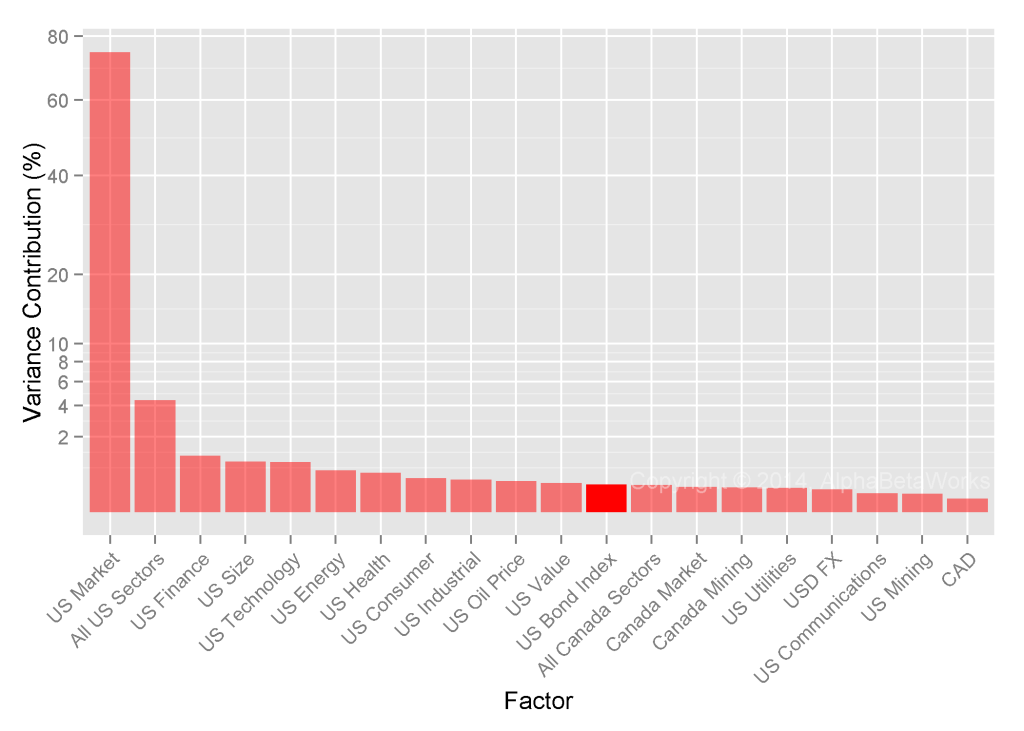

Hedge Fund Factor (Systematic) Energy Crowding

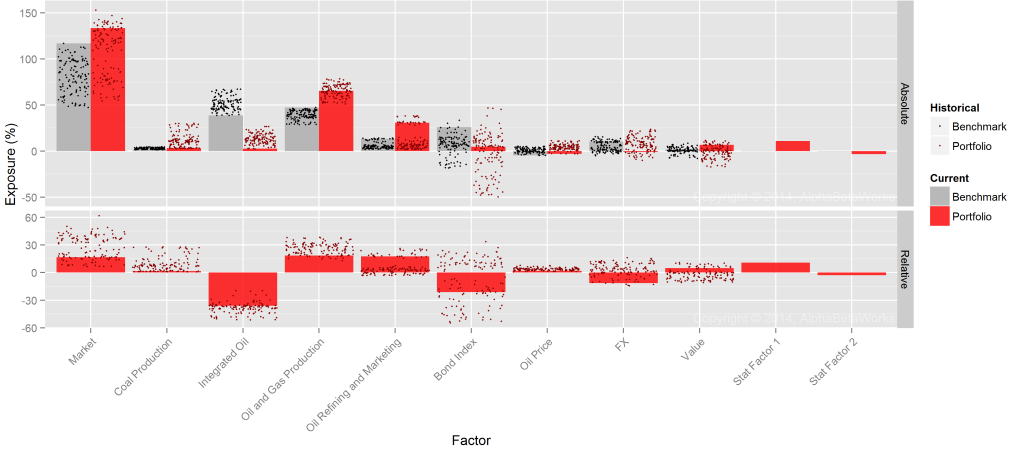

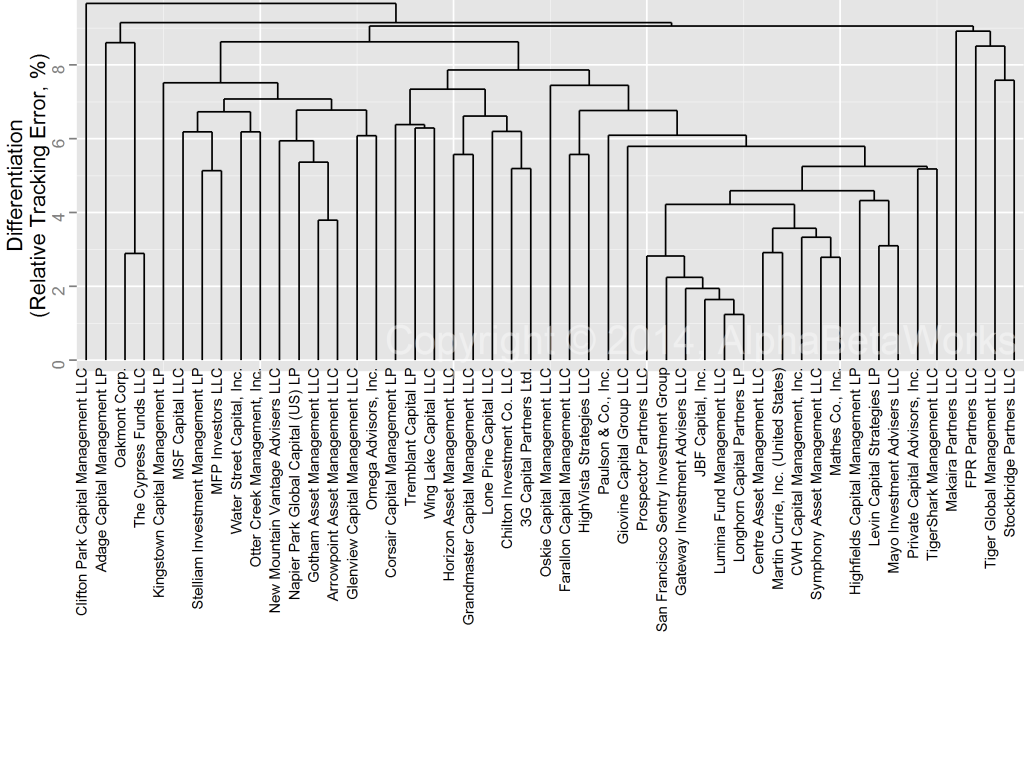

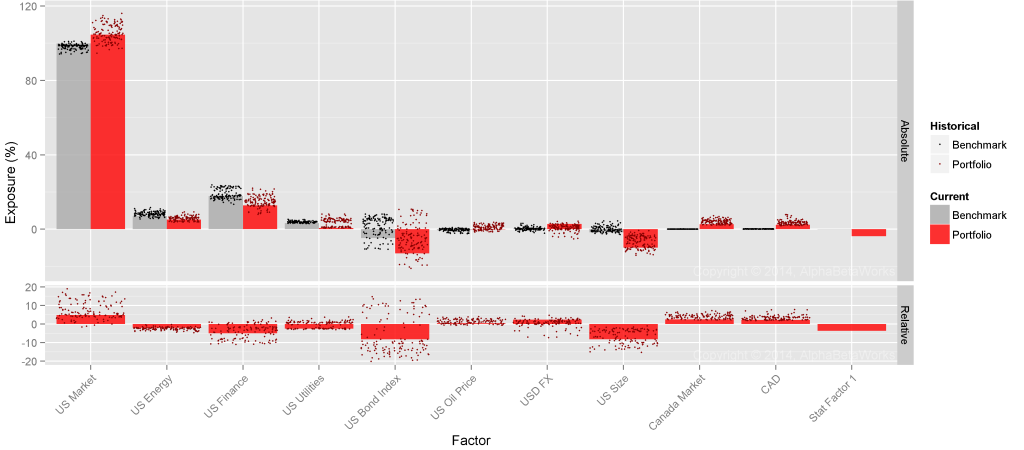

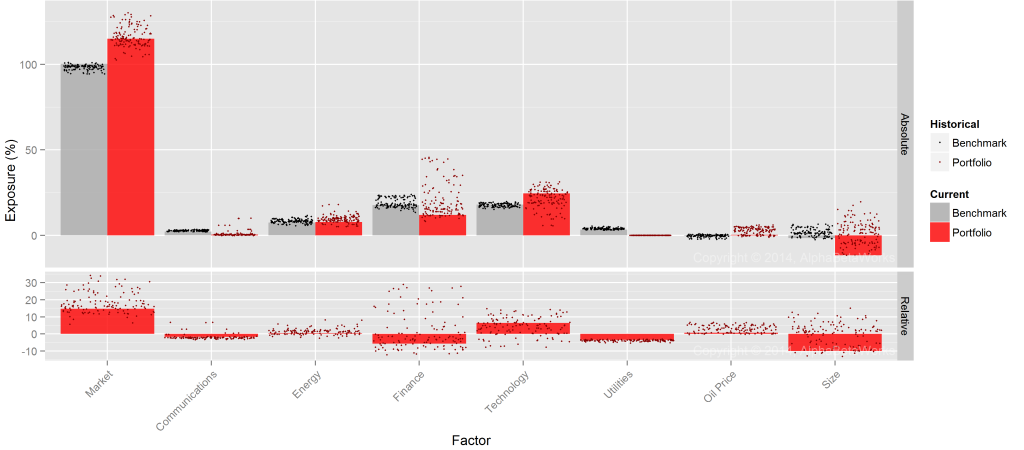

Below are HF Energy Aggregate’s most significant relative factor exposures (red). The benchmark (gray) is Market Energy Aggregate:

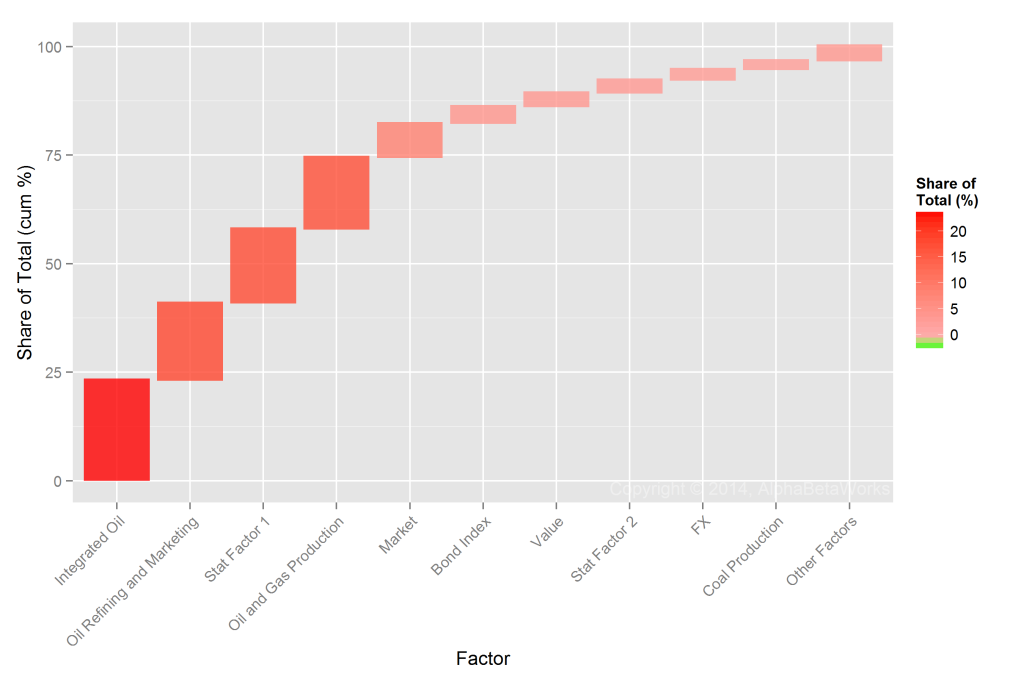

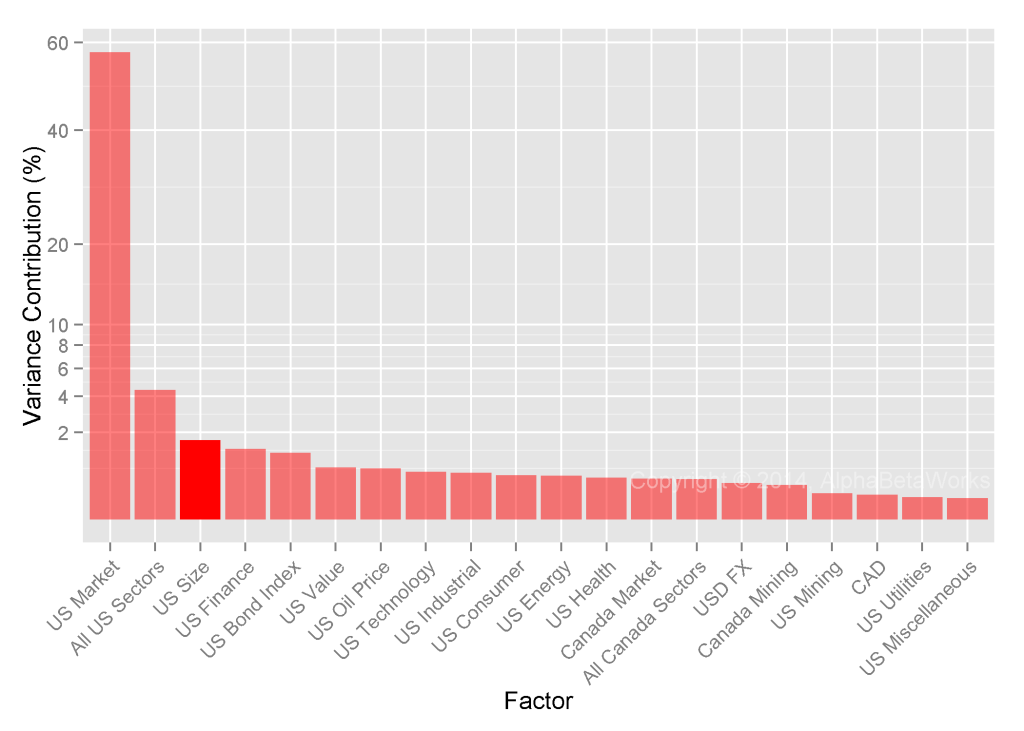

Below is the contribution of various factors to HF Energy Aggregate’s relative systematic risk. These are the components of the red “Factor Variance” in the first chart:

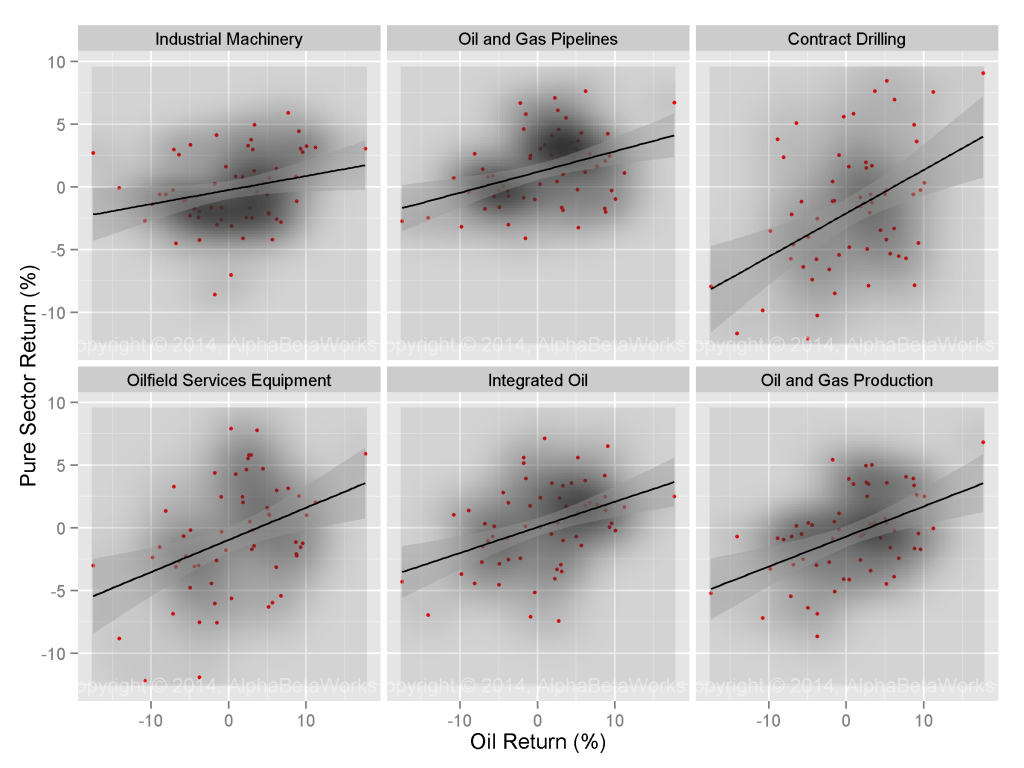

Four factors are responsible for 75% of the relative factor risk of Hedge Fund Energy Aggregate:

| Exposure (%) | ||||

| Factor | HF Energy Aggregate | Market Energy Aggregate | Relative | Share of Risk (%) |

| Integrated Oil | 2.62 | 38.75 | -36.13 | 23.01 |

| Oil Refining and Marketing | 30.87 | 13.18 | 17.68 | 17.79 |

| Stat Factor 1 | 11.86 | 0.26 | 11.59 | 17.08 |

| Oil and Gas Production | 65.53 | 47.23 | 18.30 | 16.48 |

These bets have the following meanings:

- Integrated Oil – short bet on integrated energy companies;

- Oil Refining and Marketing – long bet on oil refiners;

- Stat Factor 1 – systematic risk not captured by the standard market risk factors;

- Oil and Gas Production – long bet on non-integrated oil and gas producers.

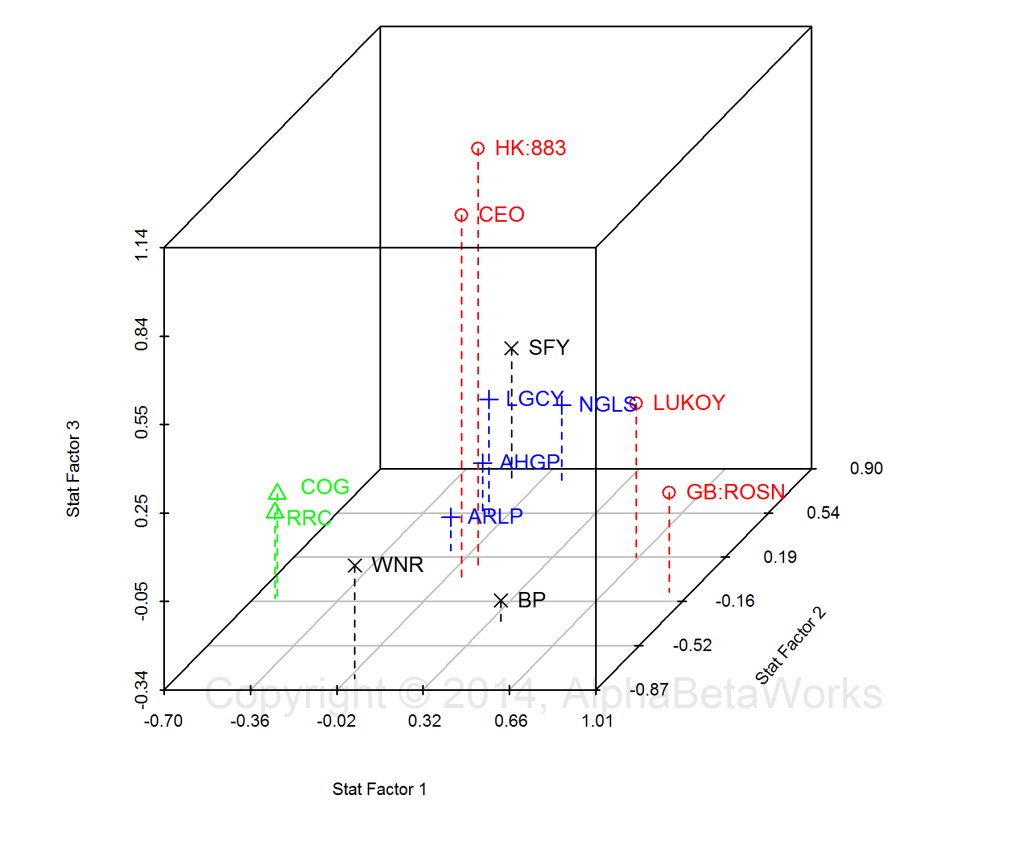

AlphaBetaWorks’ Statistical Factors (Stat Factors) capture systematic risks overlooked by traditional risk models. Statistical factors and exposures to them are estimated using factor analysis. Stat Factor 1 turns out to be a combination of bets on cheap international, and against expensive U.S. producers. Securities with the largest positive exposure to Stat Factor 1 are LukOil ADR (LUKOY), Rosneft GDR (GB:ROSN), and BP ADR (BP). Securities with the largest negative exposure to it are Range Resources (RRC) and Cabot Oil & Gas (

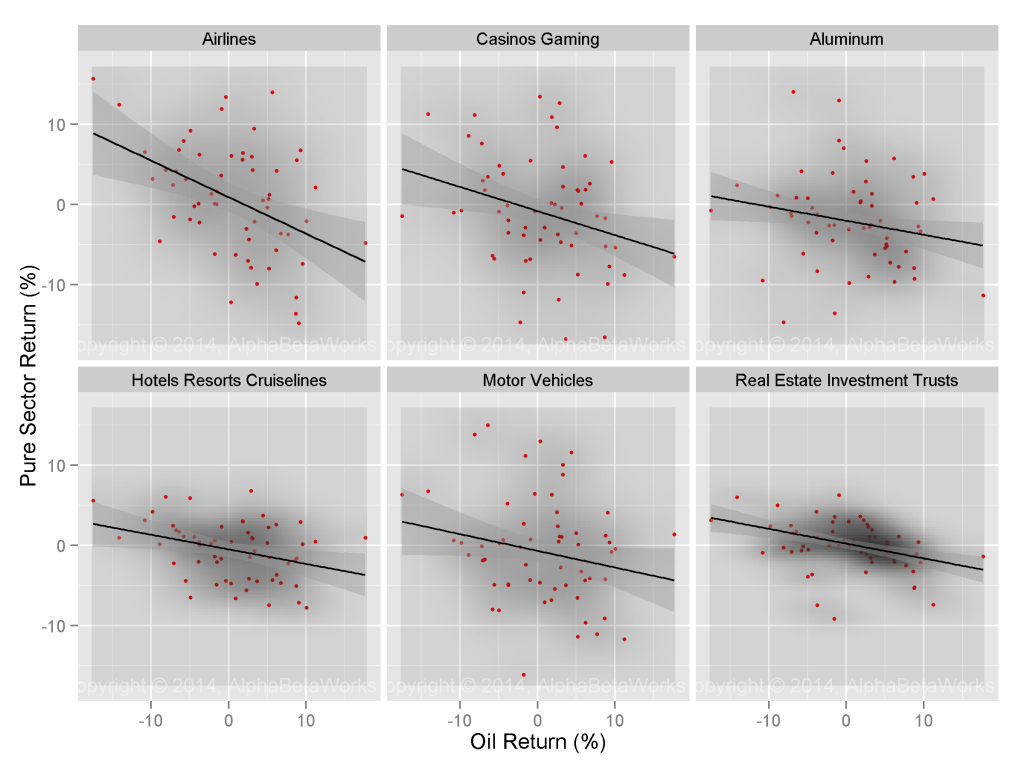

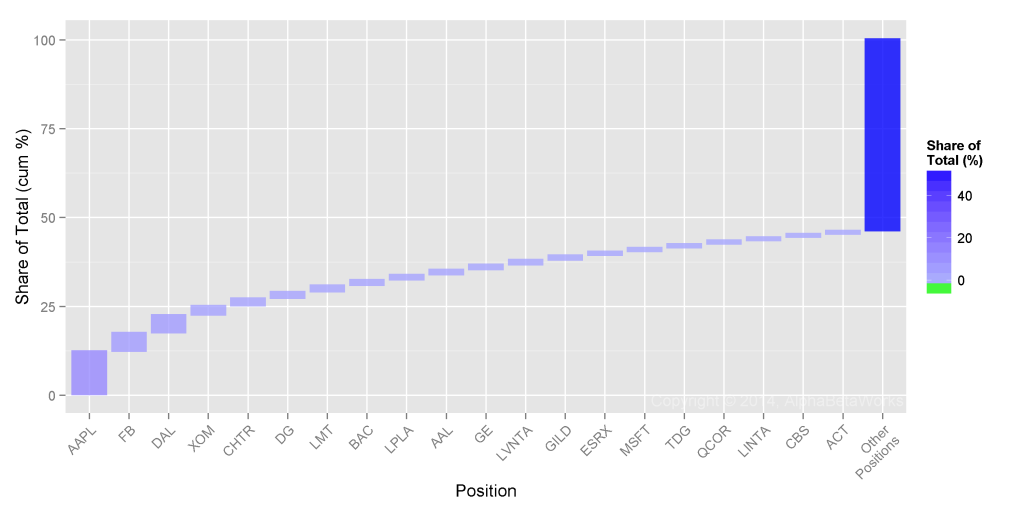

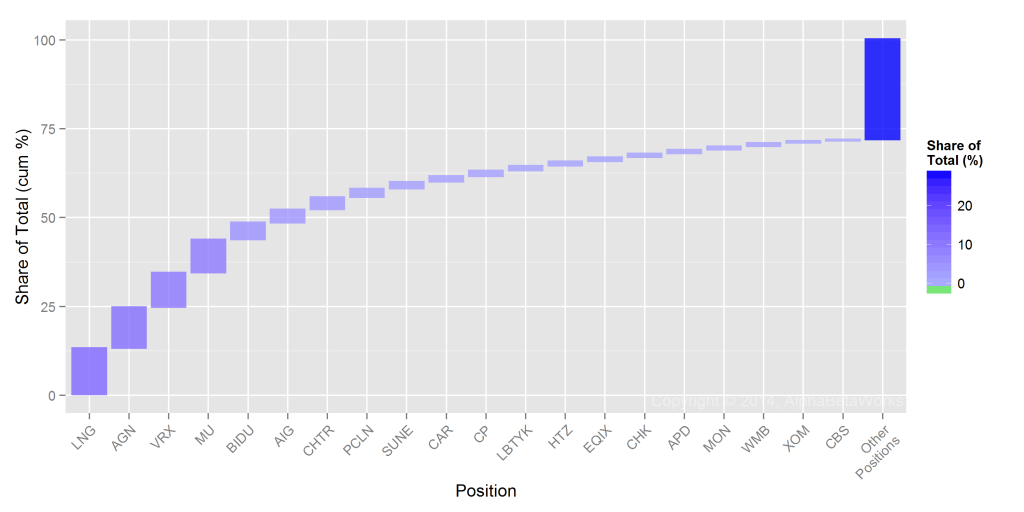

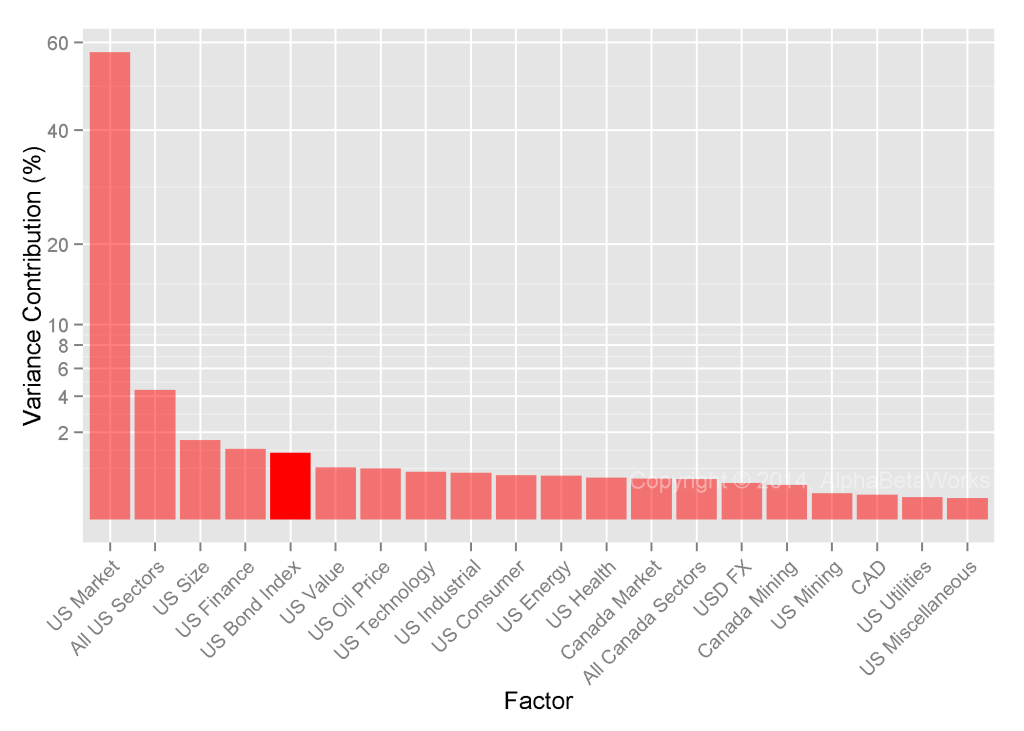

Hedge Fund Residual (Idiosyncratic) Energy Crowding

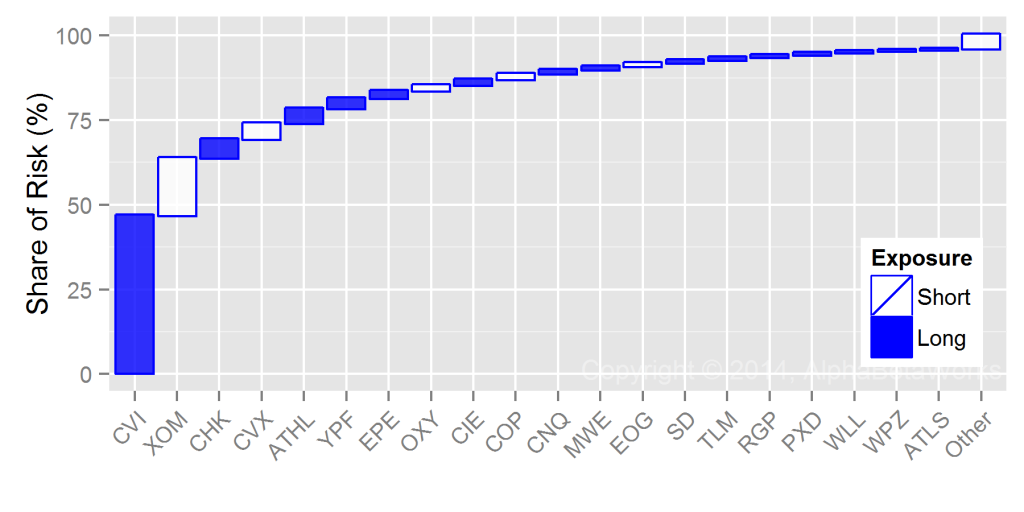

Below are the sources of HF Energy Aggregate’s relative residual variance. These are the components of the blue “Residual Variance” in the first chart. Six stocks are responsible for over three quarters of the relative residual (idiosyncratic) risk of HF Energy Aggregate:

These stocks will have the most sway on HF Energy Aggregate, and many individual funds. Conversely, the funds’ impatience will also affect these stocks the most. Investors should be ready for seemingly inexplicable volatility, especially among smaller companies:

| Position (%) | |||||

| Symbol | Name | HF Energy Aggregate | Market Energy Aggregate | Relative | Share of Risk (%) |

| CVI | CVR Energy, Inc. | 8.93 | 0.23 | 8.70 | 46.67 |

| XOM | Exxon Mobil Corporation | 0.50 | 23.90 | -23.39 | 16.98 |

| CHK | Chesapeake Energy Corporation | 5.78 | 0.91 | 4.87 | 5.49 |

| CVX | Chevron Corporation | 0.22 | 13.50 | -13.28 | 4.64 |

| ATHL | Athlon Energy, Inc. | 4.77 | 0.34 | 4.43 | 4.37 |

| YPF | YPF SA Sponsored ADR Class D | 1.89 | 0.00 | 1.89 | 3.05 |

| EPE | EP Energy Corp. Class A | 6.78 | 0.26 | 6.53 | 2.29 |

| OXY | Occidental Petroleum Corporation | 0.22 | 4.47 | -4.25 | 1.70 |

| CIE | Cobalt International Energy, Inc. | 1.99 | 0.33 | 1.66 | 1.64 |

| COP | ConocoPhillips | 0.31 | 5.61 | -5.30 | 1.64 |

| CNQ | Canadian Natural Resources Limited | 3.64 | 0.00 | 3.64 | 1.18 |

| MWE | MarkWest Energy Partners, L.P. | 3.65 | 0.85 | 2.80 | 1.03 |

| EOG | EOG Resources, Inc. | 0.52 | 3.23 | -2.71 | 1.01 |

| SD | SandRidge Energy, Inc. | 1.60 | 0.13 | 1.48 | 0.86 |

| TLM | Talisman Energy Inc. | 2.38 | 0.00 | 2.38 | 0.78 |

| RGP | Regency Energy Partners LP | 3.25 | 0.74 | 2.52 | 0.71 |

| PXD | Pioneer Natural Resources Company | 3.67 | 1.68 | 1.99 | 0.62 |

| WLL | Whiting Petroleum Corporation | 2.44 | 0.55 | 1.89 | 0.56 |

| WPZ | Williams Partners L.P. | 3.21 | 1.39 | 1.83 | 0.35 |

| ATLS | Atlas Energy, L.P. | 0.62 | 0.14 | 0.48 | 0.31 |

As with factor crowding, there is significant stock-specific crowding into a handful of popular names.

Summary

- There is both factor (systematic/market) and residual (idiosyncratic/security-specific) crowding of long hedge fund energy portfolios.

- The main sources of systematic crowding are three bets on energy sub-sectors and a relative value bet on international vs. domestic producers.

- The main sources of stock-specific crowding are CVI, XOM, CHK, ATHL, CVX, and YPF.

- Investors in crowded stocks may experience elevated volatility.

- Collectively, hedge funds’ long U.S. energy equity portfolios tend to generate negative risk-adjusted returns. Consequently, their crowded bets in this sector tend to disappoint.