A fund must take active risk to generate active returns in excess of fees. However, some managers charge active fees but manage their funds passively. Managers also tend to become less active as they accumulate assets. This problem of hedge fund closet indexing is widespread. Over a third of capital invested in U.S. hedge funds’ long equity portfolios is too passive to warrant the common 1.5/15% fee structure, even if its managers are highly skilled. Investors can replace closet indexers with cheap passive vehicles or with truly active skilled managers and improve performance.

Hedge Fund Closet Indexing Background

This article updates our earlier pieces on mutual fund and hedge fund closet indexing with mid-2015 data. We examine current and historical long equity portfolios of approximately 500 U.S. hedge funds that are analyzable from regulatory filings and identify those that are unlikely to earn their fees in the future given their current active risk. We then quantify the cost of hedge fund closet indexing for a typical investor.

Recall from our earlier discussion that Active Share is a brittle metric of fund activity: If a fund buys a position in an index ETF, this passive position may increase Active Share while making the fund less active. If a fund with S&P 500 benchmark simply indexes Russell 2000, this passive fund will have 100% Active Share. These examples are consistent with recent findings that high Active Share funds appear to outperform merely due to miss-specified benchmarks. Our factor-based approach identifies the unique passive factor benchmark for each fund and is free from these deficiencies.

Information Ratio – the Measure of Active Risk Required to Earn a Fee

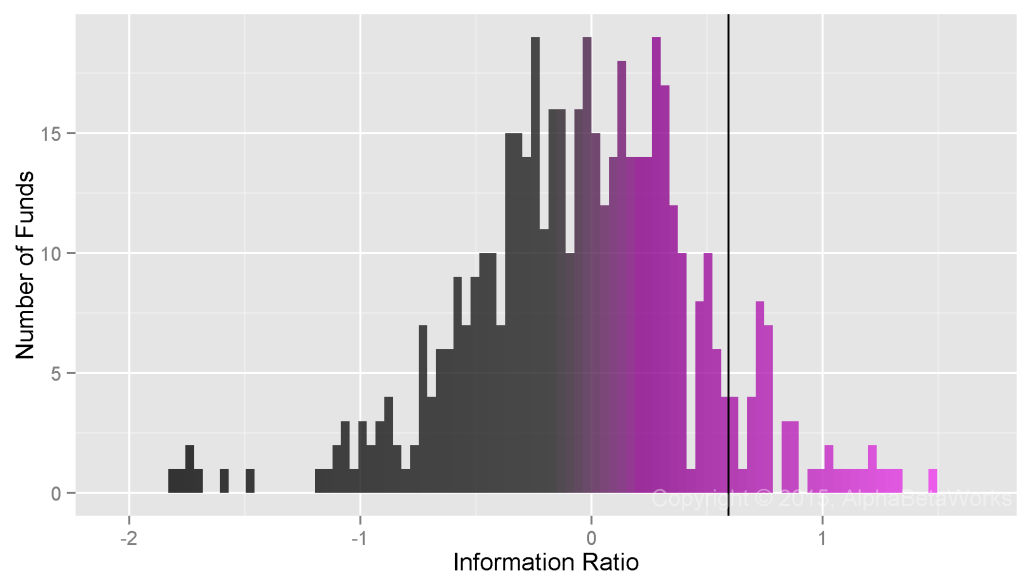

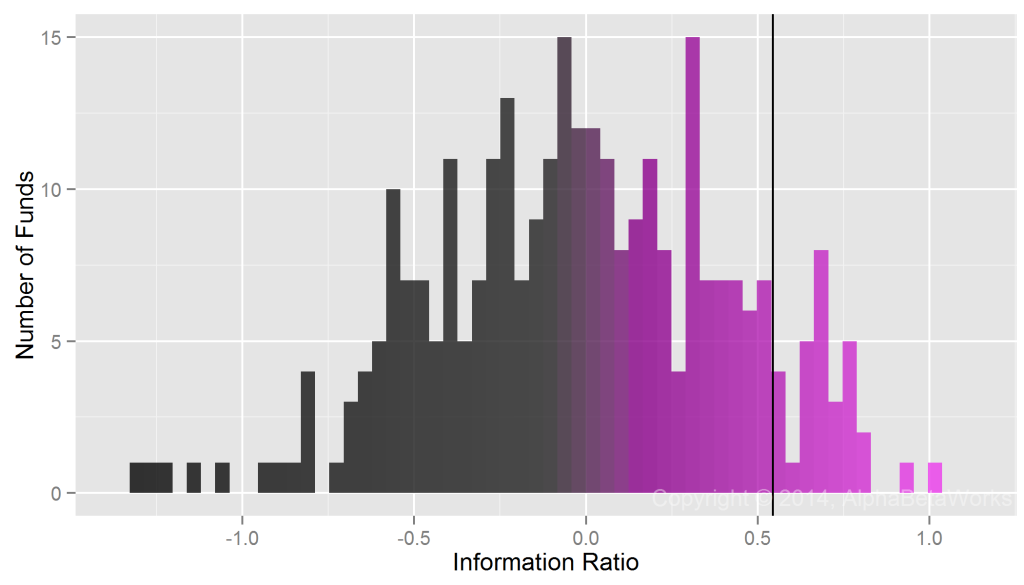

The Information Ratio (IR) is a measure of active return relative to active risk (tracking error). The best-performing 10% of U.S. hedge funds’ long portfolios achieve IRs above 0.59 relative to their passive factor benchmarks:

Min. 1st Qu. Median Mean 3rd Qu. Max. -2.58 -0.34 -0.02 -0.04 0.28 2.17

If a fund’s long portfolio exceeds the performance of 90% of the peers and achieves a 0.59 IR, then it needs a tracking error above 1.00% / 0.59 = 1.69% to generate active return above 1%.

Let’s assume that hedge funds’ long equity portfolios are burdened with 1.5% management fee and 15% incentive allocation. Further assuming a 7% market return, the mean fee is 2.55%. If all funds were able to achieve IRs in the 90th percentile, they would need annual tracking error above 2.55% / 0.59 = 4.32% to earn the 2.55% estimated mean fee and a positive net active return. We show below that a significant fraction of the industry takes too little active risk to achieve this tracking error. In fact, much of the industry may not even be trying to earn its fees.

Historical Hedge Fund Closet Indexing

Tracking error comes from funds’ active exposures: systematic (factor) and idiosyncratic (stock-specific) bets. We applied the AlphaBetaWorks Statistical Equity Risk Model to funds’ historical holdings to estimate their unique factor benchmarks. These are passive factor portfolios that capture the representative systematic risks of each fund. We then estimated past and future tracking errors of each fund relative to these benchmarks.

Over 13% (67) of the funds have taken so little risk that, even if they had exceeded the performance of 90% of their peers each year, they would still have failed to earn a typical fee. In other words, these funds have not even appeared to try earning their fees:

Min. 1st Qu. Median Mean 3rd Qu. Max. 0.43 6.04 10.04 15.17 19.43 201.00

Estimated Future Hedge Fund Closet Indexing

Fund activity changes over time as managers accumulate assets. Many funds are more passive today than they have been historically. To control for this, we estimated current tracking errors.

Approximately a fifth (88) of the funds are currently taking so little risk that, even if they were to exceed the performance of 90% of their peers each year, they would still fail to merit a typical fee. In other words, these funds are not even appearing to try earning their fees:

Min. 1st Qu. Median Mean 3rd Qu. Max. 0.76 4.96 7.67 11.01 12.48 148.30

Capital-Weighted Hedge Fund Closet Indexing

Larger hedge funds are more likely to engage in closet indexing. While approximately 20% of hedge funds surveyed have estimated future tracking errors below 4.30%, they represent a third of the assets ($240 billion out of the $720 billion total in our sample). Therefore, a third of hedge fund long equity capital is unlikely to exceed 4.32% tracking error and earn a typical fee, even when its managers are highly skilled:

Min. 1st Qu. Mean 3rd Qu. Max. 0.76 3.70 5.49 8.21 116.47

The assumption that all funds will generate higher IRs than 90% of their peers have historically is unrealistic. Hence, a portfolio of large funds built without a robust analysis of hedge fund closet indexing may be doomed to generate negative net active returns, irrespective of the managers’ skills. The 2.55% fee cited here is the estimated mean. Plenty of closet indexers charge more on their long equity portfolios, and plenty of investors who remain with them stand to lose even more.

While there is less closet indexing among hedge funds than among mutual funds, the fees that hedge funds charge and the expectations they set are significantly higher. When practiced by hedge funds, closet indexing is all the more egregious.

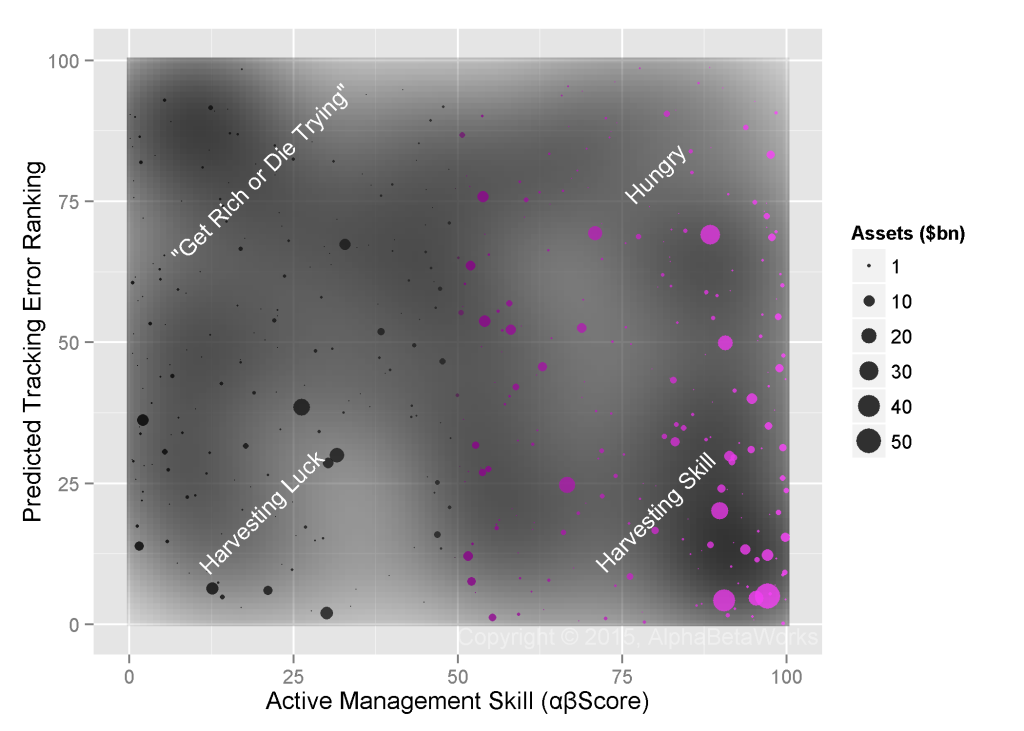

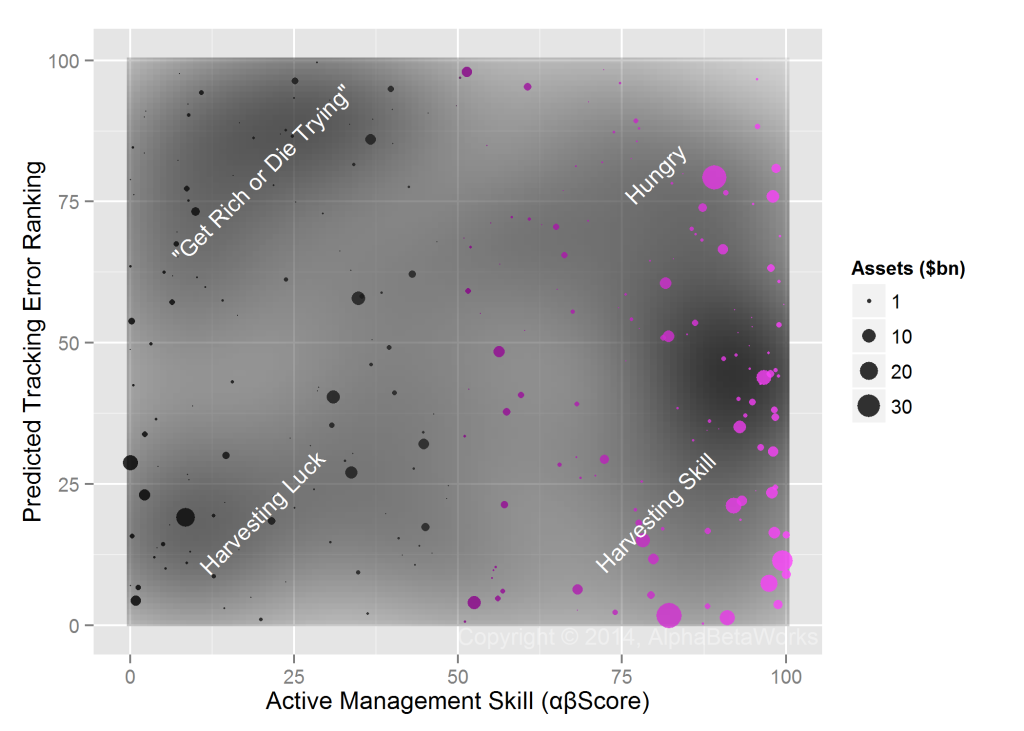

A Map of Hedge Fund Closet Indexing

The evolution of managers’ utility curves may explain their reluctance to take risk. As a manager accumulates assets, fee harvesting becomes increasingly attractive. The following map of U.S. hedge fund active management skill and current activity illustrates that large skilled funds are generally less active (large purple circles on the right cluster towards the bottom):

Yet, there are notable exceptions – several large, skilled, and active managers remain.

Conclusions

- A fifth of U.S. hedge funds’ long equity portfolios are currently so passive that, even if they exceed the information ratios of 90% of their peers, they will still fail to merit a typical fee.

- A third of U.S. hedge funds’ long equity capital will fail to merit a typical fee, even when its managers are highly skilled.

- As skilled managers accumulate assets, they are more likely to closet index.

- A typical hedge fund investor can replace a third of long hedge fund capital with cheap passive vehicles or truly active skilled managers and improve performance.