The March to Uniformity – Illustrated and Quantified

We examined the evolution of systematic, idiosyncratic, and total risk of long equity hedge fund portfolios relative to each other. We found decreasing differentiation and increasing herding over time. In summary, over the past 10 years total differentiation declined by 30% while systematic (factor) differentiation declined by 39%. As capital increasingly flows to undifferentiated managers, uninformed allocators will find themselves in crowded bets that are destined, at best, for index returns. With proper tools, investors can identify plenty of skilled and differentiated managers.

Hedge Funds Going Mainstream

The rise of hedge funds as an institutional asset class has been hazardous to diversified hedge fund portfolios. Some researchers find the asset class has under-performed a passive equivalent over the past ten years, while cumulative real investor profits over the period may have been negative. Even the industry-backed rebuttal shows similar post-2004 performance (Table 4: Investing in hedge funds vs T-bills).

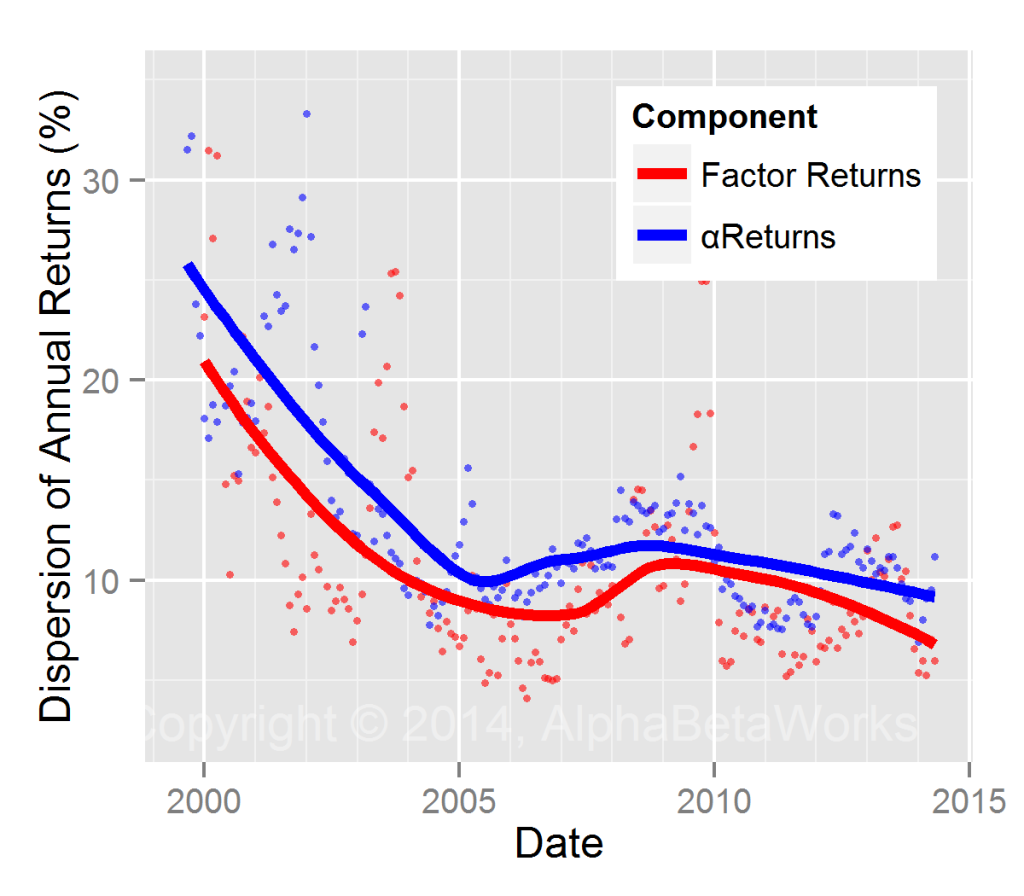

A larger pool of capital chasing a limited set of opportunities is commonly blamed. The systematic (factor) and idiosyncratic (residual) return dispersion of currently active funds’ long equity portfolios has indeed decreased dramatically over the past 15 years. Even during the 2008-2009 volatility spike, the active returns of today’s funds were less differentiated than in the lower-volatility regime of 2003-2004:

In spite of this herding, many differentiated and skilled funds remain. The key is finding them. Skilled and differentiated managers are likely to generate positive idiosyncratic returns in the future. Allocators who lack the proper tools may find themselves invested across many funds that are not nearly as distinguished as they seem.

Analyzing Hedge Fund Crowding Trends

We used the AlphaBetaWorks (ABW) North America Statistical Equity Risk Model to analyze the long equity positions of today’s medium to low turnover hedge funds at two points in time: year-end of 2004 and 2013. We combined position factor exposures to estimate fund factor exposures. We then compared the factor exposures and residual risk of every fund relative to every other fund, estimating the future relative volatility (tracking error) of every fund pair. At each date, we estimated the relative tracking errors for approximately 100,000 portfolio pairs. We then aggregated estimates of funds’ differences into a broad picture of differentiation within the asset class. We further separated differences among funds into market (factor) and security-specific (residual) bets. The higher the expected relative tracking error between two funds, the more different they are from one another.

This approach is more robust than returns-based style analysis, which fails for funds that vary factor exposures over time. The ABW Equity Risk Models also address flaws common to simpler holdings-based and fundamental analyses.

Total Hedge Fund Differentiation

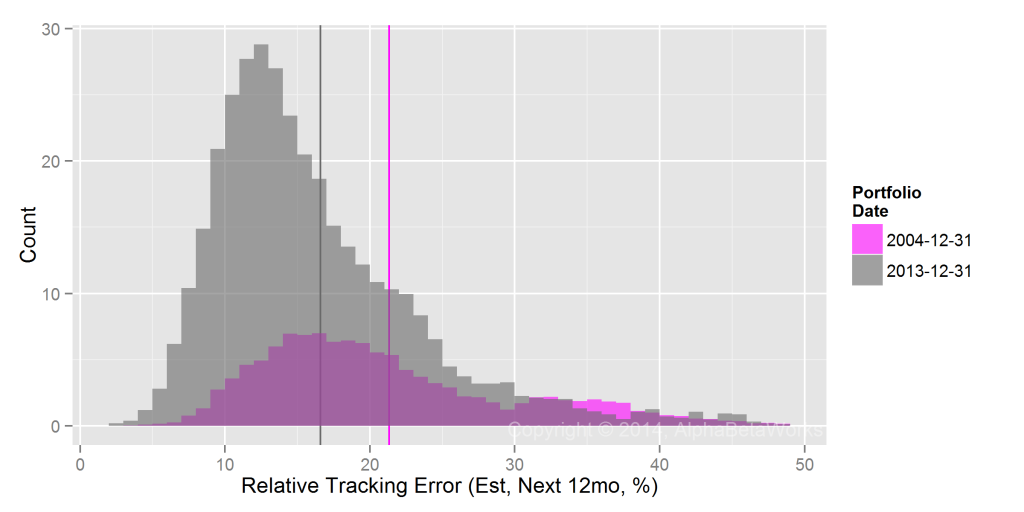

Between 2004 and 2013, the average expected tracking error between two hedge fund long portfolios declined from 21% to 16%:

However, this relative tracking error is not representative of the differentiation investors will realize – it ignores fund size.

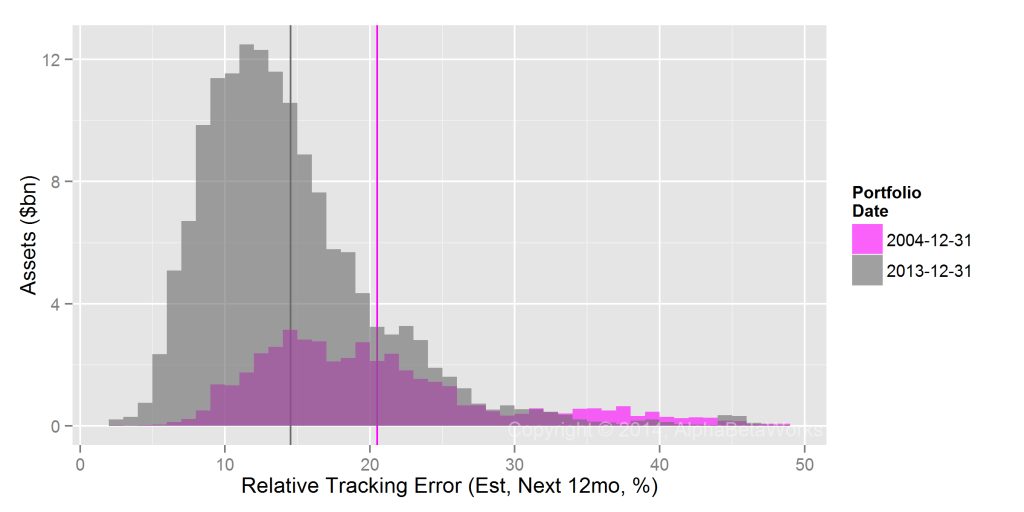

A better measure of investor outcomes uses asset-weighted tracking error – the expected relative volatility of two dollars invested in different portfolios. This measure declined from 21% to 14%:

The largest funds – and dollars invested in them – have become even more crowded than the average fund.

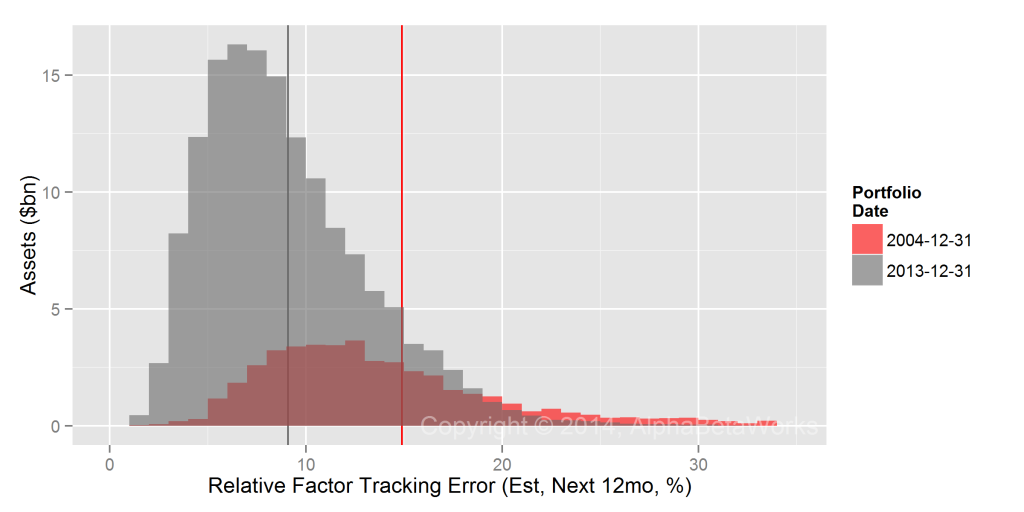

Systematic (Factor) Differentiation

The primary driver of hedge fund crowding is the herding of market (factor) bets. The expected volatility of relative factor returns for capital invested in different funds dropped from 15% in 2004 to 9% in 2013.

We estimate that in 2014, differences in factor returns of hedge funds’ long equity portfolios will be below 9% about 2/3 of the time.

While much capital is pursuing uncorrelated systematic bets, the bulk is relatively less differentiated and crowded into similar factors. Our earlier Insight discussed these shared factor bets.

Hedge Fund Skill, Size, and Differentiation

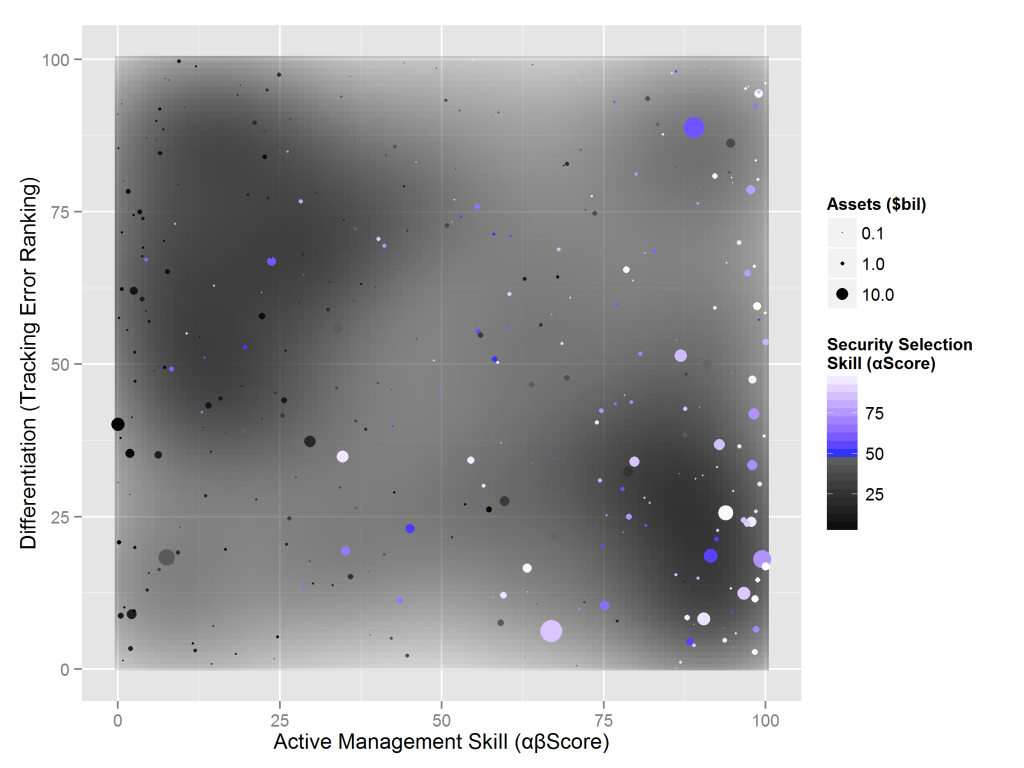

The long equity portfolios of today’s hedge funds have become markedly less differentiated between 2004 and 2013, primarily due to the crowding of factor bets. Crowding is greatest among the largest funds, as evidenced by the larger circles in the lower half of the figure below – a map depicting hedge fund skill and differentiation:

Skilled, differentiated managers are in the upper-right. Unskilled, un-differentiated managers are in the bottom-left.

In spite of increased hedge fund herding, plenty of skilled and differentiated managers remain. Especially attractive are those who stand apart from the crowd and make large bets in areas where they show significant evidence of skill. We discuss general and specific fund skills in earlier articles. AlphaBetaWorks Analytics enable allocators to identify both and quantify crowding within existing fund portfolios.

Summary

Hedge fund crowding has increased over the past 10 years due to declines in market (factor) and stock-specific (residual) differentiation:

- Between 2004 and 2013, total differentiation declined by 30%.

- Between 2004 and 2013, systematic (factor) differentiation declined by 39%.

- New capital has been predominantly committed to less differentiated managers.

- Many skilled and differentiated managers exist and can be identified with the proper tools.

- ABW identifies skilled and differentiated managers, including those most likely to outperform in the future.