Can a Fund Earn Its Fees if It Does Not Try?

To be worth the fees it charges, an actively managed fund must take some active risk, rather than merely mirror passive market exposures. However, over a quarter of “active” medium and lower turnover US mutual funds take so little active risk, they are unlikely to earn their management fees. In this article, we build on our earlier work and estimate the risk an active fund must take in order to earn the 1% mean management fee. Simply by testing for funds that are taking too little risk to generate positive net active returns, investors can save billions in fees each year.

Closet Indexing Defined

Our earlier article discussed closet indexing and proposed a new metric of fund activity: Active Share of Variance – the share of volatility due to active management (security selection and market timing). This analytic relies on the factor analysis of historical holdings and is immune to the issues with holdings-based analysis and the issues with returns-based analysis that affect the popular closet indexing tests: Active Share and R². This article uses the AlphaBetaWorks’ Performance Analytics Platform to objectively evaluate the level of fund activity necessary to earn a typical management fee.

Too Little Risk to Make a Difference

Is it possible for a highly skilled manager to take too little risk to earn management fees?

We surveyed 10 years of US filings history of approximately 1,700 non-index medium and lower turnover mutual funds with at least 5 years of filings. This group holds over $3.4 trillion in assets.

We applied the AlphaBetaWorks Statistical Equity Risk Model to funds’ historical holdings to estimate risk at the end of each month. We then attributed the following month’s returns to factor(market) and residual(security-specific) sources, estimated the appropriate factor benchmark, and calculated market timing returns due to variations in factor exposures.

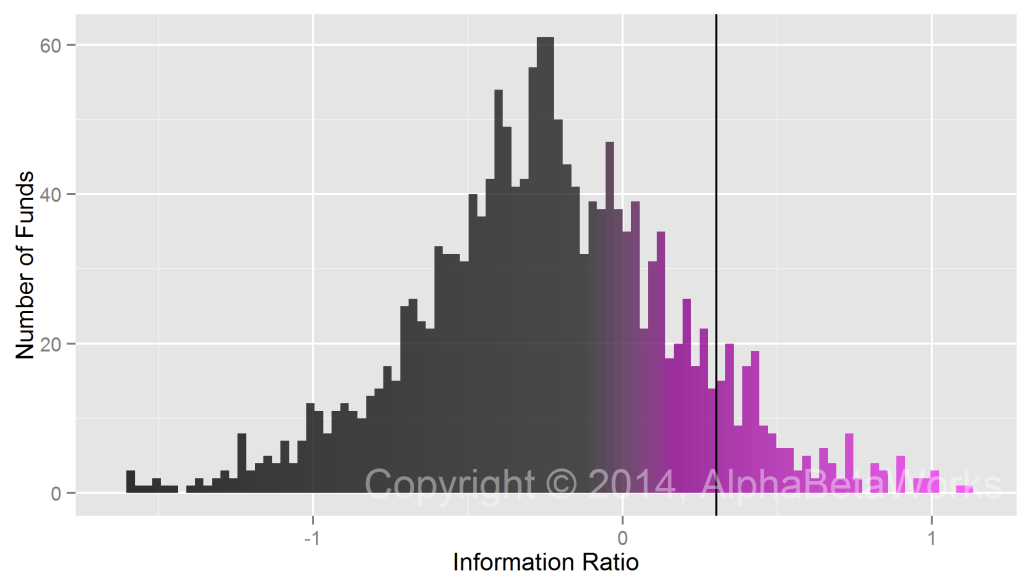

The Information Ratio (IR) is a measure of active return relative to active risk (tracking error). The AlphaBetaWorks Performance Analytics Platform calculated historical (realized) IRs for all funds in the group. The 90th percentile of IR for the group is 0.30, which suggests that 90% of funds needed a tracking error above 3.3% to generate an active return above 1%:

Knowing that the mean expense ratio for active US mutual funds is approximately 1.0%, if all funds were able to achieve the 90th percentile of IR, they would need annual tracking error over 3.3% to generate a positive net active return. Over a quarter (445) of the funds in our survey realized tracking errors below this threshold; they have been so passive that, even assuming an IR of 0.30, they would have failed to generate 1% gross and 0% net active returns:

A Map of US Mutual Fund Skill and Activity

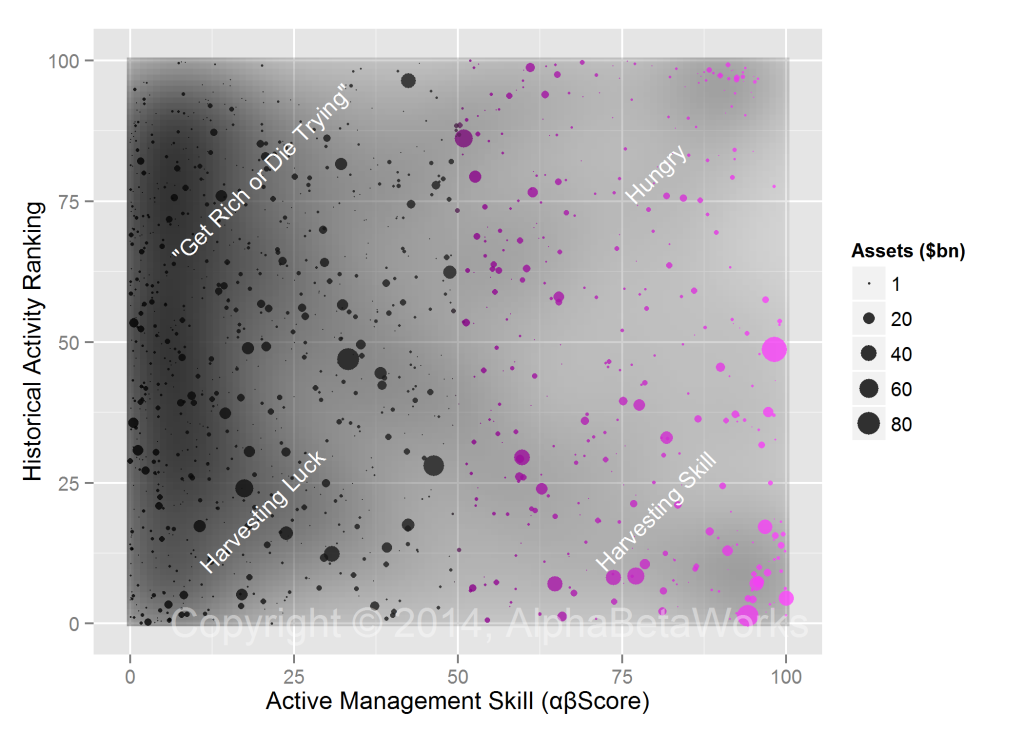

The evolution of skilled managers’ utility curves is one possible explanation for this reluctance to take risk. Perhaps, as a manager accumulates assets, fee harvesting becomes increasingly attractive. The map of fund active management skill and activity, included below, supports this hypothesis: Large skilled funds tend to be relatively less active. In fact, all the funds in the active and skilled (“Hungry”) group are relatively small:

Conclusions

- Over a quarter (26%) of US mutual funds surveyed have been so passive that, even after exceeding the information ratios of 90% of their peers, they would still fail to merit a 1% management fee.

- Large skilled funds tend to be relatively more passive.

- Skilled active managers exist, but investors need to capture them early in their life cycles.

- For this group alone, by identifying funds that take too little risk to generate positive active returns, investors could save between $4 and $10 billion in annual management fees.

Thus far, our work improves on the existing closet indexing metrics by evaluating past fund activity. In subsequent articles we will use the AlphaBetaWorks Performance Analytics Platform to analyze current risk and closet indexing, identifying those funds that are unlikely to earn their management fees in the future.