In an earlier article we discussed the U.S. sectors most affected by volatility in the U.S. Dollar. This analysis raised a number of questions from readers and clients:

- For U.S. exporters hurt by strong USD: Do foreign competitors benefit, exhibiting the opposite (positive) USD exposure?

- For U.S. retailers and distributors aided by strong USD: Do foreign suppliers benefit, exhibiting similar (positive) USD exposure?

Both intuitions are correct. Foreign transportation and technology companies turn out to be the top beneficiaries of appreciating USD.

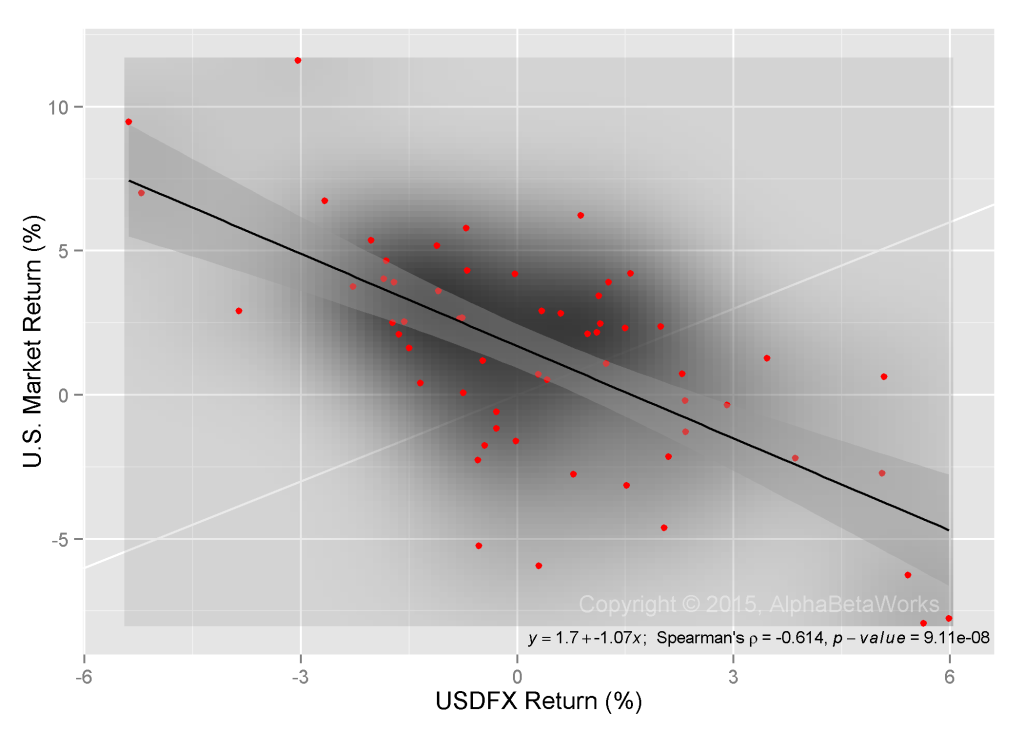

U.S. Information Technology Sector USD FX Exposure

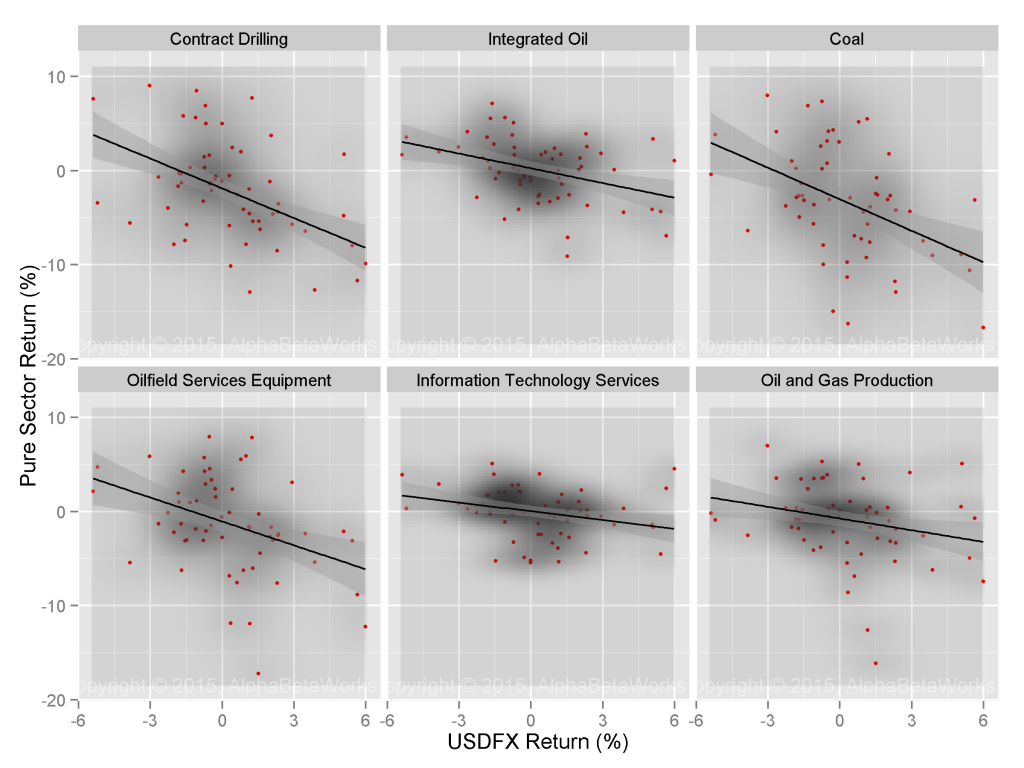

Recall from our earlier piece that U.S. Information Technology is one of the sectors with the highest negative correlation to USD:

| Sector |

USD FX |

USD FX Correlation p-value |

USD FX Beta |

USD FX |

| Contract Drilling |

-0.45 |

0.0002 | -1.01 |

0.0006 |

| Integrated Oil |

-0.39 |

0.0011 | -0.56 |

0.0011 |

| Coal |

-0.36 |

0.0021 | -1.10 |

0.0004 |

| Oilfield Services Equipment |

-0.34 |

0.0042 | -0.69 |

0.0059 |

| Information Technology Services |

-0.30 |

0.0109 | -0.27 |

0.0373 |

| Oil and Gas Production |

-0.27 |

0.0174 | -0.44 |

0.0131 |

Information Technology Services is an export industry that suffers when USD-denominated costs increase relative to foreign-currency-denominated revenues. USD appreciation squeezes margins and puts the sector at a disadvantage relative to foreign competitors. Consequently, we expect foreign technology companies to benefit from appreciating USD.

U.S. Retail Sector USD FX Exposure

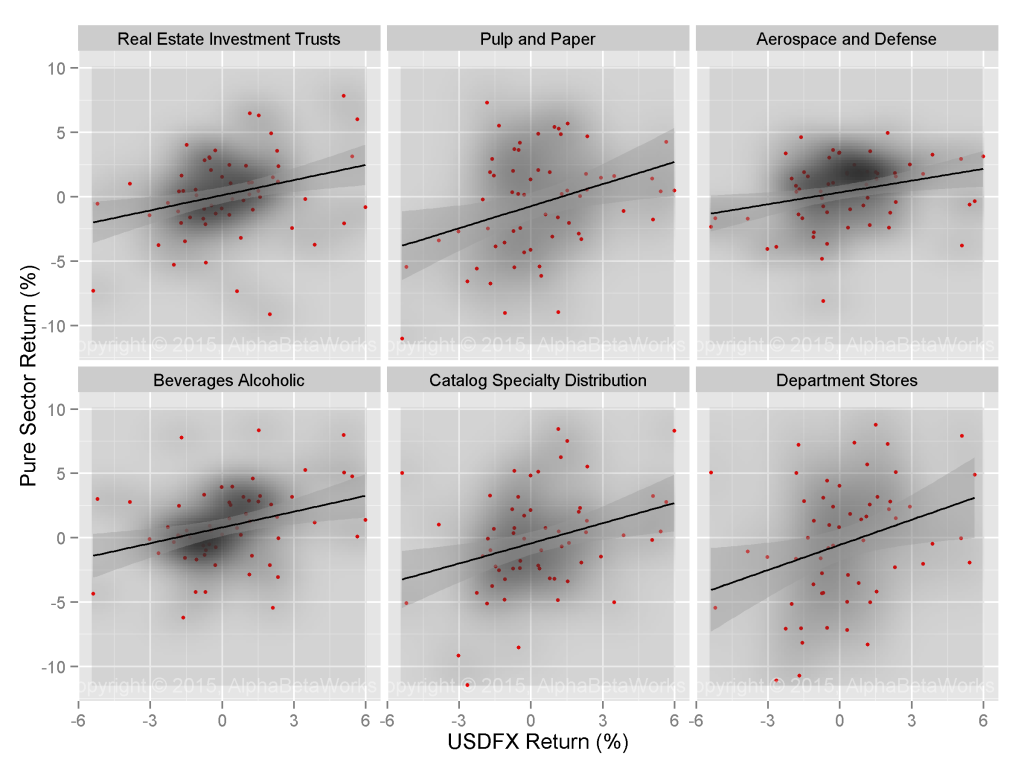

U.S. Retail and Distribution are among the sectors with the highest positive correlation to USD:

| Sector |

USD FX Correlation |

USD FX Correlation p-value |

USD FX Beta |

USD FX |

| Real Estate Investment Trusts |

0.29 |

0.0121 | 0.39 |

0.0101 |

| Pulp and Paper |

0.30 |

0.0102 | 0.52 |

0.0123 |

| Aerospace and Defense |

0.31 |

0.0084 | 0.32 |

0.0206 |

| Beverages Alcoholic |

0.33 |

0.0049 | 0.43 |

0.0025 |

| Catalog Specialty Distribution |

0.33 |

0.0045 | 0.41 |

0.0349 |

| Department Stores |

0.37 |

0.0020 | 0.70 |

0.0085 |

These businesses are sensitive to the price of imports and to the consumers’ purchasing power. When USD appreciates, U.S. retailers benefit from the drop in the price of imports and from the boost in U.S. consumers’ purchasing power. USD appreciation should also benefit foreign suppliers of U.S. retailers. Consequently, we expect foreign exporters and transportation companies to benefit from appreciating USD.

Foreign Sectors Most Positively Exposed to USD FX

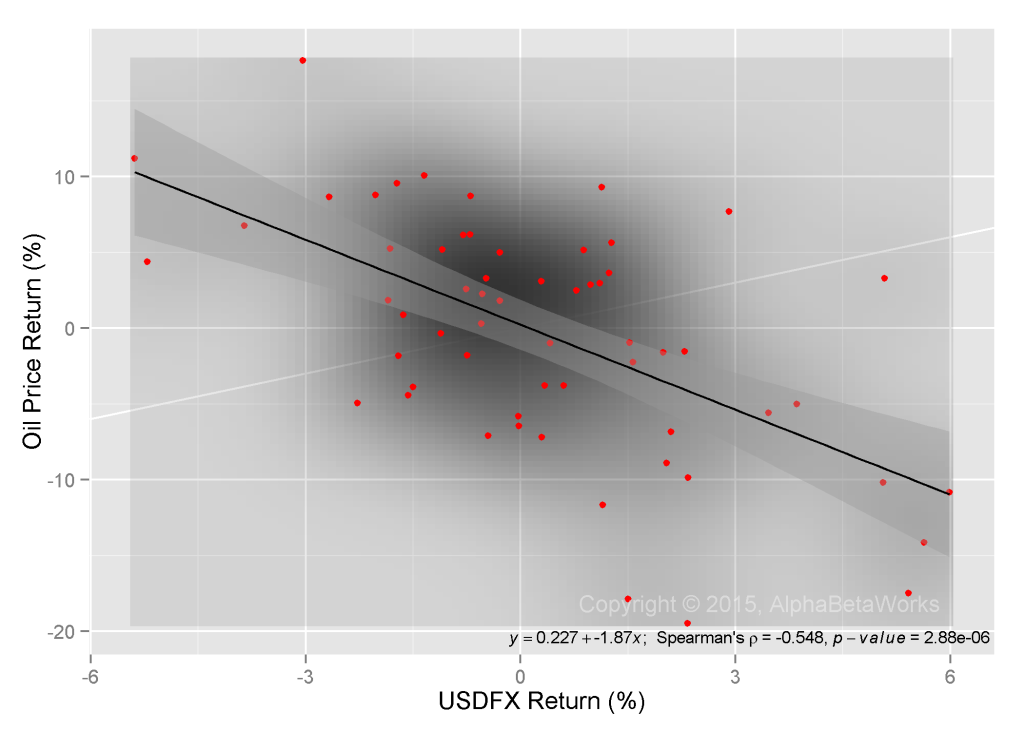

There are two common techniques to quantify relationship between two variables: correlation and beta (leverage). Correlation between pure sector factor returns and USD returns quantifies the consistency of the relationship – how much of the sector variance is attributable to USD FX. Beta, or leverage, of pure sector factor returns relative to USD returns quantifies the magnitude of the relationship – how much sector changes given a change in USD FX.

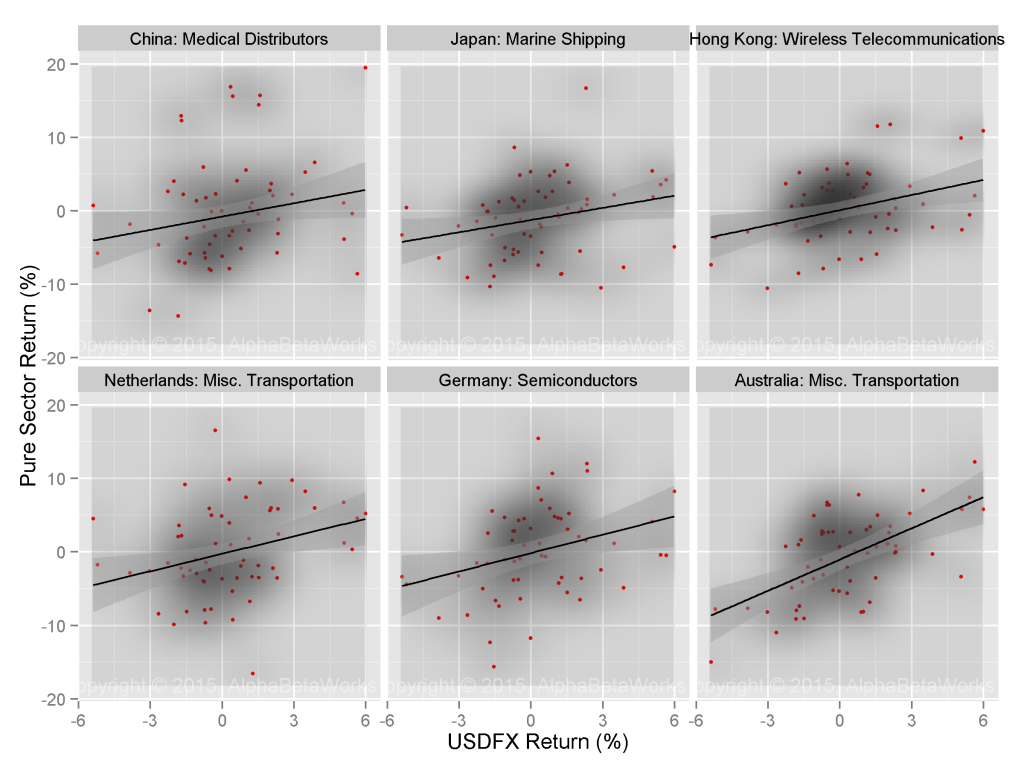

Foreign Sectors with Highest USD Correlation

Foreign sectors most correlated to USD FX are dominated by transportation and technology companies. When USD appreciates, these businesses benefit the most from reduced competitiveness of U.S. Information Technology Industry, increased appetites of U.S. consumers, and decreased commodity prices:

| Sector |

USD FX |

USD FX Correlation p-value |

USD FX Beta |

USD FX Beta |

| China: Medical Distributors |

0.28 |

0.0150 | 0.74 |

0.0223 |

| Japan: Marine Shipping |

0.31 |

0.0073 | 0.61 |

0.0206 |

| Hong Kong: Wireless Telecommunications |

0.31 |

0.0071 | 0.66 |

0.0061 |

| Netherlands: Misc. Transportation |

0.34 |

0.0043 | 0.93 |

0.0047 |

| Germany: Semiconductors |

0.42 |

0.0004 | 1.00 |

0.0033 |

| Australia: Misc. Transportation |

0.52 |

0.0000 | 1.24 |

0.0000 |

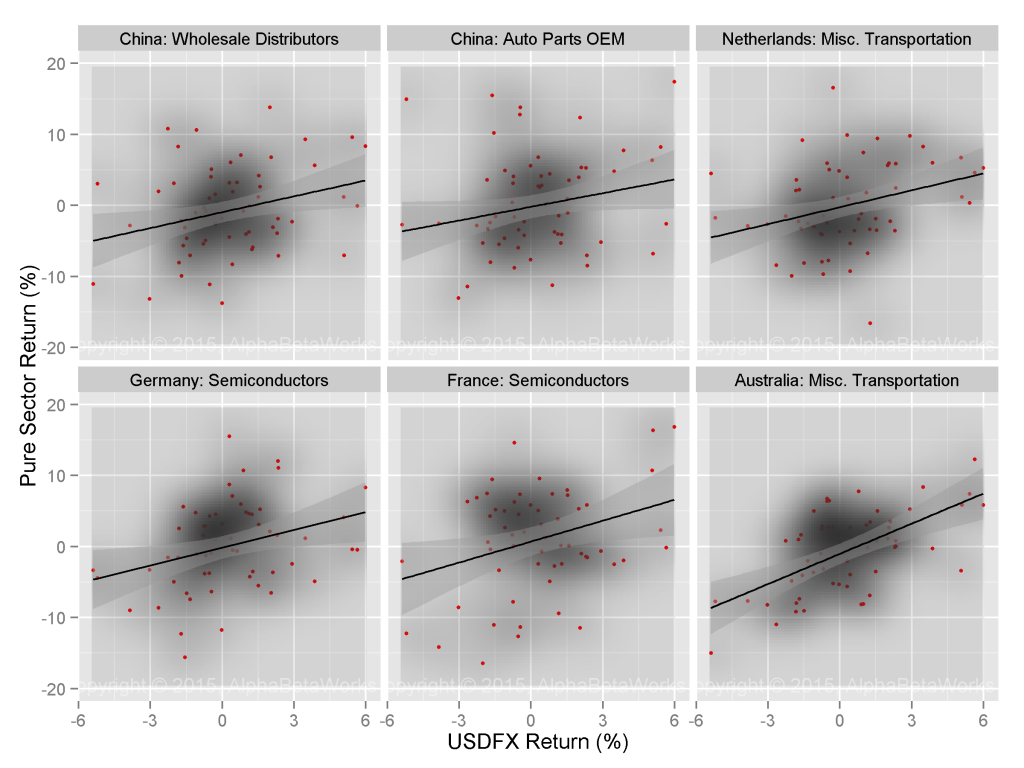

Foreign Sectors with Highest USD Beta

Likewise, foreign sectors with the highest beta (most leverage) to USD FX are dominated by transportation and technology companies. Chinese auto parts companies are another winner. Foreign Semiconductor and Auto Parts Sectors benefit from the reduced competitiveness of their U.S. competitors:

| Sector |

USD FX |

USD FX Beta |

| China: Wholesale Distributors |

0.81 |

0.0082 |

| China: Auto Parts OEM |

0.83 |

0.0191 |

| Netherlands: Misc. Transportation |

0.93 |

0.0047 |

| Germany: Semiconductors |

1.00 |

0.0033 |

| France: Semiconductors |

1.02 |

0.0082 |

| Australia: Misc. Transportation |

1.24 |

0.0000 |

Conclusions

- By stripping away the effects of broad markets, we reveal the performance of pure sector factors and their relationships with USD FX.

- U.S. importers and retailers most consistently benefit from appreciating USD.

- U.S. commodity producers and information technology exporters most consistently suffer from appreciating USD.

- The top foreign beneficiaries of these trends are Transportation, Technology, and Auto Parts Sectors.