Separating the Signal from the Noise

Market noise obscures the true relationships among individual sectors and true industry-specific performance. By stripping away market and broad macroeconomic effects, we can derive the returns of pure sector factors. Without proper analysis of these factors, accurate risk management, performance attribution, and manager skill evaluation are impossible. Investors oblivious to trends in pure sector returns may be blindsided by secular trends.

Pure Sector Performance

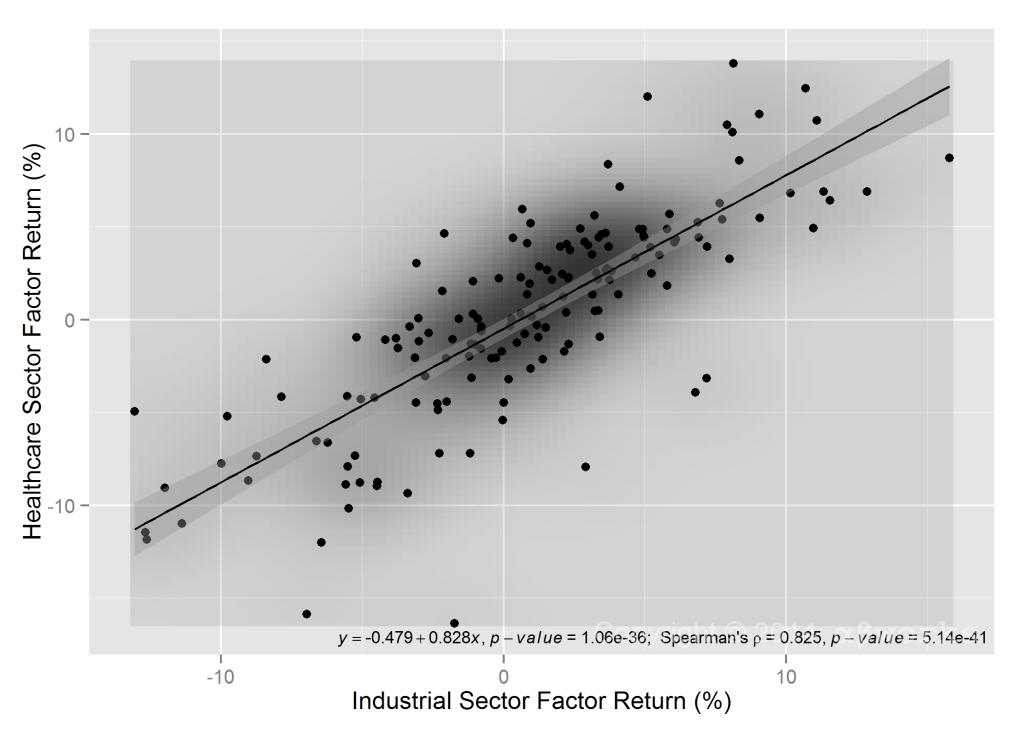

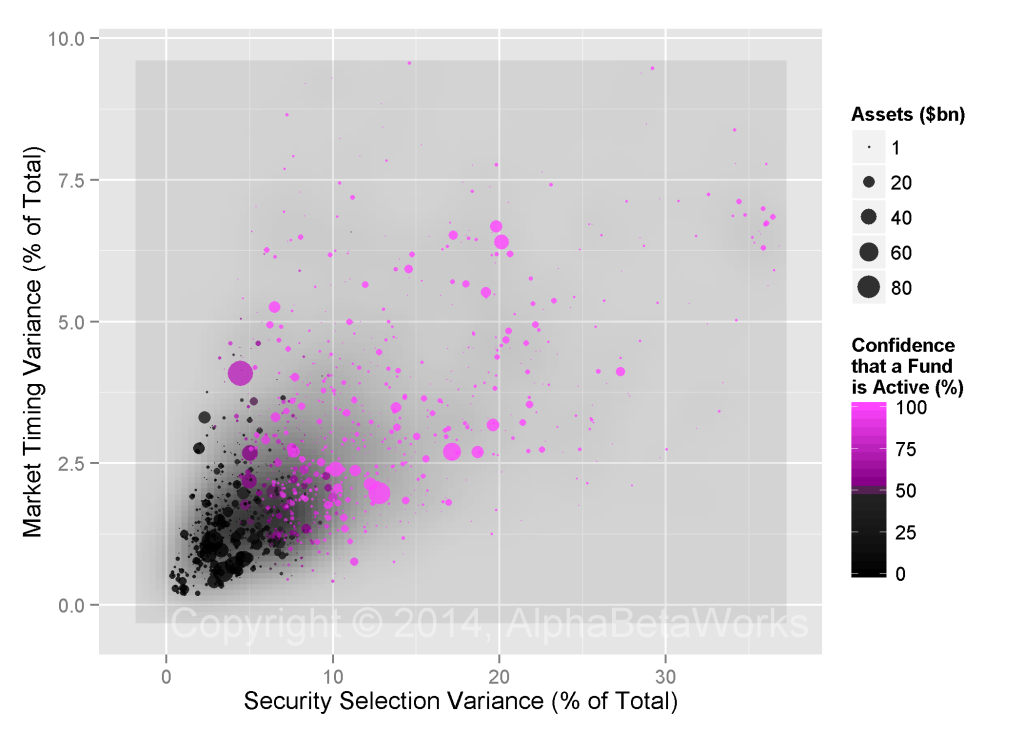

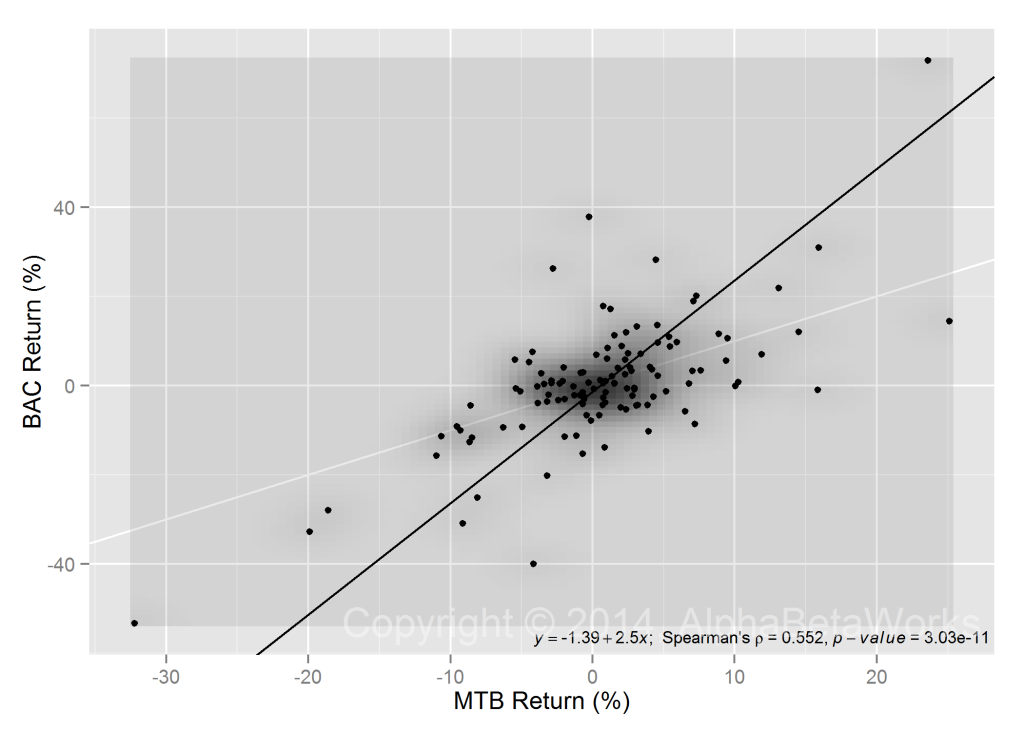

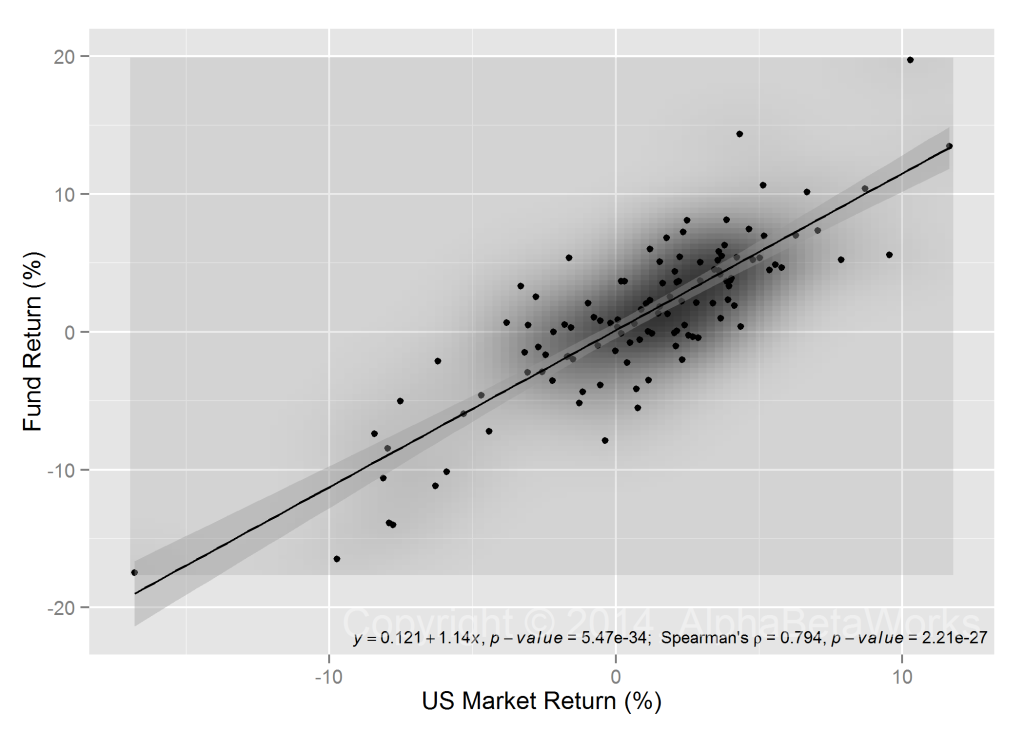

Market performance is the most important factor influencing the returns of most securities, indices, and sectors. Hence, it is generally impossible to assess the true relative performance of two sectors without first removing market effects. For example, a simple analysis of US Healthcare and Industrial Sector index returns suggests that they are highly, and positively, correlated:

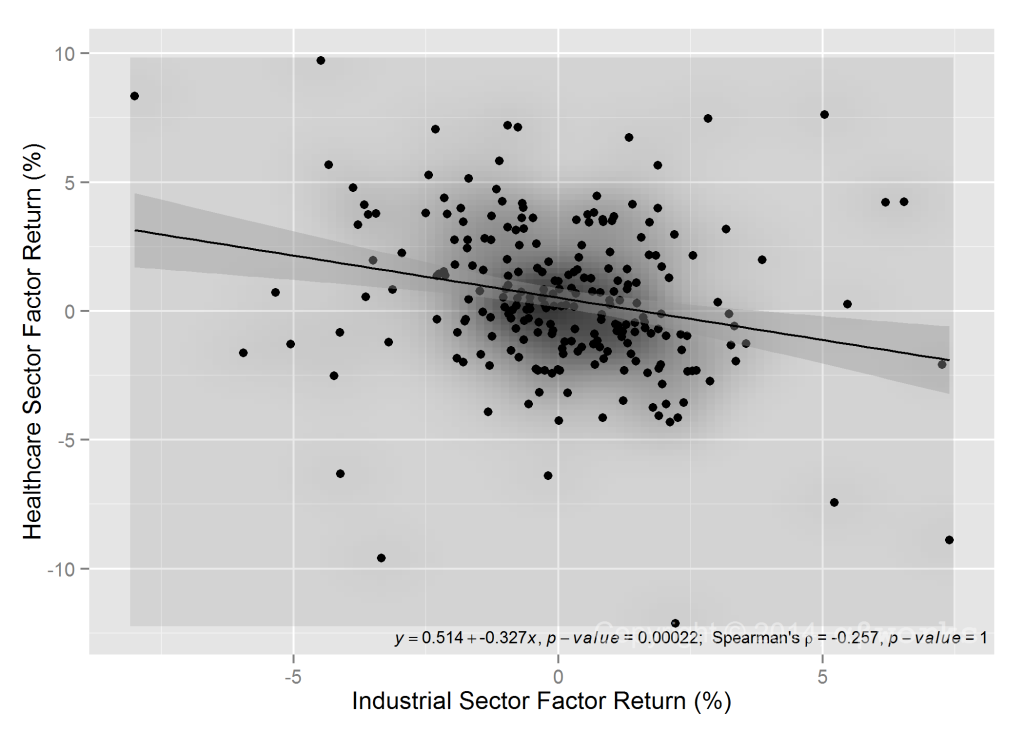

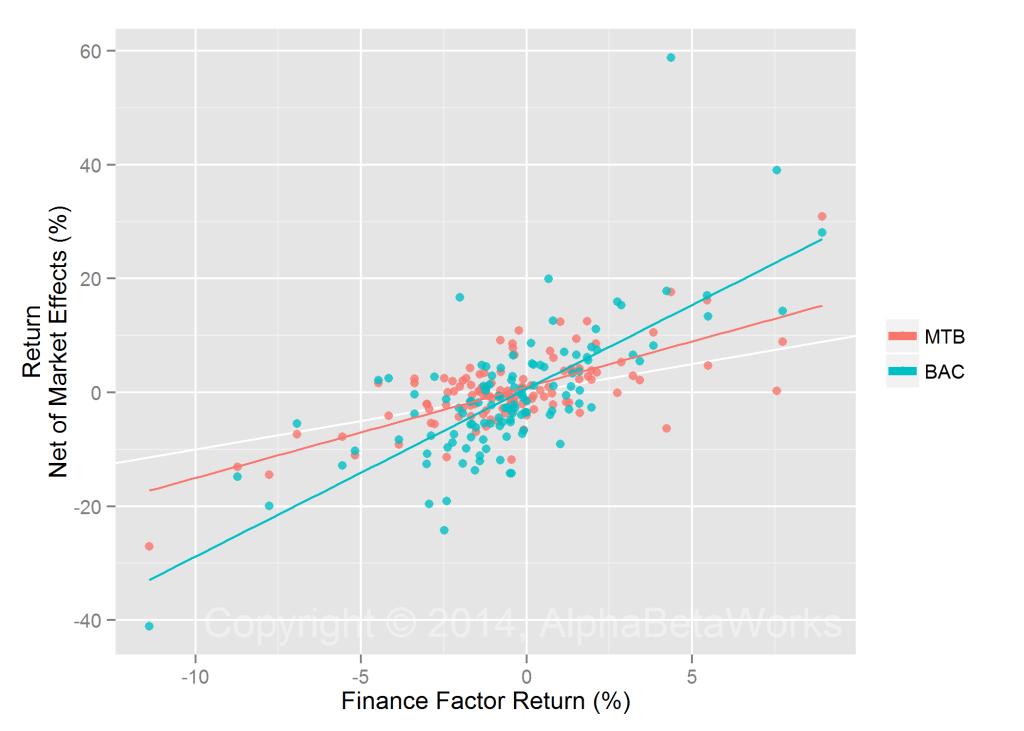

However, this positive relationship is entirely due to the shared market component of their returns. When these returns are stripped of market noise, a negative relationship emerges:

A simplistic analysis of sector index performance is often misleading: A portfolio manager may conclude that, given the high correlation between healthcare and industrials indices, one is a good hedge for the risk of the other. In reality, though their overall returns look similar, their industry-specific returns are negatively correlated. A risk model that cannot tell whether the relationship between sectors is positive or negative will produce erroneous estimates of risk and yield suboptimal portfolios.

The underlying differences in sector performance emerge once market and other macroeconomic effects are removed. Accordingly, pure sector returns provide insights into relative performance, trends, and fundamentals.

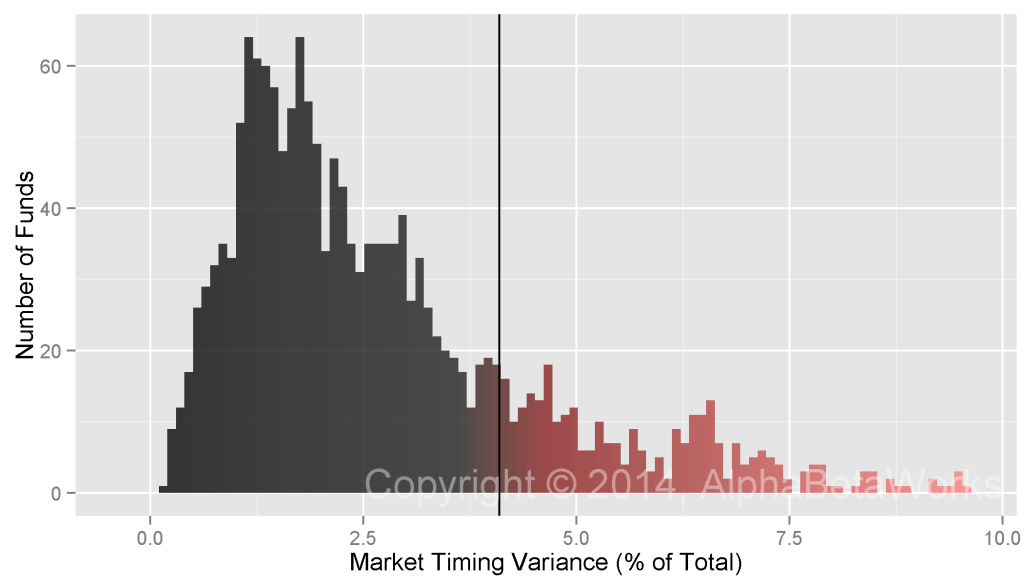

Best and Worst Performing Sectors: First Half of 2014

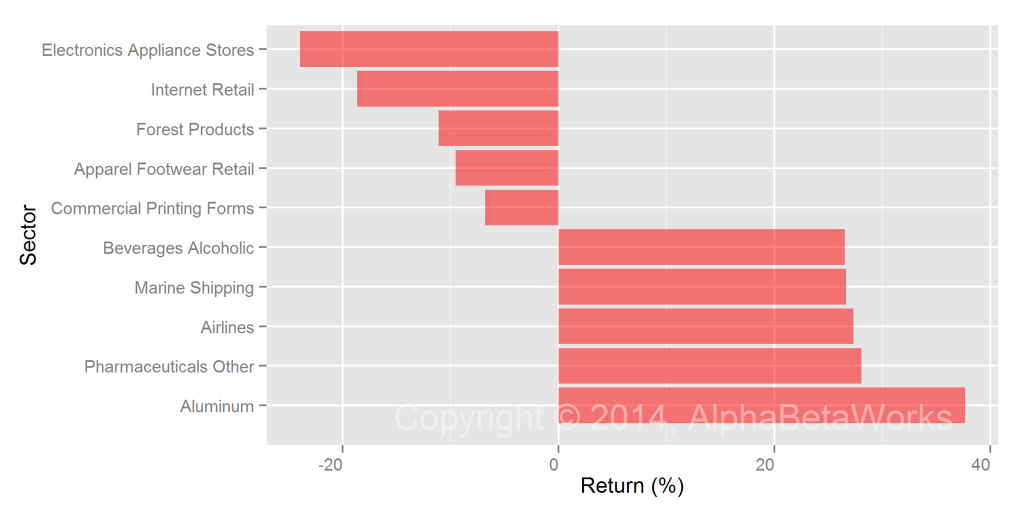

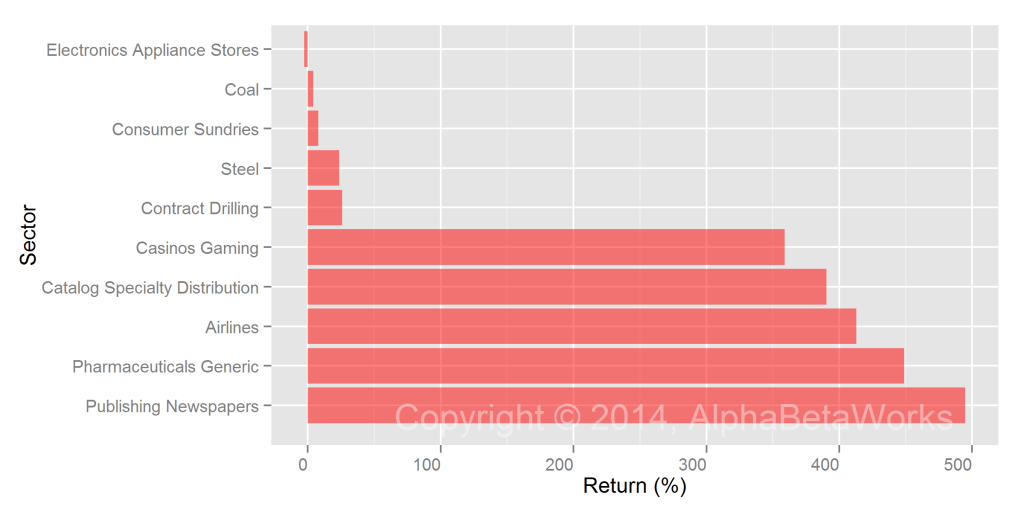

Below are two charts showing YTD performance of the best- and worst-performing sectors. The first is the performance without removing market and macroeconomic noise:

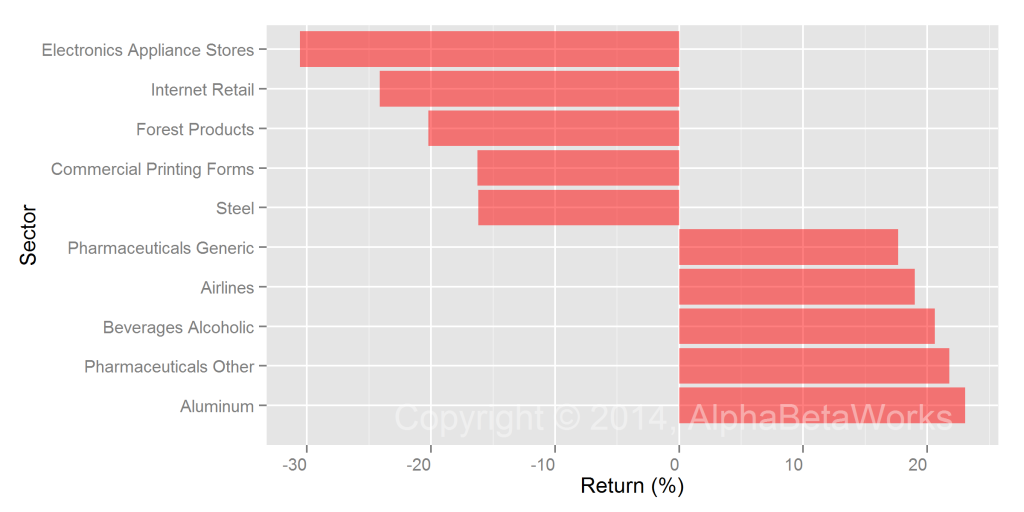

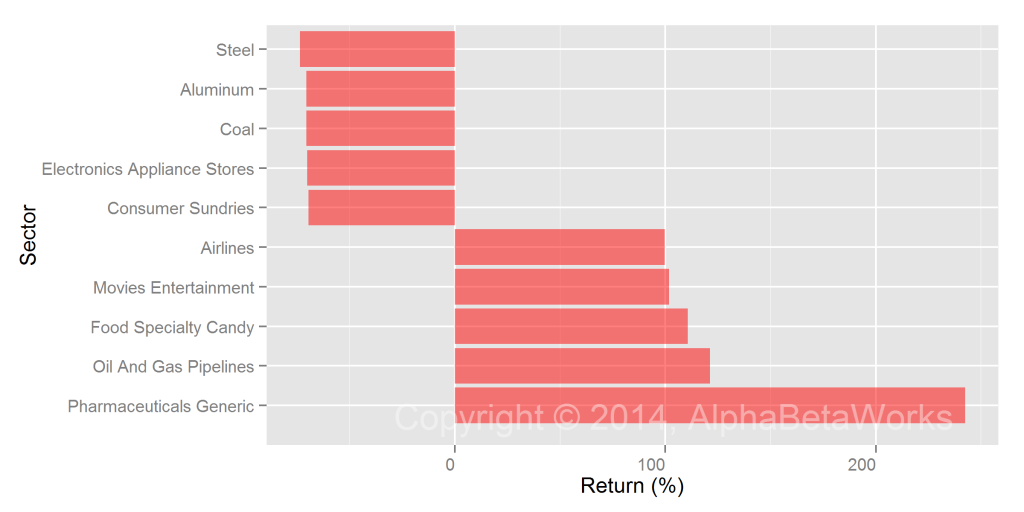

Below are the best and worst performing sectors in the first half of 2014, after market and macroeconomic noise is removed:

| Electronics Appliance Stores | -31% |

| Internet Retail | -24% |

| Forest Products | -20% |

| Commercial Printing Forms | -16% |

| Steel | -16% |

| Pharmaceuticals Generic | +18% |

| Airlines | +19% |

| Beverages Alcoholic | +21% |

| Pharmaceuticals Other | +22% |

| Aluminum | +23% |

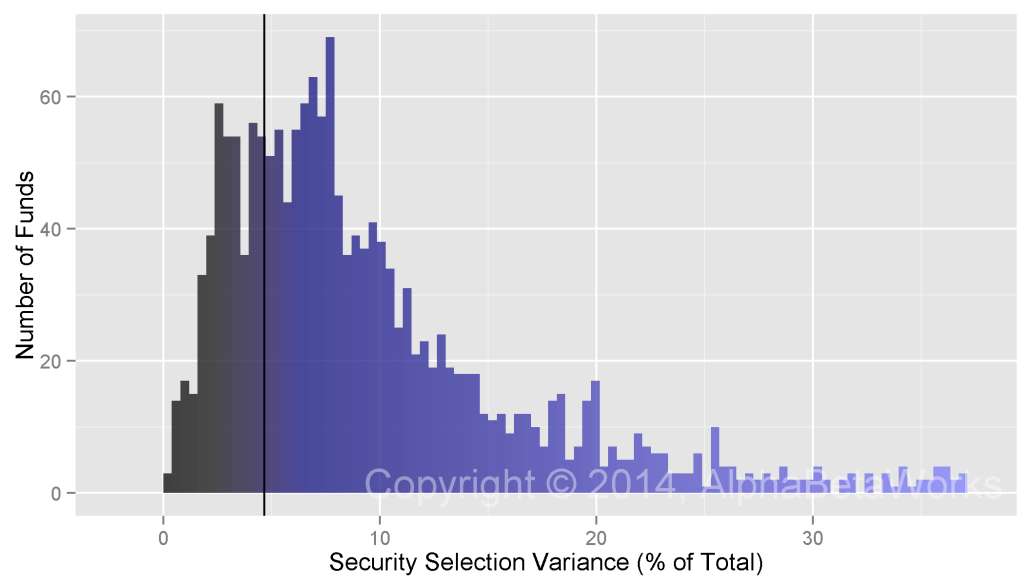

Best and Worst Performing Sectors: Trailing Five Years

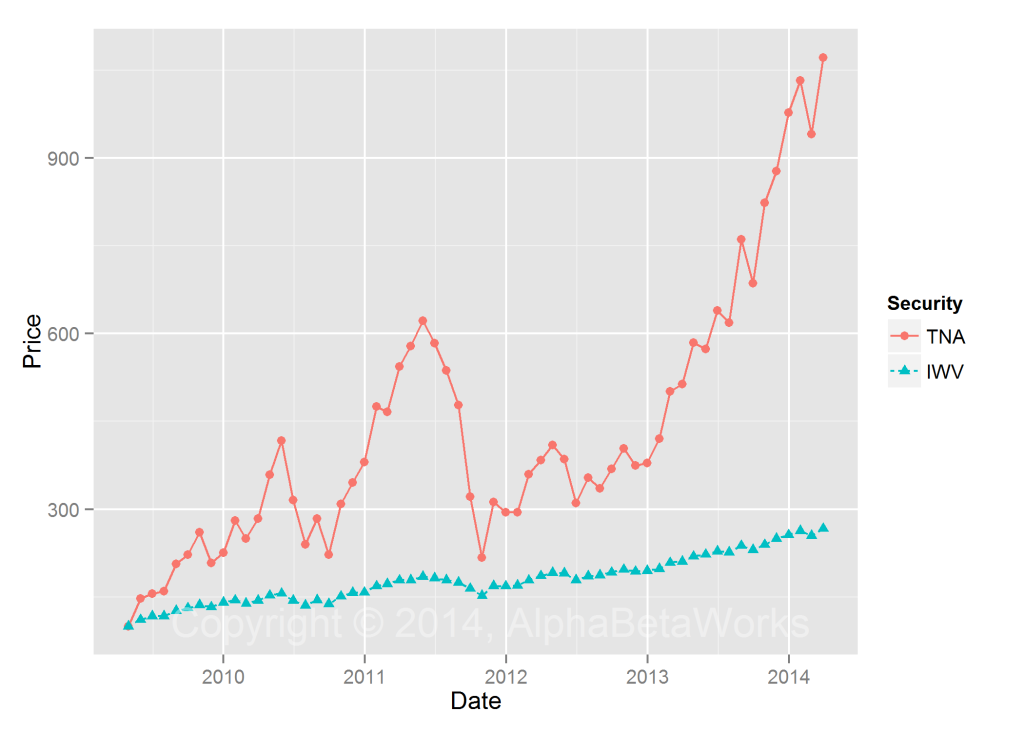

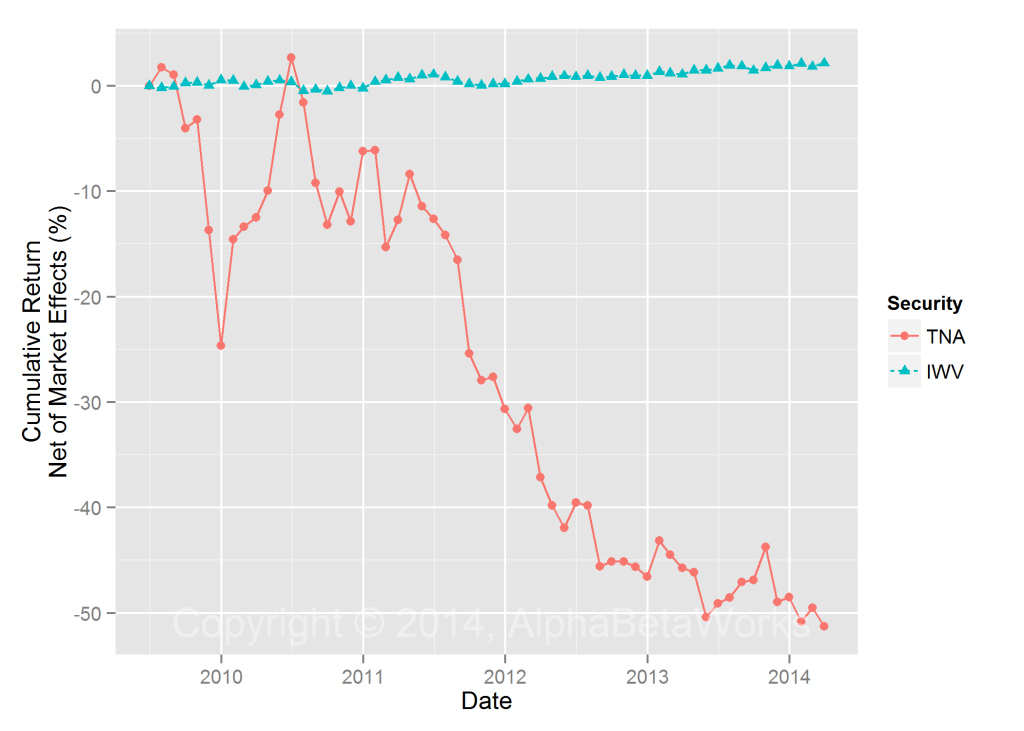

The above differences in short-term performance between sector indices and pure sector factors may appear minor; they are far more dramatic over the long term. All but one sector index have generated positive returns over the past five years (including market performance):

The market tide lifted all industry boats, obscuring their intrinsic performance. The chart below, with market and macroeconomic noise removed, tells a different story. The worst-performing pure sector factors have lost over 50%. The industry-specific returns of the top performers are also substantially lower.

| Steel | -74% |

| Aluminum | -70% |

| Coal | -70% |

| Electronics Appliance Stores | -70% |

| Consumer Sundries | -69% |

| Airlines | +100% |

| Movies Entertainment | +102% |

| Food Specialty Candy | +111% |

| Oil And Gas Pipelines | +121% |

| Pharmaceuticals Generic | +242% |

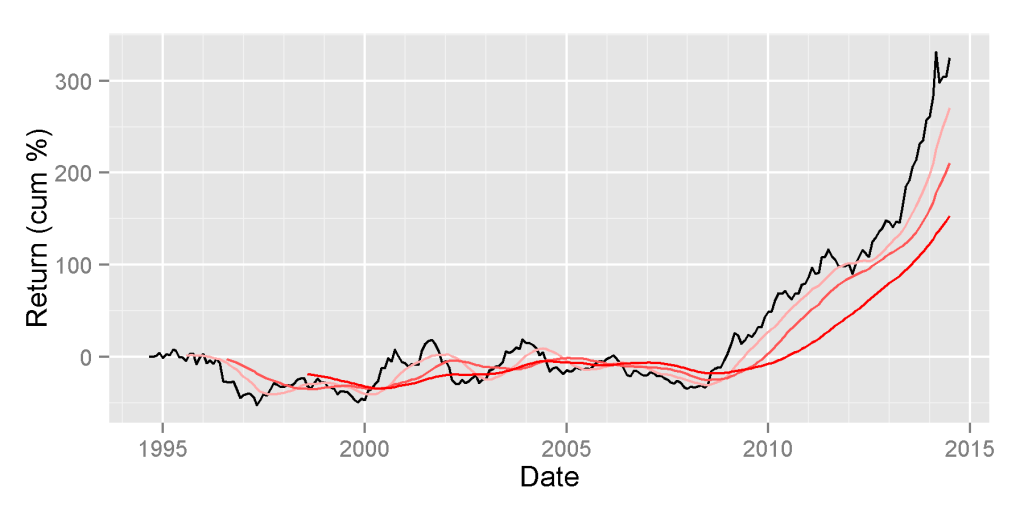

Best Long-Term Performance: Generic Pharmaceuticals

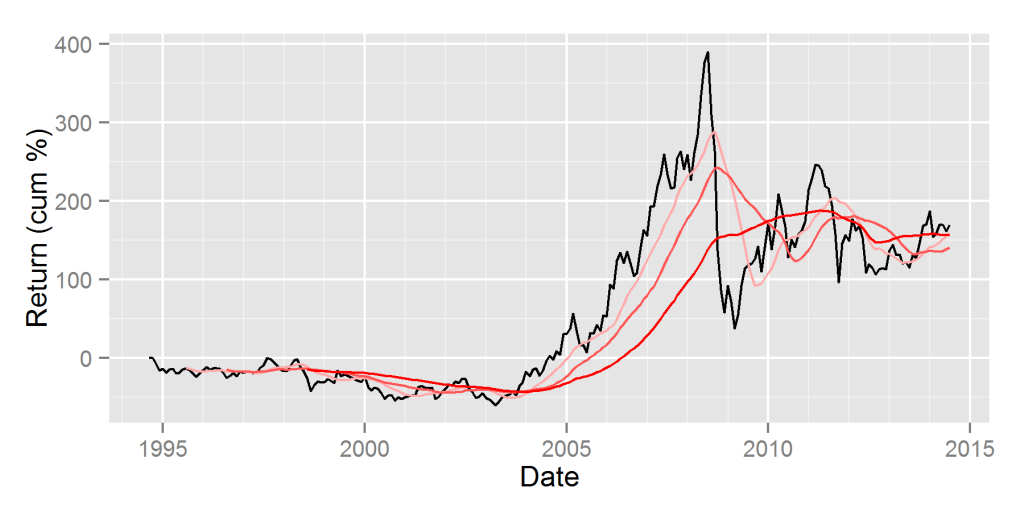

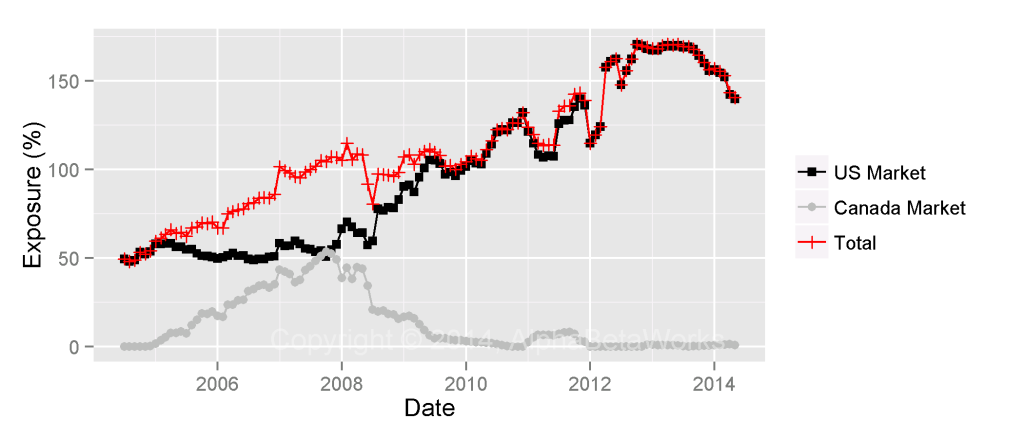

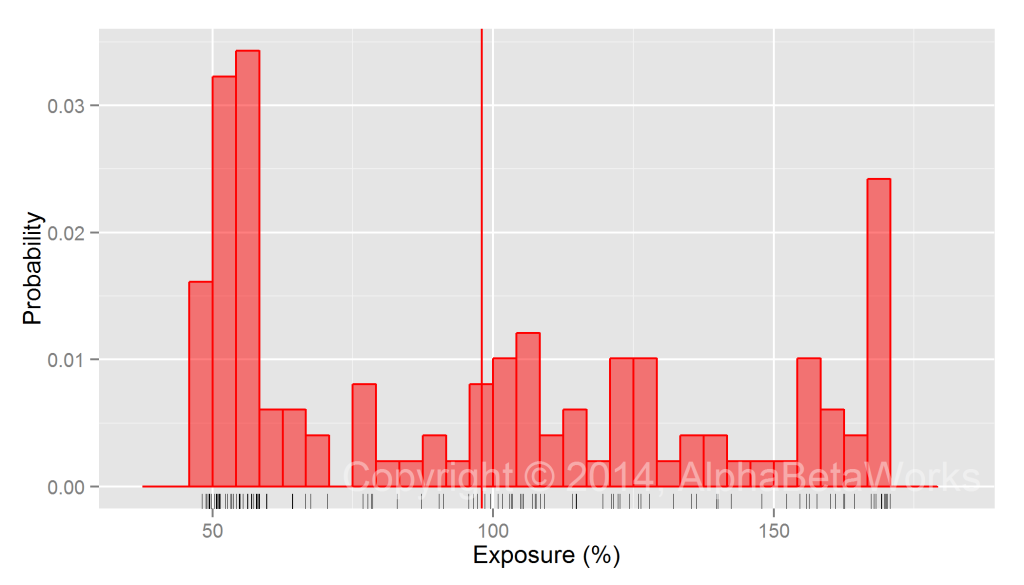

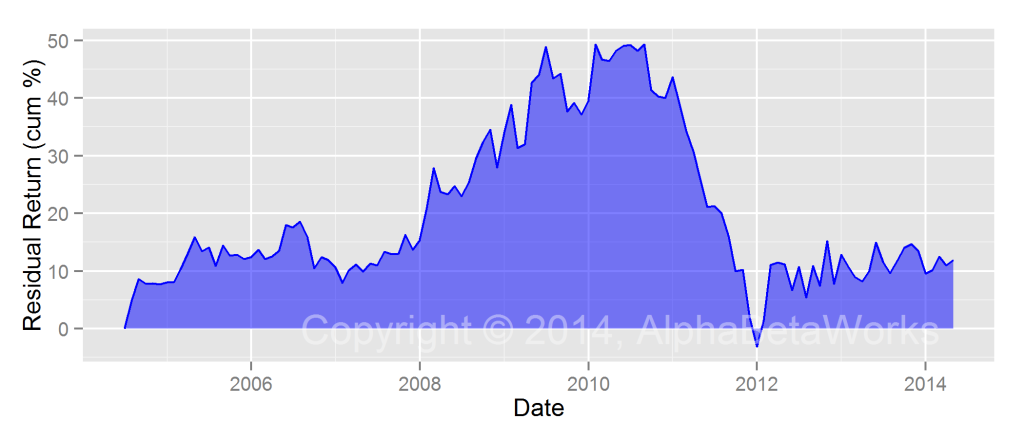

The Generic Pharmaceuticals Sector had the best 5-year performance and remains one of the top performers in 2014. The uptrend started in 2008, continued through the market turmoil, and has persisted for over six years:

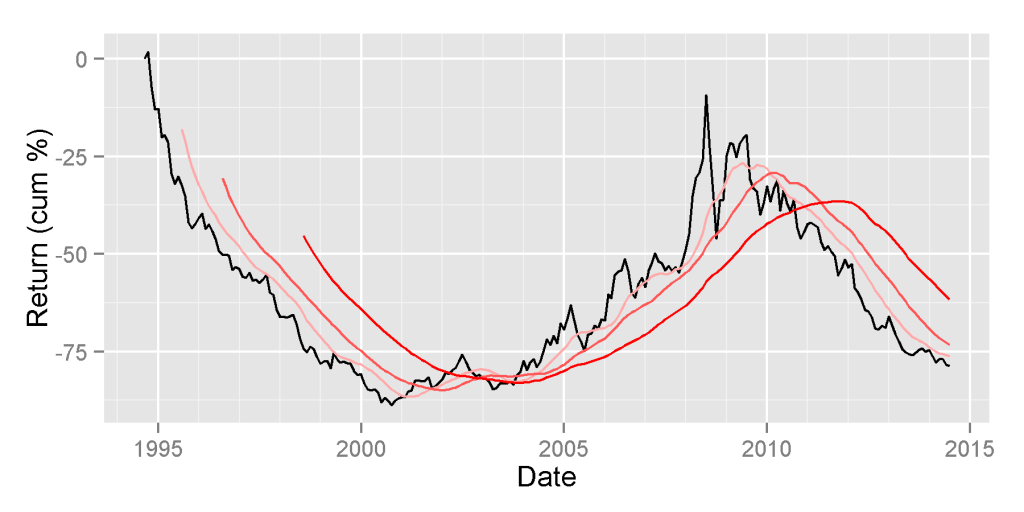

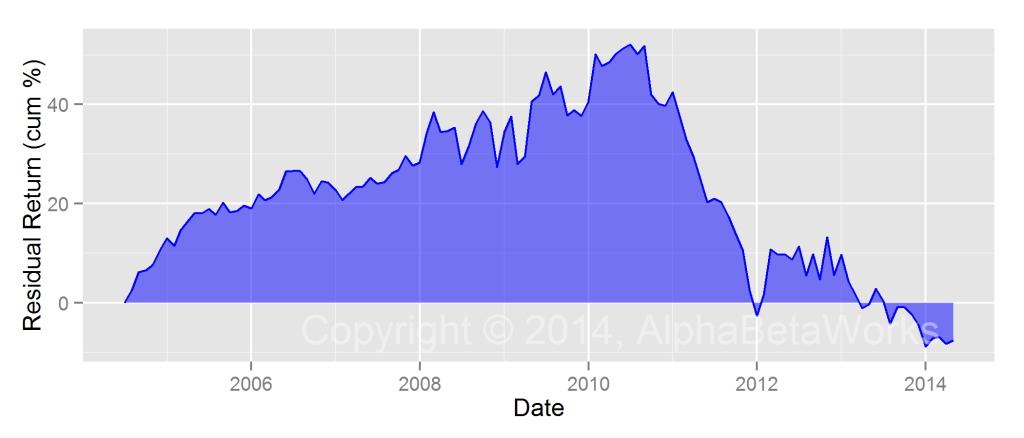

Worst Long-Term Performance: Steel

The Steel Producers Sector had the worst 5-year performance and remains among the worst performers in 2014. This time series tells a story of broad economic and geopolitical trends: industry overcapacity, the Chinese commodity boom, and uneconomic over-investment, precipitating a return to overcapacity:

This story is not visible in a simplistic index performance chart. Obscured by market noise, the clean trends of pure sector returns disappear:

Conclusions

- Industry-specific performance is clouded by market noise.

- By stripping away the effects of market and macroeconomic variables, we can calculate the returns of pure sector factors.

- Pure sector factors exhibit strong trends and are valuable indicators for tactical portfolio allocation.

- Pure sector factors are required for robust risk management, performance attribution, and investment skill evaluation.

- Failure to isolate pure sector factors leads to flawed risk analysis, performance attribution, and skill evaluation.

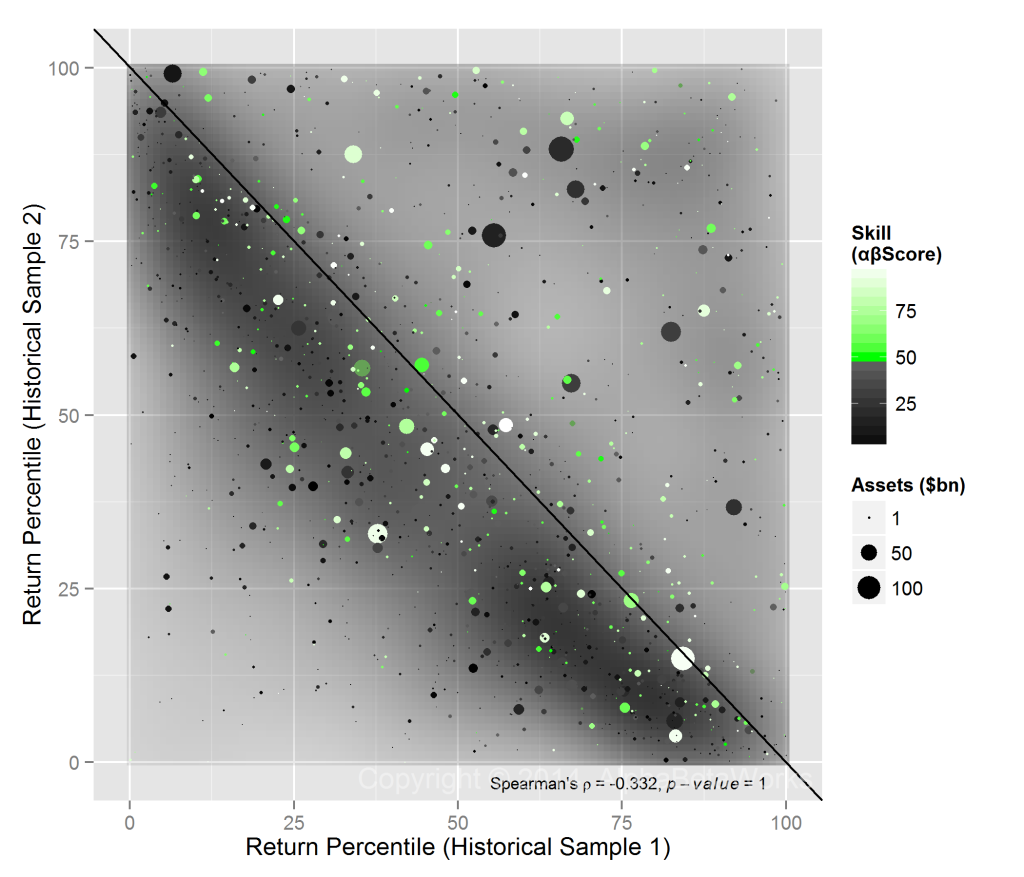

While we alluded to the trends in sector factor returns, we have not yet provided hard evidence that historically top-performing sector factors continue to outperform. Our upcoming articles on sector factors will address their return persistence.