Currencies are major drivers of other assets. In periods of Foreign Exchange (FX) volatility, there is much discussion of its impact on specific equity sectors. Regrettably, market noise obscures true industry-specific performance, so FX impact is impossible to judge from simple index returns. But, by stripping away market effects, we observe relationships between pure sector returns and exchange rates:

- Oil Drillers have the largest negative correlation with USD and one of the largest negative exposures.

- Retailers have the highest positive correlation and one of the highest positive exposures.

Below we identify sectors most exposed to USD FX volatility and quantify these relationships.

Pure Sector Performance

As we illustrated earlier, market noise obscures relationships among individual sectors; it also conceals industry-specific performance. Without separating pure industry-specific returns from the market, robust risk management, performance attribution, and investment skill evaluation are impossible. When stripped of market effects, pure sector factors capture sector-specific trends and risks, including sector-specific USD exposures.

Equity Market’s USD FX Exposure

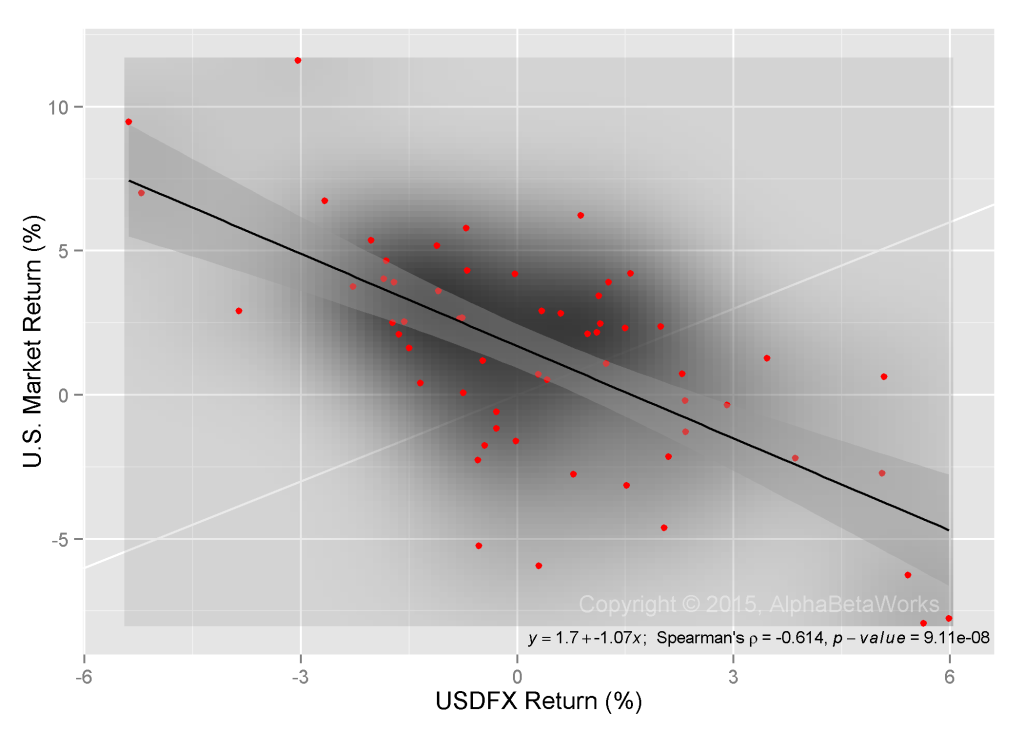

In addition to industry-specific foreign currency exposures, the equity market is significantly correlated with the currency market. Broad macroeconomic risks affect both exchange rates and the equity market. Below we plot U.S. Market returns against USD returns:

The beta of the U.S. Equity Market to USD FX is approximately -1.1: Over the past five years, when USD appreciated by 1% relative to a basket of foreign currencies, the U.S. Equity Market decreased by approximately 1.1%. USD FX variance explains approximately 38% of U.S. market variance. Perhaps more accurately, 38% of U.S. market variance is due to shared macroeconomic variables that drive both equities and currencies.

The exposure of an individual stock to USD FX is a combination of market, sector, and idiosyncratic effects.

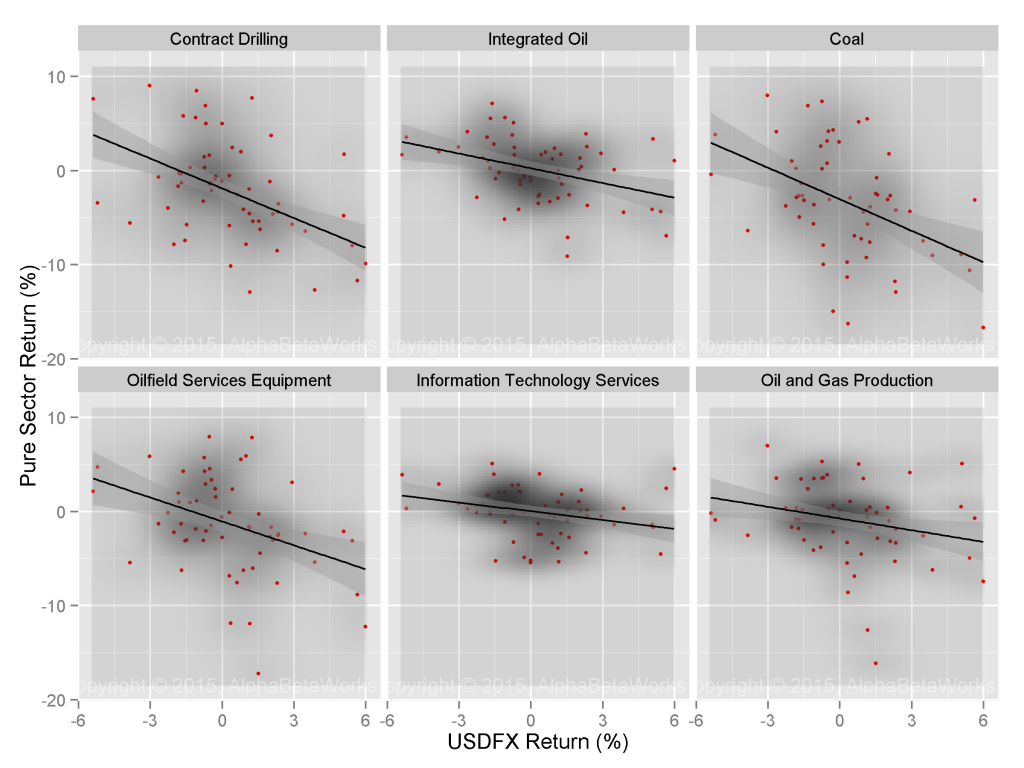

Sectors Most Negatively Exposed to USD FX

Sectors with the highest negative correlation to USD are not surprising:

| Sector | USD FX Correlation | USD FX Correlation p-value |

USD FX Beta | USD FX Beta p-value |

| Contract Drilling | -0.45 | 0.0002 | -1.01 | 0.0006 |

| Integrated Oil | -0.39 | 0.0011 | -0.56 | 0.0011 |

| Coal | -0.36 | 0.0021 | -1.10 | 0.0004 |

| Oilfield Services Equipment | -0.34 | 0.0042 | -0.69 | 0.0059 |

| Information Technology Services | -0.30 | 0.0109 | -0.27 | 0.0373 |

| Oil and Gas Production | -0.27 | 0.0174 | -0.44 | 0.0131 |

(Note that we use the Spearman’s rank correlation coefficient to evaluate correlations. Spearman’s correlation is robust against outliers, unlike the commonly used Pearson’s correlation. All correlations are significant; most at a 1% level or better.)

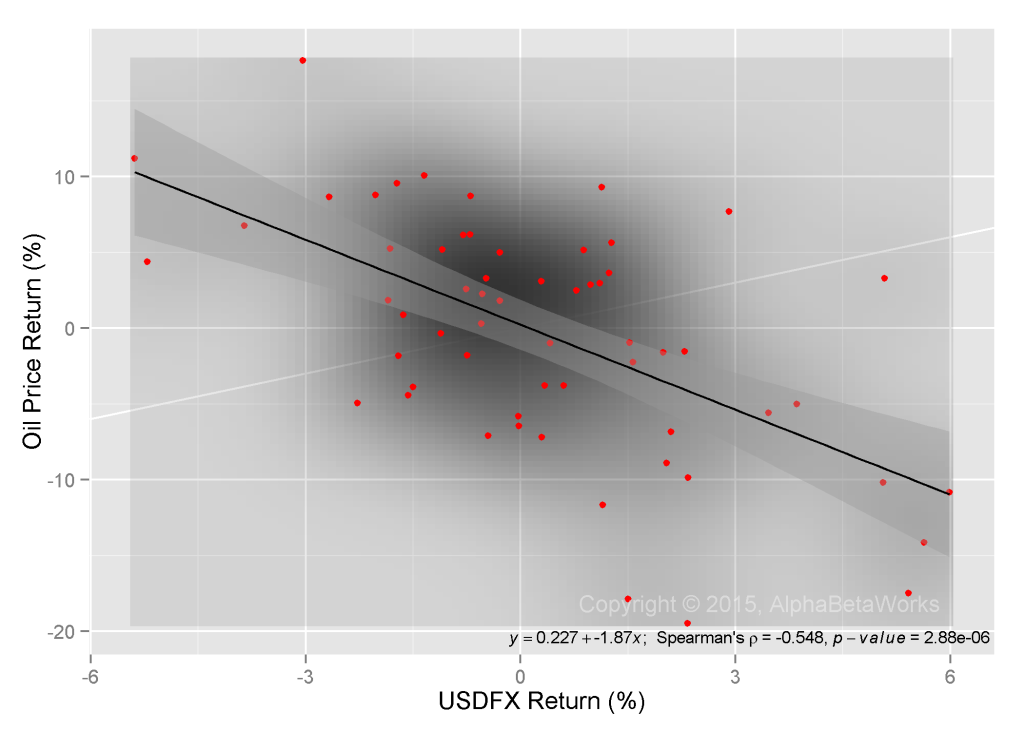

Oil Price USD FX Exposure

Commodity industries’ (oil, coal, etc) exposure to USD FX is due to their macroeconomic sensitivity, inflation sensitivity, and the global nature of the commodity markets. When USD strengthens, USD-denominated commodity prices have to decline in order for broad currency-weighted prices to remain unchanged. Consequently, commodity prices tend to be strongly negatively correlated with USD FX:

The Oil Price’s beta to USD FX is -1.9: Over the past five years, when USD appreciated by 1% relative to a basket of foreign currencies, the Oil Price decreased by approximately 1.9%. 30% of Oil Price variance is explained by the shared macroeconomic variables that drive both commodity and currency markets.

Information Technology Sector USD FX Exposure

Information Technology Services is a typical export industry that suffers margin compression when USD-denominated costs increase relative to foreign-currency-denominated revenues. However, our analysis indicates this exposure is barely statistically significant with the beta’s p-value of 0.04. This exposure is also low: a 1% increase in USD FX is associated with approximately 0.3% decrease in the value of the sector.

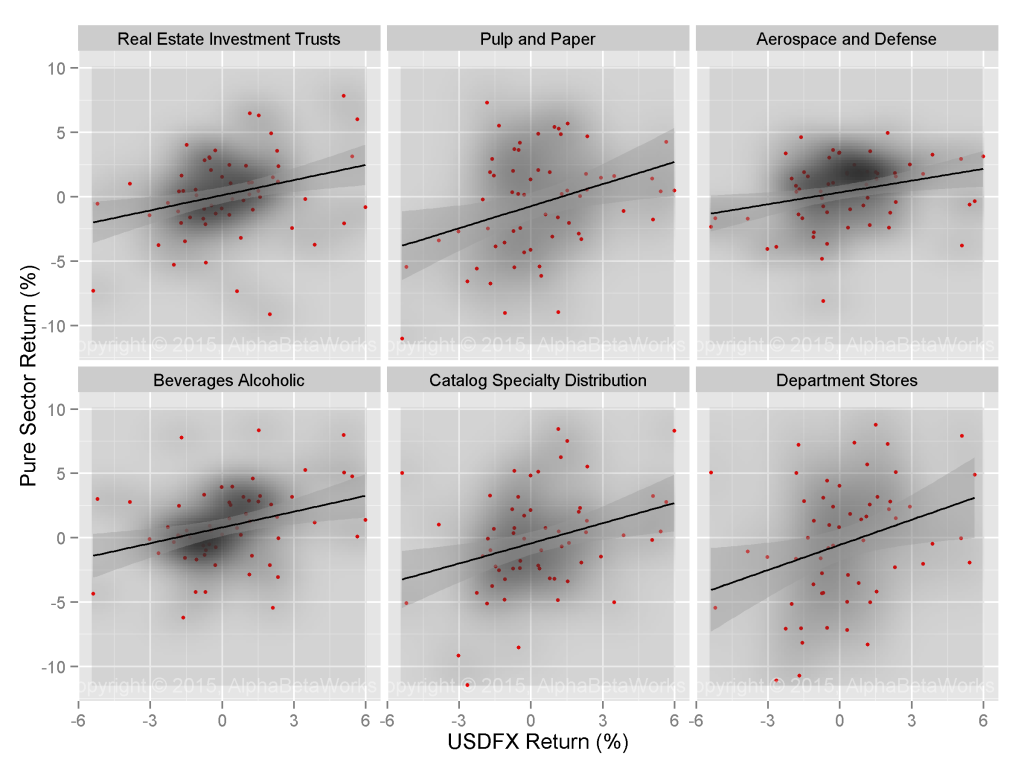

Sectors Most Positively Exposed to USD FX

The list of sectors with the highest positive correlation to USD FX is less intuitive:

| Sector | USD FX Correlation | USD FX Correlation p-value |

USD FX Beta | USD FX Beta p-value |

| Real Estate Investment Trusts | 0.29 | 0.0121 | 0.39 | 0.0101 |

| Pulp and Paper | 0.30 | 0.0102 | 0.52 | 0.0123 |

| Aerospace and Defense | 0.31 | 0.0084 | 0.32 | 0.0206 |

| Beverages Alcoholic | 0.33 | 0.0049 | 0.43 | 0.0025 |

| Catalog Specialty Distribution | 0.33 | 0.0045 | 0.41 | 0.0349 |

| Department Stores | 0.37 | 0.0020 | 0.70 | 0.0085 |

The list is dominated by import-sensitive sectors that benefit from a boost in U.S. consumer purchasing power from an appreciating USD. Also, when the USD appreciates, the associated drop in import prices boosts aerospace and defense companies, likely due to depreciating foreign inputs.

The presence of REITs on the list appears unexpected. Yet, it is due to the same shared variables as the negative correlation between REITs and oil prices: inflation, growth rates, and macroeconomic uncertainty.

Conclusion

- Industry-specific performance is clouded by market noise.

- By stripping away the effects of market and macroeconomic variables, we reveal the performance of Pure Sector Factors and their relationships with USD FX.

- Commodity producers and information technology exporters most consistently suffer from appreciating USD.

- Importers and retailers most consistently benefit from appreciating USD.

Interesting work, though conclusions along expected lines (sector rotation strategies perhaps are exploiting this very phenomena implicitly). However, there may be an exception and possibly it could be explained by your focus from the US perspective. IT companies in India and other nations get a boost (i.e. are positively correlated with the US$) because their contracts are denominated in US$’s. Any depreciation in local currency vis-a-vis the US$ should result in an upward thrust to their earnings providing a positive momentum to stock price and performance.

You are right and bring up an interesting idea for further study: Discriminating the impact of USD FX volatility on countries and country-specific sectors.

For instance, while U.S. Technology Service Companies suffer from appreciating USD, Indian competitors benefit. The highest and less obvious industry USD exposures may thus reside internationally.