Hedge funds share a few systematic and idiosyncratic bets. These crowded bets are the main sources of the industry’s relative performance and of many individual funds’ returns. We survey risk factors and stocks responsible for the majority of hedge fund long U.S. equity herding during Q4 2014.

Investors should treat crowded ideas with caution: Due to the congestion of their hedge fund investor base, crowded stocks tend to be more volatile and are vulnerable to mass liquidation. In addition, consensus hedge fund bets have underperformed in the past.

Identifying Hedge Fund Crowding

This piece follows the approach of our earlier articles on fund crowding: We created a position-weighted portfolio (HF Aggregate) consisting of popular long U.S. equity holdings of all hedge funds with medium to low turnover that are tractable from quarterly position filings. We then analyzed HF Aggregate’s risk relative to U.S. Market (Russell 3000) using AlphaBetaWorks’ Statistical Equity Risk Model to identify sources of crowding. More background information and explanations of the terms used below are available in those earlier articles.

Hedge Fund Aggregate’s Risk

The Q4 2014 HF Aggregate had 3.0% estimated future annual tracking error relative to U.S. Market. Risk was primarily due to factor (systematic) bets:

The components of HF Aggregate’s relative risk on 12/31/2014 were the following:

| Source |

Volatility (%) |

Share of Variance (%) |

| Factor |

2.23 |

56.32 |

| Residual |

1.96 |

43.68 |

| Total |

2.97 |

100.00 |

Systematic risk increased by a tenth from the previous quarter. We will see the factors behind this increase below.

With an estimated future tracking error near 3%, HF Aggregate continues to be nearly passive. HF Aggregate will have a very hard time earning a typical fee. Investors in a broadly diversified portfolio of long-biased hedge funds will likely struggle also.

Hedge Fund Factor (Systematic) Crowding

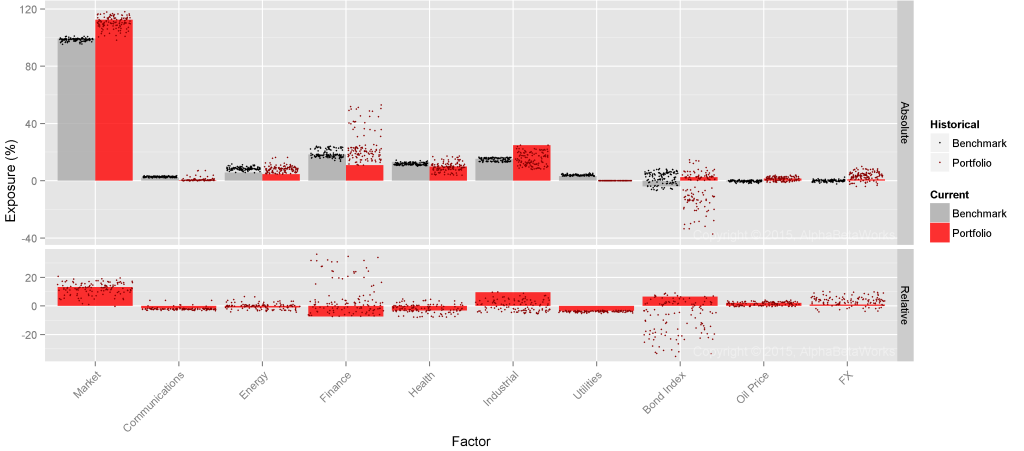

Below are HF Aggregate’s principal factor exposures (in red) relative to U.S. Market’s (in gray) as of 12/31/2014:

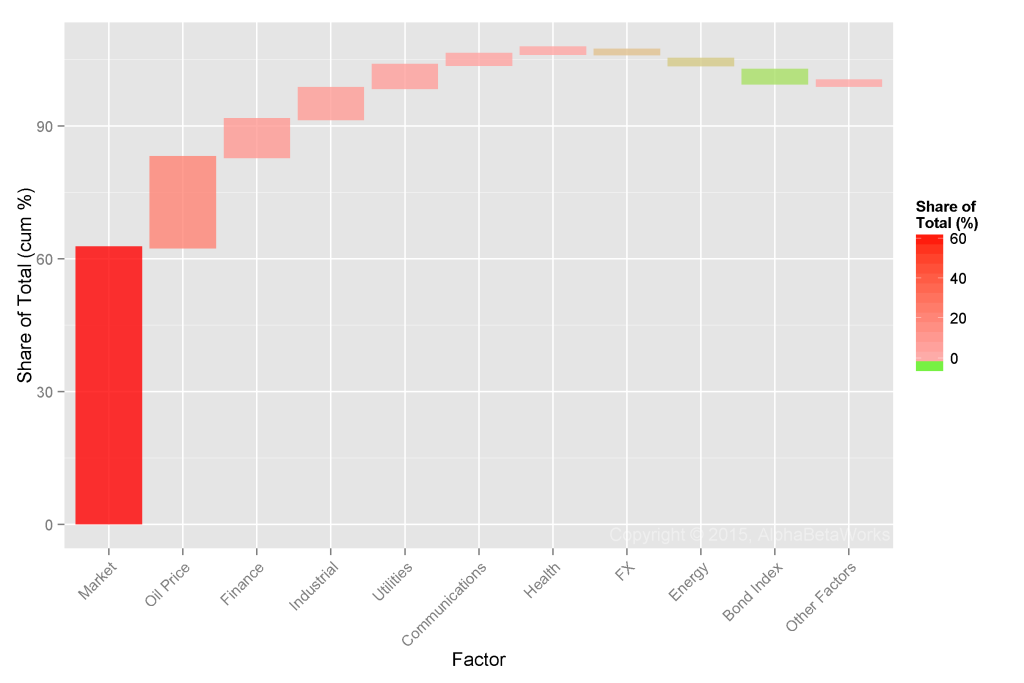

Of these bets, Market (Beta) and Oil are responsible for over 80% of the factor risk relative to U.S. Market. These are the main components of the 2.23% Factor Volatility in the first table:

HF Aggregate has become more systematically crowded since Q3 2014. The following factors were the top contributors to the relative systematic risk on 12/31/2014:

| Factor |

Relative Exposure (%) |

Portfoio Variance (%²) |

Share of Systematic Variance (%) |

| Market |

13.26 |

3.10 |

62.37 |

| Oil Price |

2.23 |

1.01 |

20.32 |

| Finance |

-7.49 |

0.43 |

8.65 |

| Industrial |

9.53 |

0.35 |

7.04 |

| Utilities |

-3.36 |

0.26 |

5.23 |

| Other Factors | -0.18 |

-3.62 |

|

| Total | 4.97 |

100.00 |

The increased factor risk during Q4 2014 was primarily due to a 2% increase in U.S. Market Exposure (Beta). After adding long oil exposure in Q3 2014 as the energy sector selloff intensified, hedge funds kept it steady through Q4.

Hedge Fund Residual (Idiosyncratic) Crowding

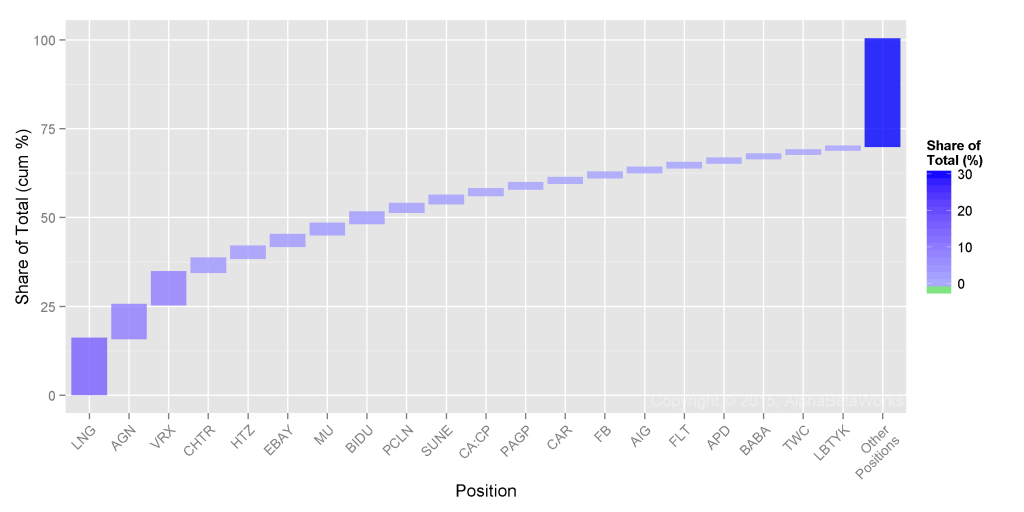

Turning to HF Aggregate’s residual variance relative to U.S. Market, eight stocks were responsible for over half of the relative residual risk:

These stocks will be the primary drivers of HF Aggregate’s and of the most crowded firms’ returns. They will also be affected by the vagaries of capital flows into and out of hedge funds. Investors should be ready for seemingly inexplicable volatility in these names. They may be wonderful individual investments, but history is not on their side, since crowded bets have historically underperformed.

The list is mostly unchanged from the previous quarter:

| Symbol |

Name |

Exposure (%) |

Share of Idiosyncratic Variance (%) |

| LNG |

Cheniere Energy, Inc. |

1.70 |

15.73 |

| AGN |

Allergan, Inc. |

3.53 |

9.51 |

| VRX |

Valeant Pharmaceuticals International, Inc. |

2.35 |

9.18 |

| CHTR |

Charter Communications, Inc. Class A |

1.80 |

3.88 |

| HTZ |

Hertz Global Holdings, Inc. |

1.37 |

3.35 |

| EBAY |

eBay Inc. |

1.91 |

3.27 |

| MU |

Micron Technology, Inc. |

1.08 |

3.21 |

| BIDU |

Baidu, Inc. Sponsored ADR Class A |

1.22 |

3.14 |

| PCLN |

Priceline Group Inc |

1.29 |

2.43 |

| SUNE |

SunEdison, Inc. |

0.63 |

2.29 |

When investing in these crowded names, investors should perform particularly thorough due-diligence, since any losses will be magnified when hedge funds rush for the exits.

Historically, consensus bets have done worse than a passive portfolio with the same risk. Consequently, fund allocators should thoroughly investigate hedge fund managers’ crowding to avoid investing in a pool of undifferentiated bets destined for disappointment.

AlphaBetaWorks’ analytics assist in both tasks: Our sector crowding reports identify hedge fund herding in each equity sector. Our fund reports measure hedge fund differentiation and skills that are strongly predictive of future performance.

Summary

- There is both factor (systematic/market) and residual (idiosyncratic/security-specific) crowding of hedge funds’ long U.S. equity portfolios.

- Hedge funds have become more systematically crowded during Q4 2014, primarily by increasing their Beta.

- The main sources of idiosyncratic crowding are: LNG, AGN, VRX, CHTR, HTZ, EBAY, and MU.

- The crowded hedge fund portfolio has historically underperformed its passive alternative. Investors would have made more by taking the same risk passively – hedge fund investors should pay close attention to crowding before allocating capital.