Many Large-Cap Funds in Theory Are Small-Cap in Practice

Using the market capitalization of holdings, common in rudimentary forms of style-box analysis, provides an incorrect picture of style and risk for as much as a fifth of large- and mega-cap funds. In practice, these funds have the risk and return profiles of small-cap funds. Misidentifying such “Small-Cap Large-Cap Funds” distorts the risk profile and performance of a fund portfolio. A robust risk model, such as the AlphaBetaWorks Statistical Equity Risk Model, estimates pure equity size risk.

Size Risk Defined

The weighted average market cap of holdings is a common, simple, and convenient measurement of portfolio size risk. However, a factor model is preferable due to its stronger predictive power.

AlphaBetaWorks’ Size Factor (ABW Size Factor) is closely related to the Fama–French SMB Factor, but with enhancements: The ABW Size Factor strips out market and sector effects from security returns, revealing pure size risk. By contrast, SMB Factor captures size risk, but it also picks up market beta and sector effects within security returns, since these effects influence the relative performance of small and large cap stocks. This market and sector noise in the SMB Factor makes accurate risk estimation challenging and accurate performance attribution impossible.

The ABW Size Factor strips market and sector effects from security returns, revealing pure size risk. The ABW Size Factor is the difference in returns, net of market and sector effects, between the largest and the smallest stocks. The opposite of the ABW Size Factor is the ABW Small-Cap Factor – the outperformance, net of market and sector effects, of the smallest stocks:

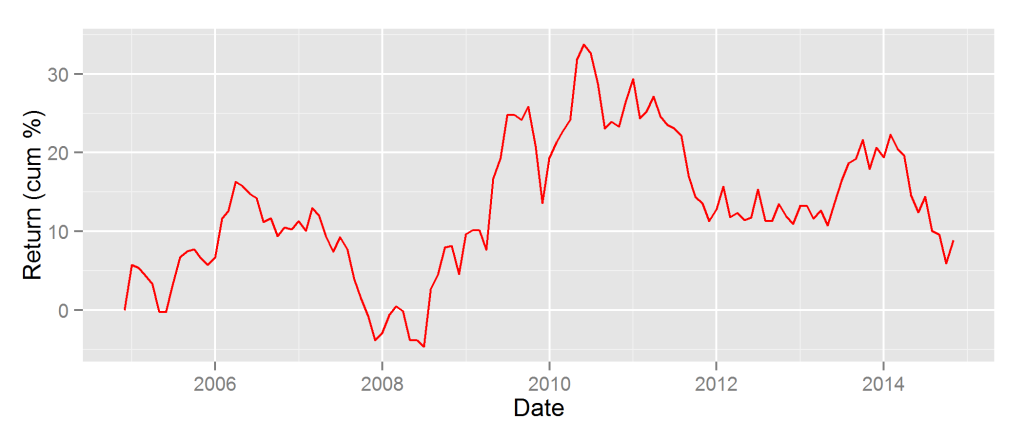

Size Factor and Small-Cap Factor are key drivers of portfolio returns in all markets. The Small-Cap Factor declined by approximately 6% from January through July of 2014. This volatility affected not only small-cap funds but also large-cap funds with small-cap risk (“Small-Cap Large-Cap Funds”).

Size Risk of Individual Stocks

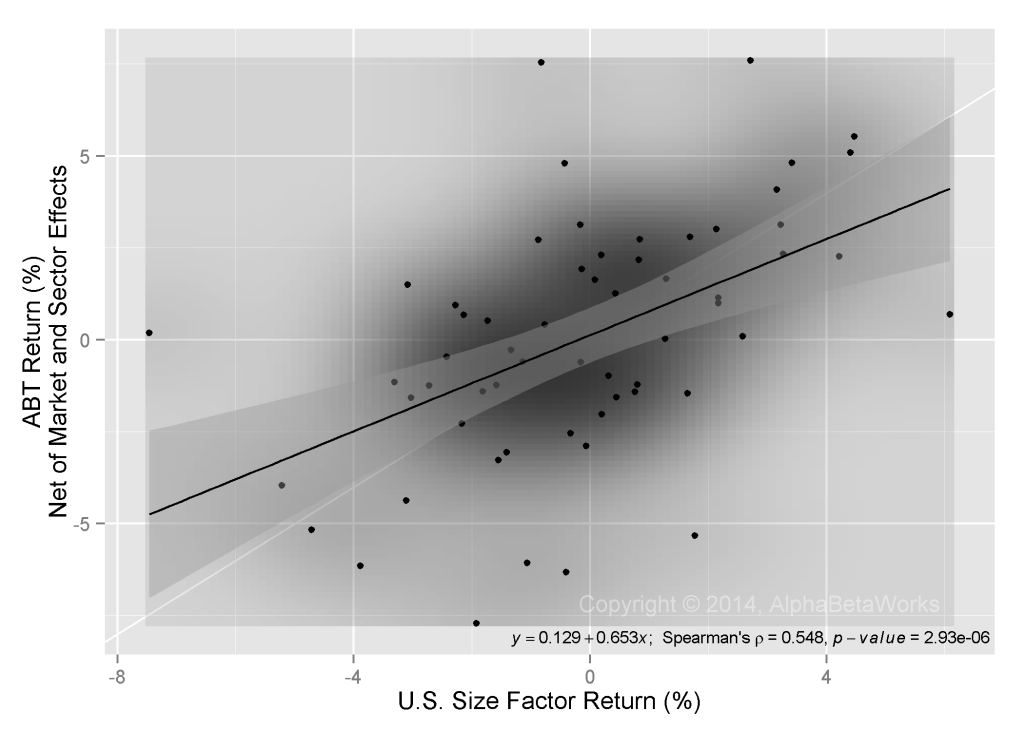

Large-cap companies generally have positive exposure to Size Factor. For example, Abbott Laboratories (ABT), with a $64 billion market cap, has Size Factor exposure of +0.65. If large stocks outperform small stocks by 10% in a flat market, ABT will, on average, return 6.5%:

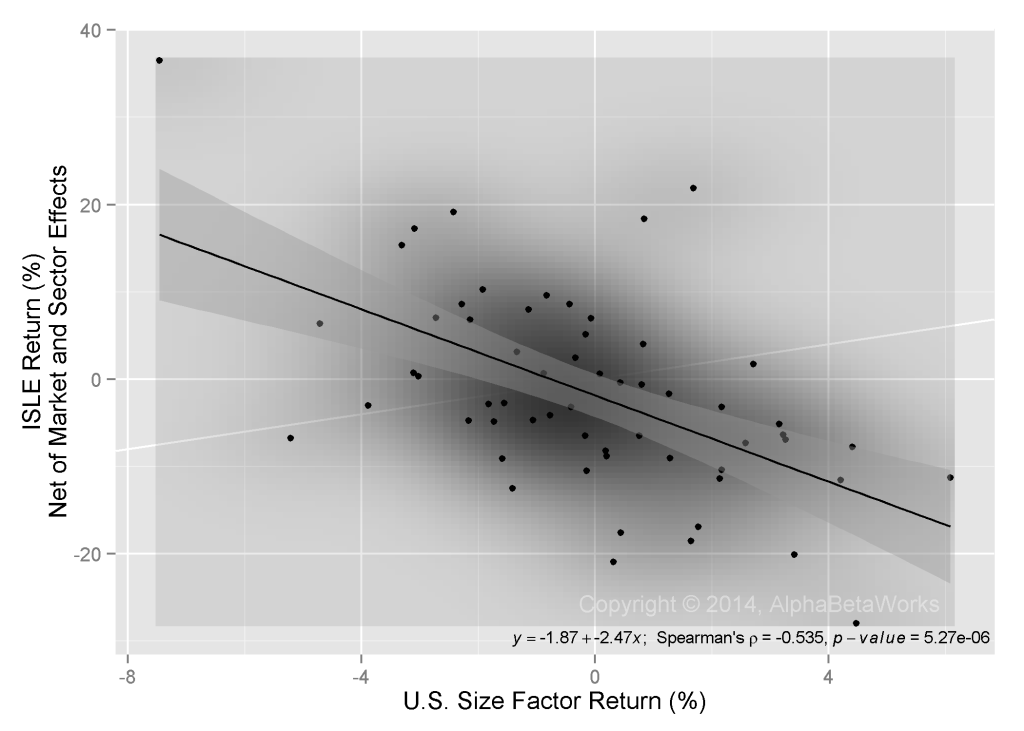

Small-caps generally have negative exposure to Size Factor. For example, Isle of Capri Casinos, Inc. (ISLE), with a $300 million market cap, has Size Factor exposure of -2.47. If large stocks outperform small stocks by 10% in a flat market, ISLE will, on average, decline by 24.7%:

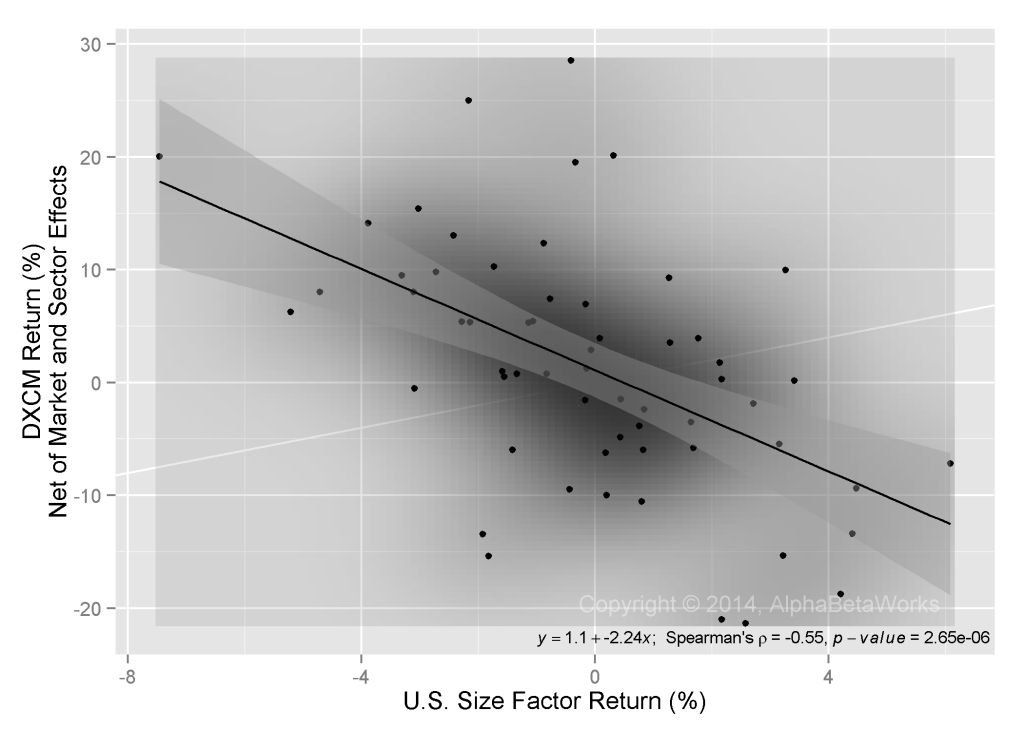

Similar to large cap funds, not all large-cap companies have a positive relationship with Size Factor. If a large-cap company is owned primarily by small-cap investors, has a very small float, or was rapidly elevated to large-cap status, it may retain the risk and behavior of a small-cap. For instance, DexCom, Inc. (DXCM) having appreciated by approximately 500% in a few years, remains a favorite among small-cap traders, retaining its small-cap risk profile. Despite its current $3.5 billion market cap, DXCM has a Size Factor exposure of -2.24. If the largest stocks outperform the smallest stocks by 10% in a flat market, DXCM will, on average, decline by 22.4%:

Size Risk Impact on Mutual Funds and Hedge Funds

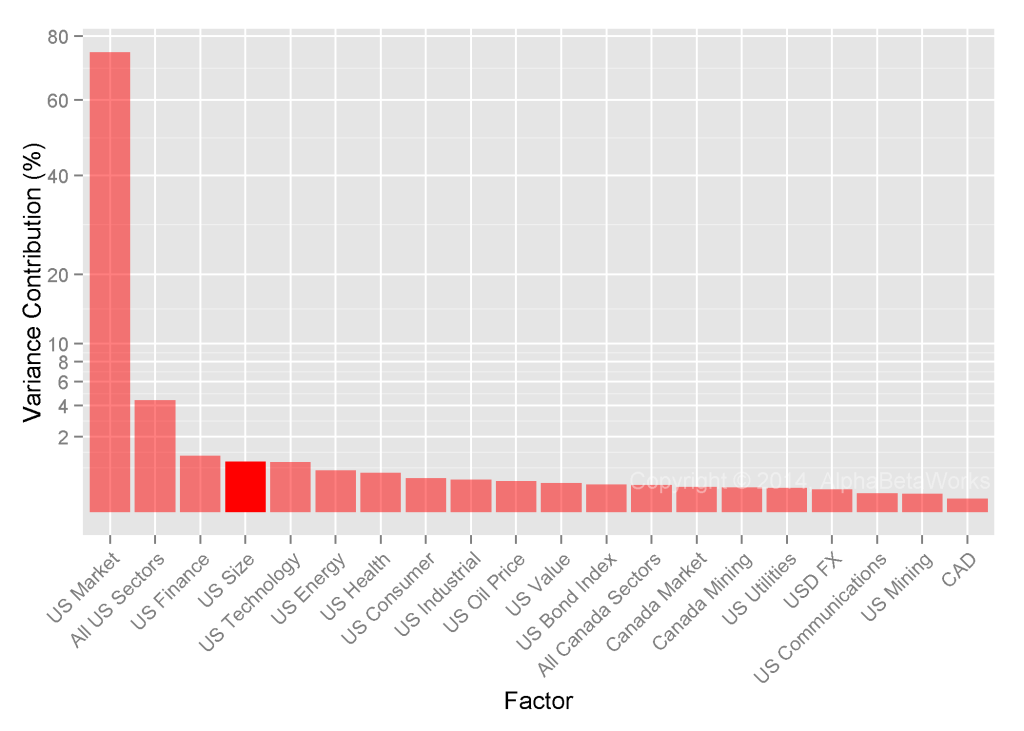

How important is Size Factor in practice? Size Factor exposure accounts for approximately 1.0% of aggregate U.S. mutual fund variance – about the same as the Finance Sector – making Size Factor the third-most important driver of risk and return:

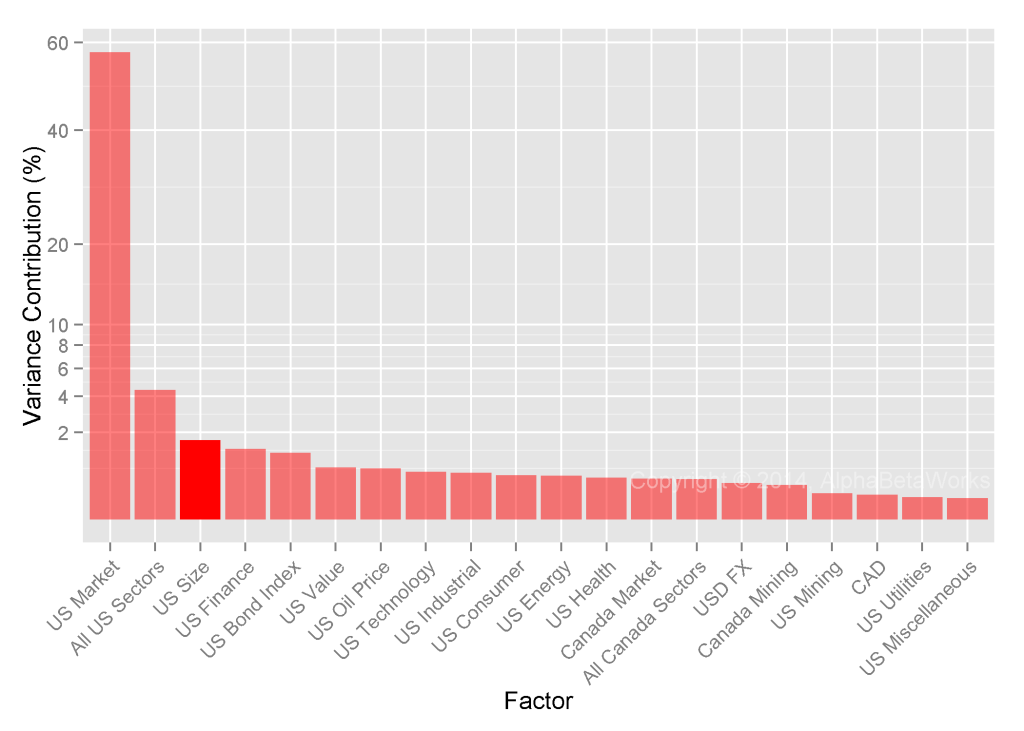

Among U.S. hedge funds, Size Factor exposure is a more significant source of returns, explaining 1.7% of variance. Only the Market Factor (market beta) is more influential.

The importance of size risk to hedge funds is one of the consequences of their fondness for “cheap call options,” often small and speculative issues. Mind you, this is aggregate data. For many individual funds size risk is even more important.

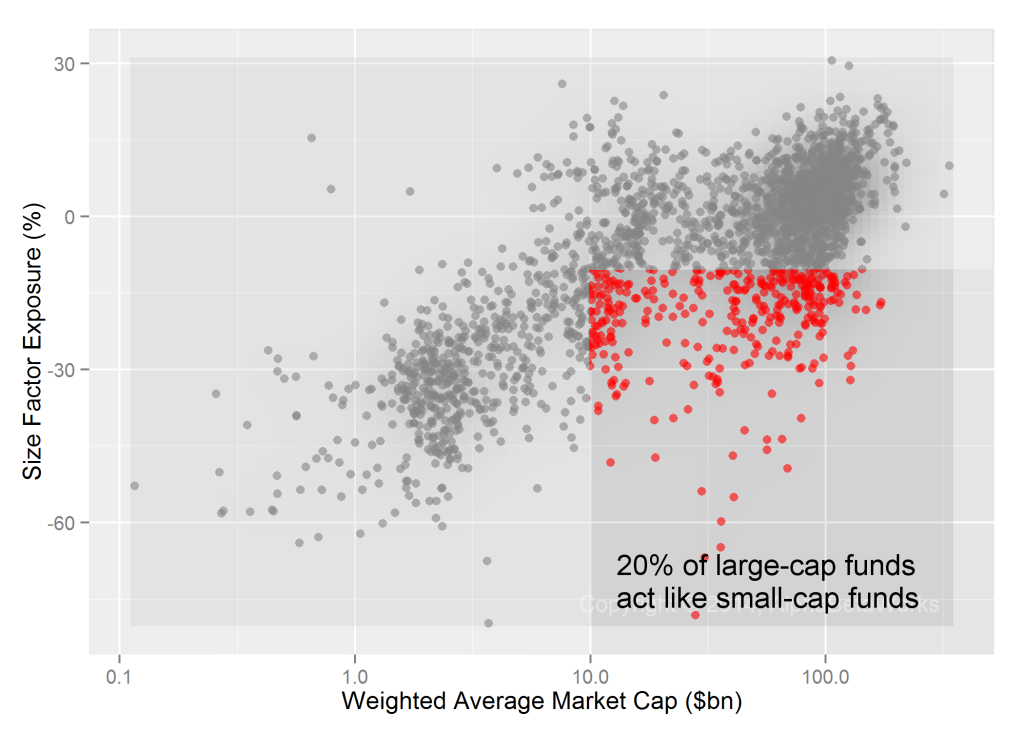

Size Risk and Market Cap

Since small-cap companies tend to outperform over the long-term, a large-cap fund can outperform its benchmark by owning large caps that act like small caps (i.e. being short Size). Therefore, we should expect to find large-cap funds trending towards short size exposures. Our observation of approximately 3,000 medium and lower turnover U.S. mutual funds confirms this trend: 20% (342) of 1759 large- and mega-cap funds have Size Factor exposure of small- and micro-cap funds. These funds will tend to act like small-cap funds in the future.

Small-Cap Large-Cap Funds

Below is a list of “large-cap” mutual funds having small-cap risk profiles. These are funds with the largest divergence between their weighted average market caps and their size risk (Size Factor exposure):

| Symbol | Name | Weighted Average Market Cap ($bn) | Size Factor Exposure (% of Equity) |

| RYOIX | Rydex Biotechnology Fund | 27.93 | -78.13 |

| FBIOX | Fidelity Select Biotechnology Portfolio | 30.59 | -66.80 |

| FBDIX | Franklin Biotechnology Discovery Fund | 35.90 | -64.88 |

| ETNHX | Eventide Healthcare & Life Sciences Fund | 3.70 | -79.71 |

| FBTTX | Fidelity Advisor Biotechnology Fund | 36.02 | -59.77 |

| SCATX | RidgeWorth Aggressive Growth Stock Fund | 40.68 | -55.00 |

| JAMFX | Jacob Internet Fund | 68.97 | -49.35 |

| HTECX | Hennessy Technology Fund | 29.71 | -53.84 |

| INPSX | ProFunds Internet Ultrasector Fund | 56.34 | -45.69 |

| PRGTX | T Rowe Price Global Technology Fund | 65.29 | -43.59 |

For example, the size exposure of PRGTX above (-43.59%) is that of a typical mutual fund with holdings averaging $1 to $5 billion market capitalizations.

The large-cap funds above (and over 300 others we identified) benefit the most from small-cap returns. If misidentified or misunderstood, they and others may contribute to a risk profile that was not intended by the allocator or investor.

Conclusions

- The market capitalization of holdings, used by the rudimentary forms of style analysis, mischaracterizes the risk of 20% of large-cap mutual funds.

- Some large-cap funds and stocks have small-cap size risk.

- The ABW Size Factor estimates pure size risk of securities and portfolios by stripping out all market and sector effects.

- Since small-caps outperform over the long term, many large-cap funds seek small-cap risk exposures to enhance returns.

- Investors must monitor the size risk of their funds, to ensure that their portfolios have the expected exposures to small-caps.

The information herein is not represented or warranted to be accurate, correct, complete or timely.

Past performance is no guarantee of future results.

Copyright © 2012-2014, AlphaBetaWorks, a division of Alpha Beta Analytics, LLC. All rights reserved.

Content may not be republished without express written consent.