Why Most Investors Lose, Even if Their Manager is Skilled

An actively managed fund must take risk sufficient to generate active returns in excess of the fees that it charges. However, as skilled managers accumulate assets, they tend to become less active. Skilled managers who took sufficient active risk to earn their fees in the past may be closet indexing today. Consequently, over two thirds of the capital invested in “active” U.S. mutual funds is allocated to managers who are unlikely to earn the average fee, even if highly skilled. Simply by identifying these managers, investors can eliminate most active management fees and improve portfolio performance.

Closet Indexing Defined

Our first article in this series discussed closet indexing and proposed a new metric of fund activity: Active Share of Variance – the share of volatility due to active management (security selection and market timing). The second article analyzed historical performance of U.S. mutual funds and discovered that over a quarter (26%) of the funds surveyed have been so passive that, even after exceeding the information ratios of 90% of their peers, they would still not be worth the 1% mean management fee.

Too Little Current Risk to Earn Future Fees

Thus far, our analysis improved on existing closet indexing metrics by evaluating past fund activity. The shortcoming of this analysis has been its failure to identify funds that have been active in the past but are closet indexing today. This article addresses the shortcoming: We analyze current and historical positions of approximately 1,700 non-index medium and lower turnover U.S. mutual funds, identifying those that are unlikely to earn their management fees in the future given their current active risk.

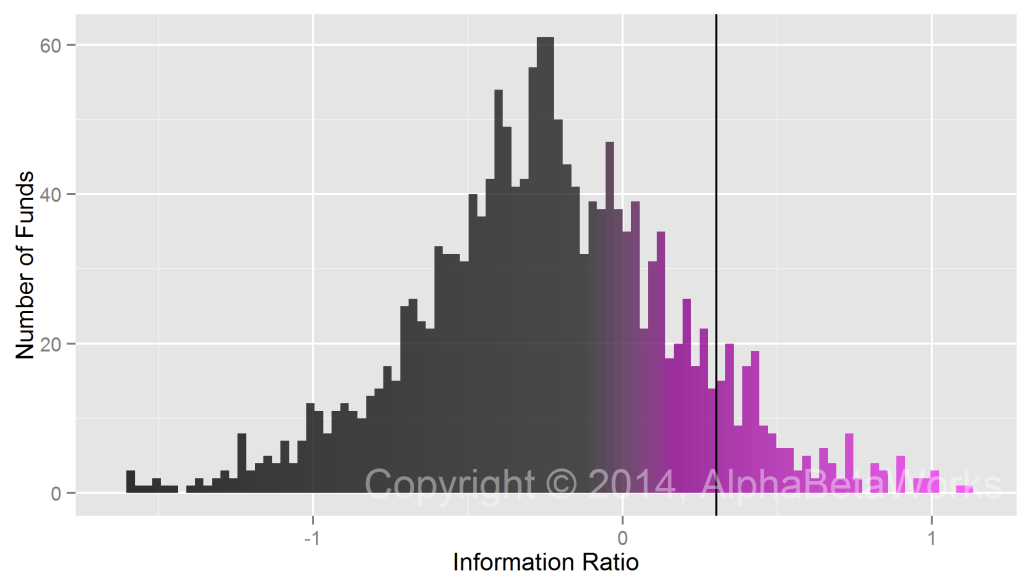

The Information Ratio (IR) is a measure of active return relative to active risk (tracking error). The top 10% of the funds achieve IR’s greater than or equal to 0.30; 90% achieve IR’s below 0.30:

If a fund exceeds the performance of 90% of its peers and achieves IR of 0.30, then it needs tracking error above 3.3% to generate active return above 1%. The mean expense ratio for active U.S. mutual funds is approximately 1%. Therefore, if all funds were able to achieve the 90th percentile of IR, they will need annual tracking error above 3.3% to earn the mean fee and generate a positive net active return.

Tracking error is due to active risks a fund takes: security selection risk due to stock picking and market timing risk due to variation in factors bets. We applied the AlphaBetaWorks Statistical Equity Risk Model to funds’ historical and latest holdings and estimated their future tracking errors.

Over half (911) of the funds have such low estimated future tracking errors that, even if they exceeded the performance of 90% of their peers and achieved the IR of 0.30, they will fail to merit the 1% mean management fee:

Capital-Weighted Closet Indexing

Larger mutual funds are more likely to engage in closet indexing. While only 54% of mutual funds surveyed have estimated future tracking errors below 3.3%, they represent 70% of the assets ($2.4 trillion out of the $3.4 trillion total). Therefore, even if capital is invested with highly skilled managers, more than two thirds of it will not earn the 1% mean management fee:

A portfolio that primarily consists of large mutual funds may be doomed to generate negative active returns, regardless of the managers’ skills. The 1% management fee cited here is the mean. Plenty of closet indexers charge more and plenty of investors who remain with them stand to lose more.

Conclusions

- Over half (54%) of active U.S. mutual funds surveyed are currently so passive that, even after exceeding the information ratios of 90% of their peers, they will still fail to merit a 1% management fee.

- Over two thirds (70%) of active U.S. mutual fund capital surveyed will fail to merit a 1% management fee, even if its managers are highly skilled.

- Skilled active managers do exist, but investors need to capture them early in their life cycles.

- Investors must monitor the evolution of their skilled managers towards passivity.

- By identifying closet indexers, a typical investor can eliminate most active fees and improve performance.