Asset outflows and portfolio liquidations have devastated crowded hedge fund bets since 2015. Losses have been especially severe in the Finance Sector. We survey hedge fund finance sector crowding and identify the stocks driving it. Investors and allocators must be vigilant: when capital flows out, these bets tend to suffer sharp losses. When capital flows in, they tend to benefit. We also provide an early indicator of this underperformance and outperformance.

Identifying Hedge Fund Finance Crowding

We created an aggregate position-weighted portfolio (Hedge Fund Finance Aggregate, or HF Finance Aggregate) consisting of finance sector equities held by all hedge fund long equity portfolios that are tractable from regulatory filings. The size of each position is the dollar value of its ownership by hedge funds. This process is similar to our earlier analyses of hedge fund crowding. We then evaluated HF Finance Aggregate’s risk relative to the capitalization-weighted portfolio of U.S. finance equities (Market Finance Aggregate) using an AlphaBetaWorks’ Statistical Equity Risk Model. Finally, we analyzed HF Finance Aggregate’s idiosyncratic bets and identified the most crowded ones.

Hedge Fund Finance Sector Performance

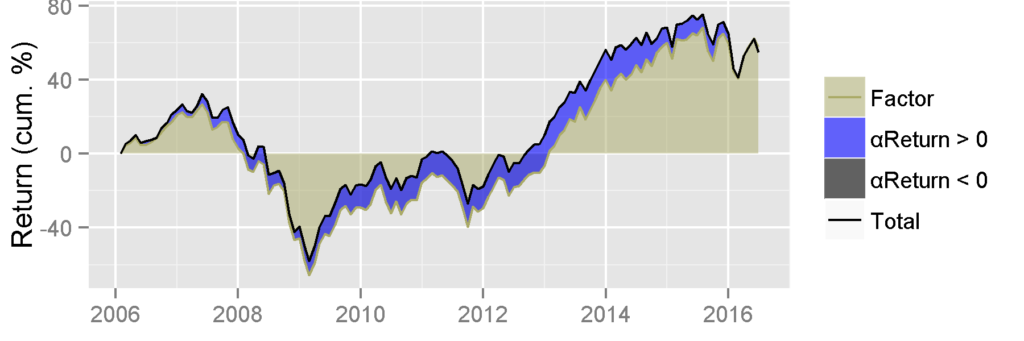

Over the past 10 years HF Finance Aggregate generated approximately the same return as a portfolio of index funds and ETFs with the same systematic (market) risk (Factor Portfolio):

Blue area represents positive and gray area represents negative risk-adjusted returns from security selection, net of factor effects. HF Finance Aggregate outperformed the Factor Portfolio between 2006 and 2013 and has underperformed since. A look at the security selection performance below illustrates the underlying cycles of performance.

Hedge Fund Finance Sector Security Selection

AlphaBetaWorks’ metric of security selection is αReturn – the performance a portfolio would have generated if markets had been flat. It is also the performance of a portfolio with its factor exposures hedged:

Hedge funds have enjoyed positive αReturn in the finance sector during calm market regimes. Throughout our test period, the only episode of security selection losses prior to 2014 was Q3 2008. It was followed by a sharp reversal starting in late-2008. The 2008-2010 security selection gains of HF Finance Aggregate illustrate how forced liquidation of 2008 ended with a mean-reversion: the biggest losers became attractive opportunities.

The cycles of asset inflows and liquidations are common to HF Sector Aggregates. Illustrations can be found in our previous pieces on hedge fund semiconductor crowding and hedge fund exploration and production crowding.

HF Finance Aggregate has been showing signs of liquidation since mid-2014. This was also the time when the overall HF Aggregate began to generate negative αReturns that eventually turned into a rout. Since 2014, hedge funds’ long finance picks underperformed by 15% on a risk-adjusted basis. Had the industry taken the same risks passively with ETFs, its long financials portfolio would have generated approximately 15% higher return.

Hedge Fund Residual (Idiosyncratic) Finance Sector Crowding

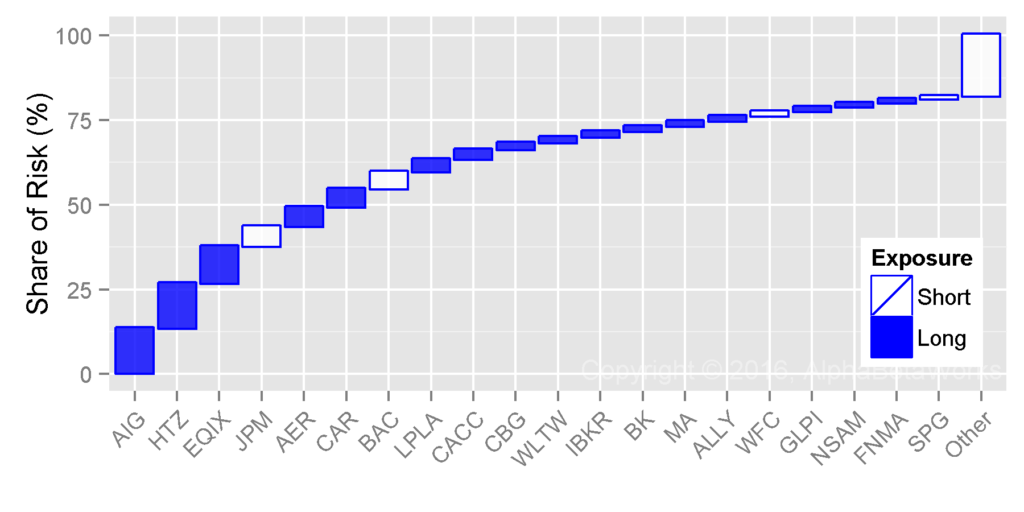

Hedge fund sector portfolios have a history of booms and busts. Their sharply negative αReturns usually signal liquidations. Consequently, identifying and avoiding crowded bets is vital during these periods. When a cycle eventually turns, the biggest losers can present attractive opportunities. The following stocks were recent top contributors to idiosyncratic (stock-specific) risk of HF Finance Aggregate – its most crowded stocks. Blue bars represent long (overweight) exposures relative to Market Finance Aggregate. White bars represent short (underweight) exposures. Bar height represents contribution to relative stock-specific risk:

The following table contains detailed data on the residual hedge fund finance sector crowding:

| Exposure (%) | Net Exposure | Share of Risk (%) | |||||

| HF Sector Aggr. | Sector Aggr. | % | $mil | Days of Trading | |||

| AIG | American International Group, Inc. | 7.98 | 1.49 | 6.49 | 3,651.8 | 6.6 | 13.33 |

| HTZ | Hertz Global Holdings, Inc. | 2.51 | 0.11 | 2.40 | 1,350.1 | 10.3 | 13.32 |

| EQIX | Equinix, Inc. | 4.20 | 0.56 | 3.64 | 2,048.5 | 10.0 | 10.95 |

| JPM | JPMorgan Chase \& Co. | 0.80 | 5.31 | -4.51 | -2,536.9 | -1.9 | 5.85 |

| AER | AerCap Holdings NV | 2.24 | 0.19 | 2.05 | 1,154.8 | 8.4 | 5.71 |

| CAR | Avis Budget Group, Inc. | 1.39 | 0.06 | 1.33 | 746.5 | 8.2 | 5.34 |

| BAC | Bank of America Corporation | 0.66 | 3.40 | -2.74 | -1,543.8 | -0.9 | 5.11 |

| LPLA | LPL Financial Holdings Inc. | 1.62 | 0.05 | 1.56 | 879.1 | 38.4 | 3.60 |

| CACC | Credit Acceptance Corporation | 1.32 | 0.09 | 1.23 | 693.5 | 22.3 | 2.84 |

| CBG | CBRE Group, Inc. Class A | 1.76 | 0.24 | 1.52 | 856.0 | 8.9 | 2.00 |

| WLTW | Willis Towers Watson Public Limited Comp | 2.46 | 0.40 | 2.06 | 1,161.3 | 8.0 | 1.73 |

| IBKR | Interactive Brokers Group, Inc. Class A | 1.27 | 0.06 | 1.21 | 680.8 | 20.9 | 1.65 |

| BK | Bank of New York Mellon Corporation | 3.60 | 0.97 | 2.63 | 1,481.9 | 5.1 | 1.58 |

| MA | MasterCard Incorporated Class A | 4.29 | 2.51 | 1.78 | 1,002.7 | 0.9 | 1.56 |

| ALLY | Ally Financial Inc | 1.84 | 0.22 | 1.62 | 911.9 | 4.1 | 1.41 |

| WFC | Wells Fargo & Company | 2.43 | 5.97 | -3.54 | -1,994.8 | -1.9 | 1.33 |

| GLPI | Gaming and Leisure Properties, Inc. | 1.28 | 0.09 | 1.19 | 672.0 | 9.1 | 1.33 |

| NSAM | NorthStar Asset Management Corp | 0.95 | 0.05 | 0.90 | 506.3 | 19.3 | 1.29 |

| FNMA | Federal National Mortgage Association | 0.29 | 0.04 | 0.25 | 139.5 | 42.7 | 1.10 |

| SPG | Simon Property Group, Inc. | 0.01 | 1.60 | -1.59 | -894.9 | -2.0 | 0.89 |

| … | Other Positions | 0.64 | 18.06 | ||||

| Total | 100.00 | ||||||

Long (overweight) exposures to AIG, HTZ, EQIX, and AER as well as short (underweight) exposure to JPM account for half of the stock-specific risk and volatility of hedge funds’ long financials books. The stock-specific losses of the crowded financials bets in 2015-2016 have been more severe than those in the 2008 crisis. Given this severity, when the cycle turns positive the crowded books are likely to outperform.

Analytics built on a robust risk model, such as the AlphaBetaWorks Statistical Equity Risk Model used here, offer leading indicators of portfolio liquidations and losses to crowding. These analytics provided portfolio managers and investors with warning signs as early as 2014, helping avoid losses, or even profit from herding. Since liquidations and crowding losses are routine, it is also vital that allocators identify undifferentiated managers.

Conclusions

- Analysis of hedge fund crowding using robust risk models provides early signs of portfolio liquidations and opportunities.

- Half of hedge fund residual (idiosyncratic, stock-specific) finance sector crowding comes from only five stocks.

- Investors with robust data on hedge fund crowding and cycles of capital flow can reduce losses and profit from opportunities.

- Allocators with robust data on hedge fund crowding can monitor manager differentiation and reduce losses.