ESG constraints and overlays can create significant systematic exposures within equity portfolios. Whereas some of these exposures may be intentional long and short industry bets, others are unintentional bets on the overall equity market or other macroeconomic factors. In order to deploy ESG strategies successfully, it is vital to identify, quantify, and manage the effect of ESG constraints on systemic risk. That is the only way to avoid unintended hidden risks and the poor performance that results.

Background and Methodology

Over the past decade, institutional investors have been increasingly incorporating Environmental, Social, and Governance (ESG) metrics into their portfolios. Common approaches include separate ESG mandates and ESG constraints applied across entire portfolios. The investors who have implemented these strategies have too often paid little attention to the changes they cause in their portfolios’ factor exposures. This oversight is regrettable, since such changes in systematic risk can dominate subsequent tracking error.

To illustrate a typical ESG overlay effect, we created a constrained portfolio using the FTSE-Russell ESG ratings for S&P 500 Index constituent. The constrained portfolio excluded approximately 18% of the index’s market capitalization with low ESG ratings (below 2.5). A highly predictive multi-factor equity risk model allowed us to analyze the constrained portfolio’s tracking error relative to the unconstrained index.

Tracking Error Due to ESG Constraints

This ESG overlay resulted in an estimated 1.2% tracking error:

Approximately 80% of the tracking error was due to relative factor exposures – relative systematic bets of the constrained portfolio.

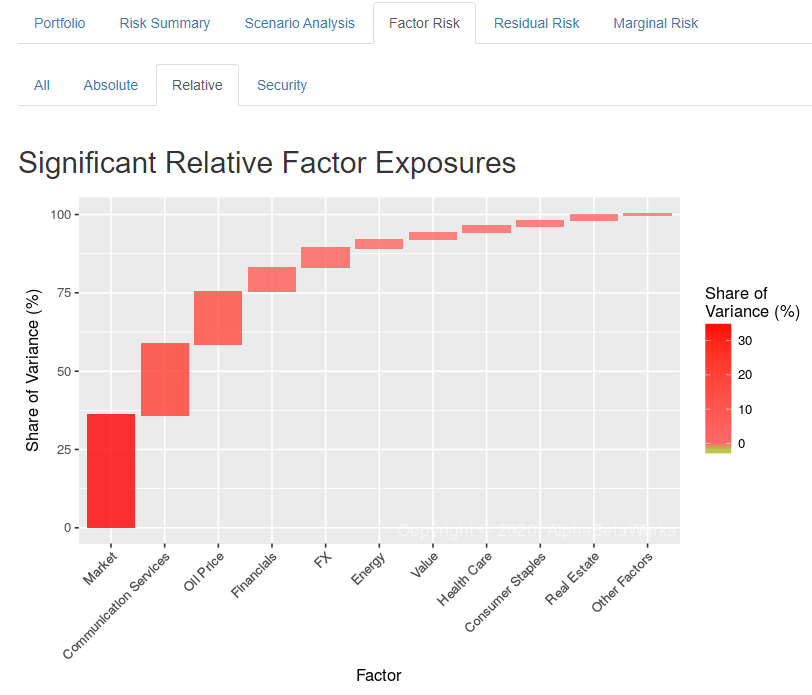

Relative Factor Exposures Due to ESG Constraints

Some relative factor bets – for instance, oil price and Energy sector exposures – are reasonable and expected consequences of the overlay. Others look like risky unintended macro tilts:

At nearly 50%, the Equity Market is by far the largest relative factor bet. Market, FX, and Style factor exposures are frequent unintended side-effects of ESG overlays. Fortunately, this risk to strategy’s long-term viability is easy to mitigate. Cheap passive investment vehicles such as index funds, ETFs, futures, and swaps can offset unintended effects of ESG constraints.

The above simple example is representative of the impact of ESG constraints on systematic risk in the real world. Such rules often create factor bets that are undiscovered until they lead to costly underperformance. The effect can be so dramatic that a completely different benchmark could be necessary for this type of strategy. Yet, this solution may not always be feasible and leaves the sacrificed performance unaddressed. Instead, institutions that deploy ESG criteria would benefit from analyzing the resulting exposures and managing any unintended factor bets. Predictive multi-factor models built with liquid investable factors are powerful tools for this task. Such models can identify the inadvertent market bets and guide their mitigation with cheap passive investments, thus avoiding style drift and costly underperformance.

Conclusions

- ESG constraints and portfolio overlays can lead to unintended systematic bets.

- Some effects of ESG constraints on systematic risk, such as reducing energy sector exposure, may be intentional.

- Other effects of ESG constraints may be unintentional long/short market and macro bets.

- A robust and predictive equity risk model built with investable factors can identify such unintended effects of ESG constraints and guide their mitigation with cheap and liquid passive instruments.

This article was produced in collaboration among AlphaBetaWorks, a division of Alpha Beta Analytics, LLC, Beacon Pointe, and Peer Analytics.

The information herein is not represented or warranted to be accurate, correct, complete or timely. Past performance is no guarantee of future results. Copyright © 2012-2021, AlphaBetaWorks, Beacon Pointe, and Peer Analytics. All rights reserved. Content may not be republished without express written consent.