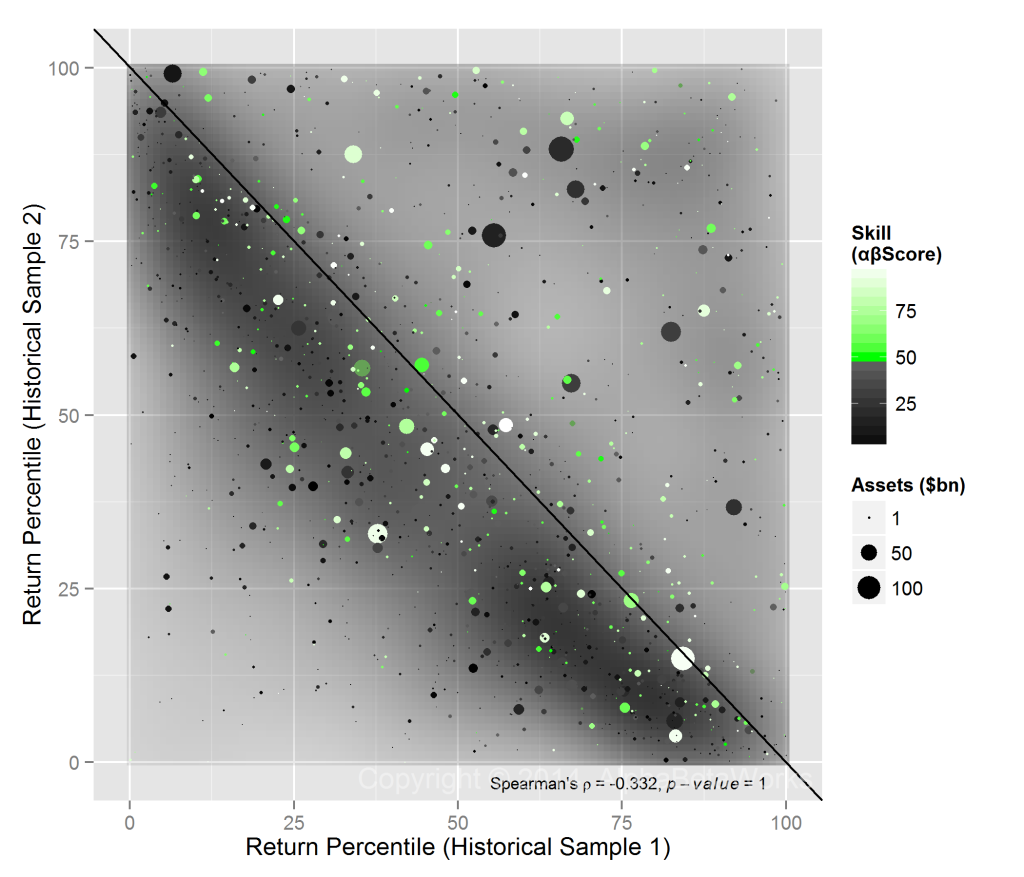

Managers Are Skilled in Specific Areas, Seldom Excellent at Everything

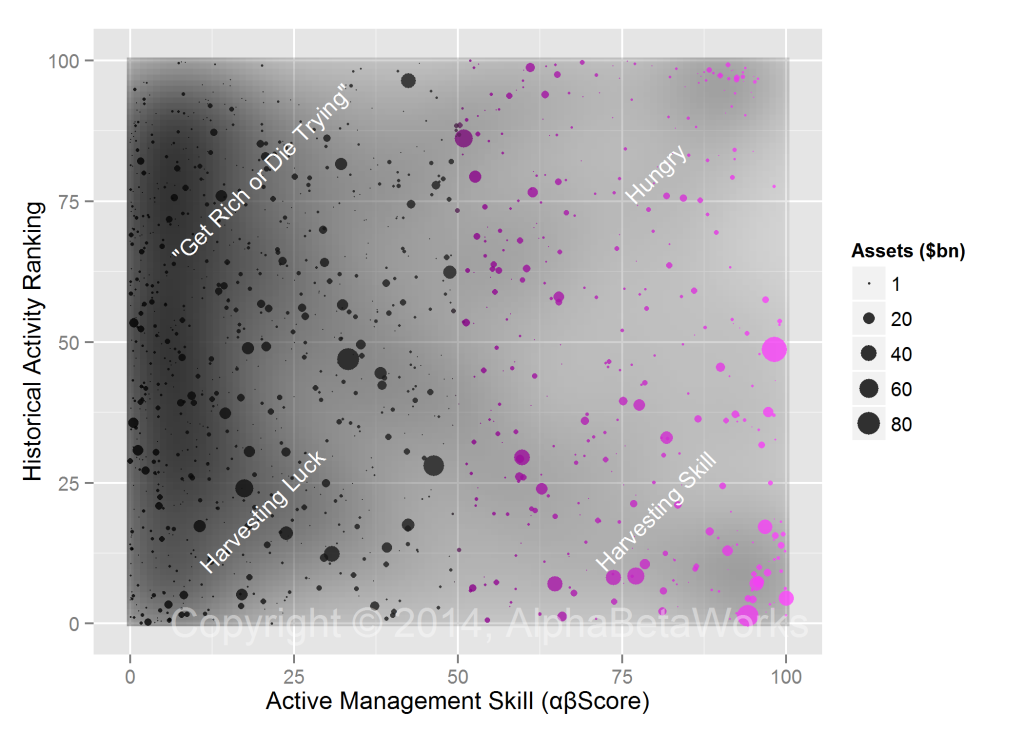

Investors typically treat all ideas of excellent managers with equal deference. This is a mistake. Most skilled managers achieve positive risk-adjusted performance in a few specific areas, and under-perform in others. This article continues the series surveying specific skills of widely-followed investment managers.

Paulson & Co – Long Equity Security Selection

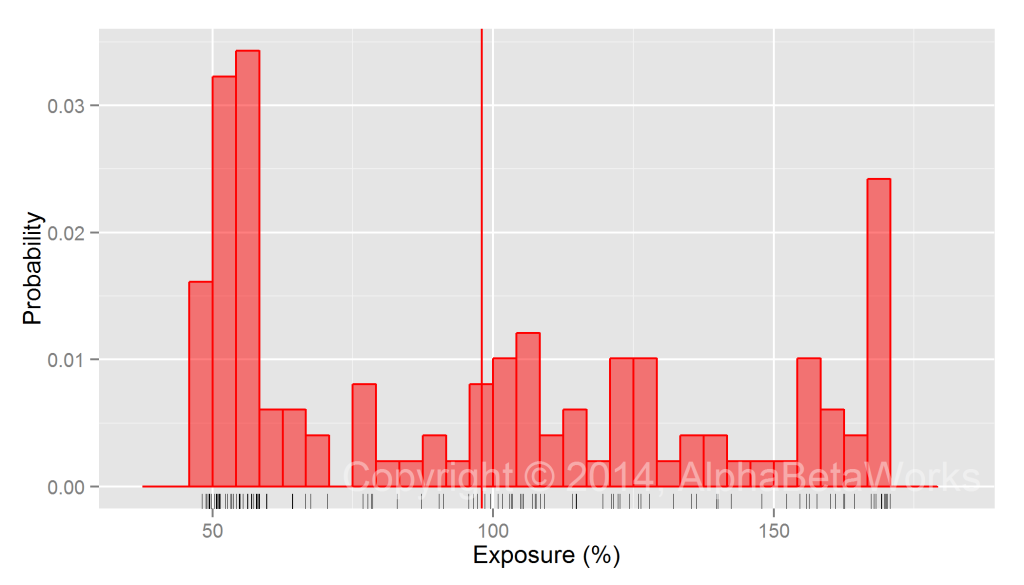

John Paulson’s investment management firm, Paulson & Co., is best-known for the 2007 bet against the subprime mortgage market. The phenomenal success of this bet, generating a reported $15 billion in profit during 2007, earned the firm investor and media following. As a result, many continue to monitor the firm’s equity holdings and invest in its top positions. Putting the famed short-credit bet aside, how well has Paulson & Co selected long equity positions?

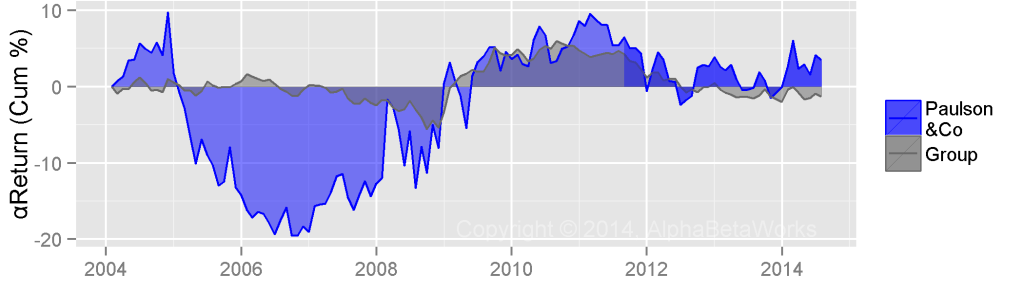

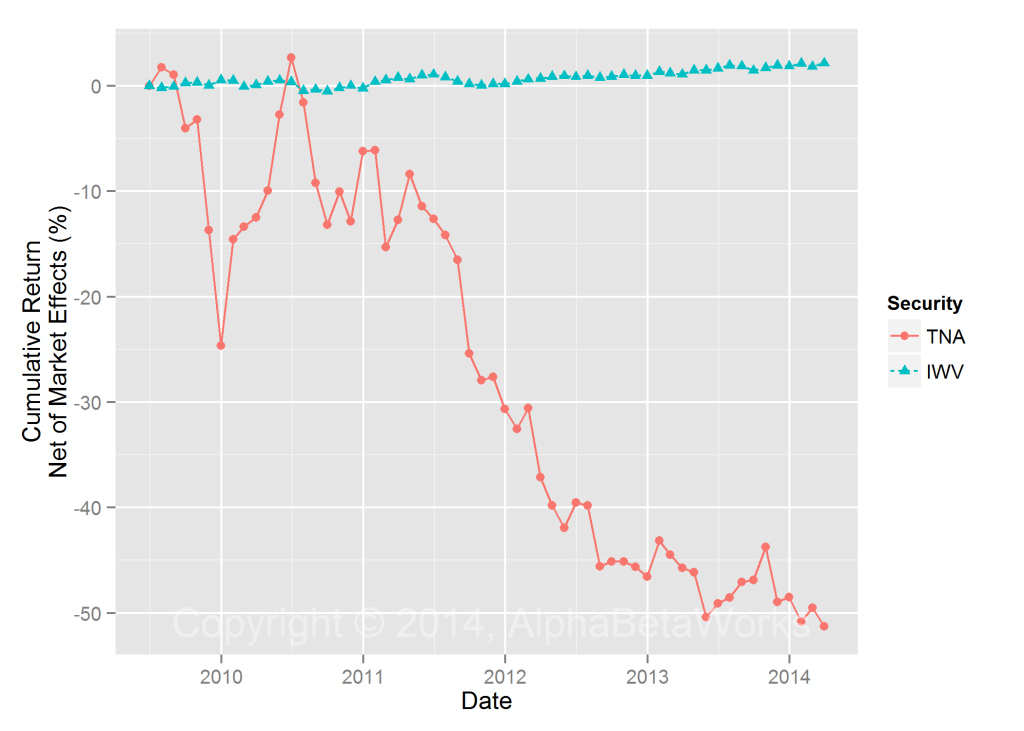

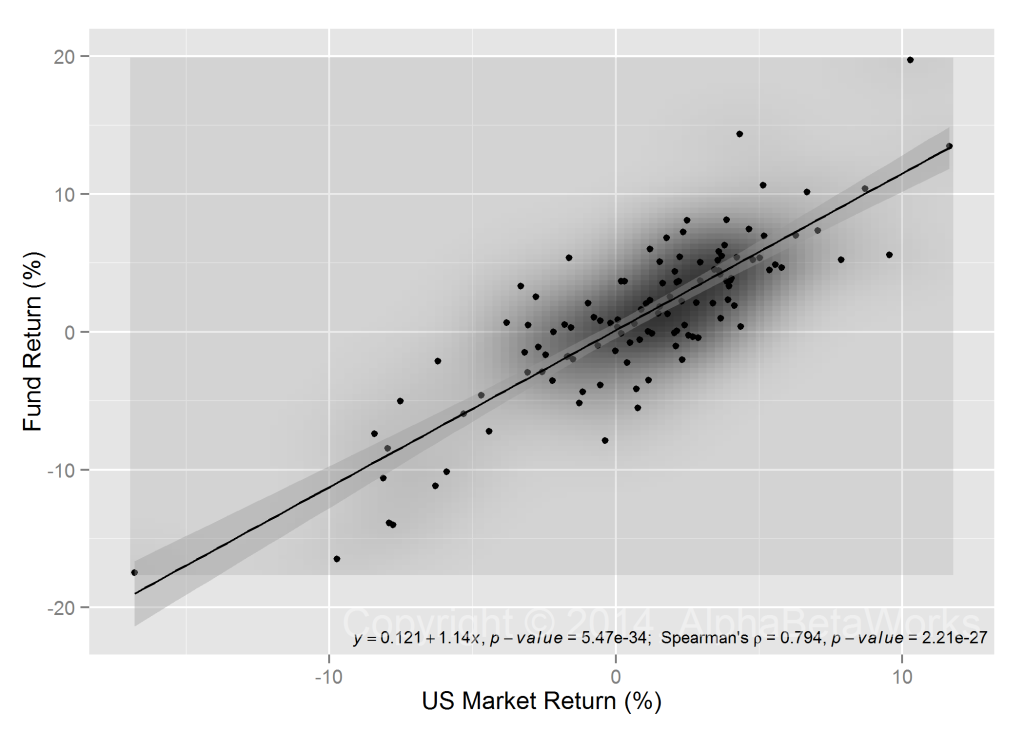

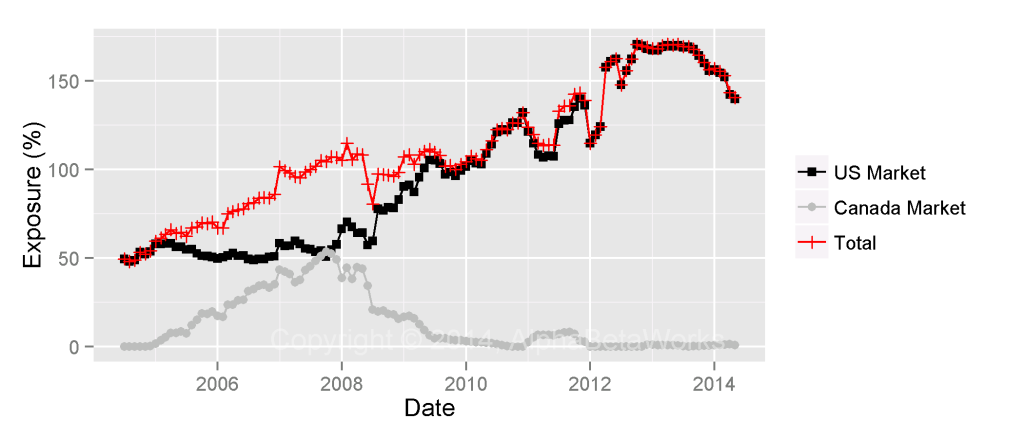

We estimate that over the past 10 years, Paulson & Co’s long equity holdings generated approximately 6% cumulative risk-adjusted return from security selection (stock picking). This is Paulson & Co’s 10-year αReturn, a metric of security selection performance – the estimated annual percentage return the fund would have generated in a flat market. αReturn is independent of the market and is a component of total return.

- Between 2007 and 2011 the firm generated over 35% αReturn. Insights into the subprime crisis benefited risk-adjusted equity performance during this period.

- In 2011 most of the firm’s well-publicized losses came from poor market timing. But stock picking also played a role: αReturn was

-10%. An analysis of Paulson’s market timing is beyond the scope of this article.

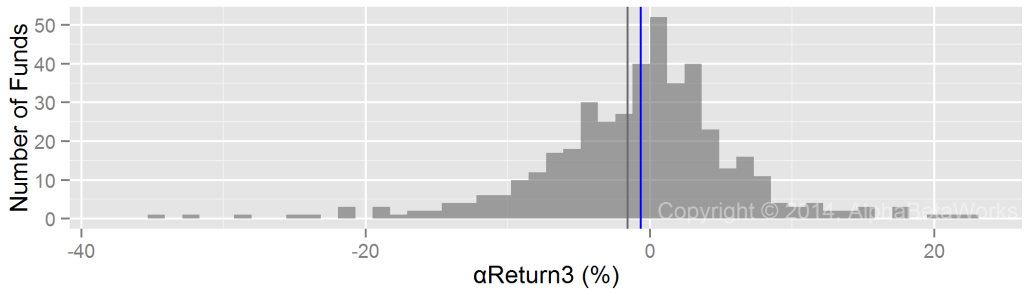

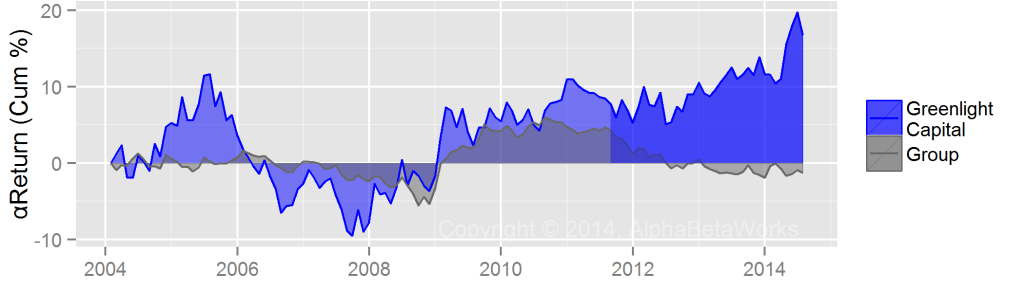

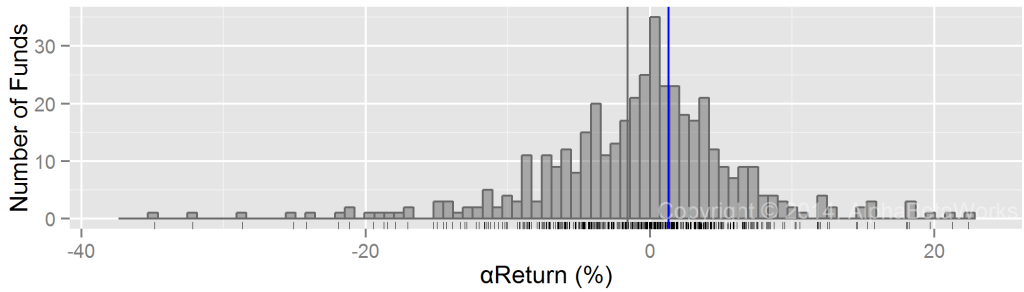

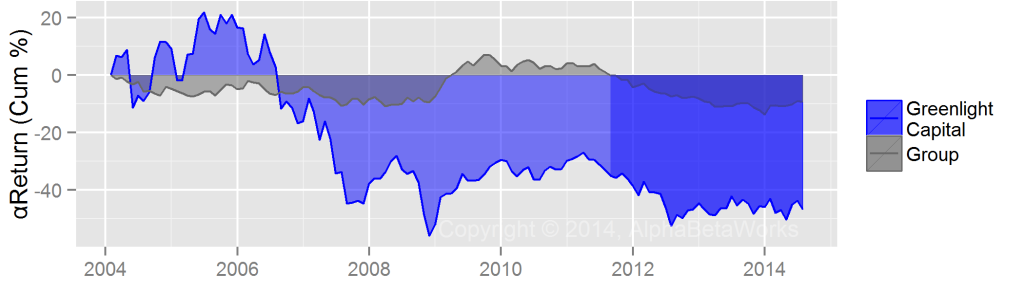

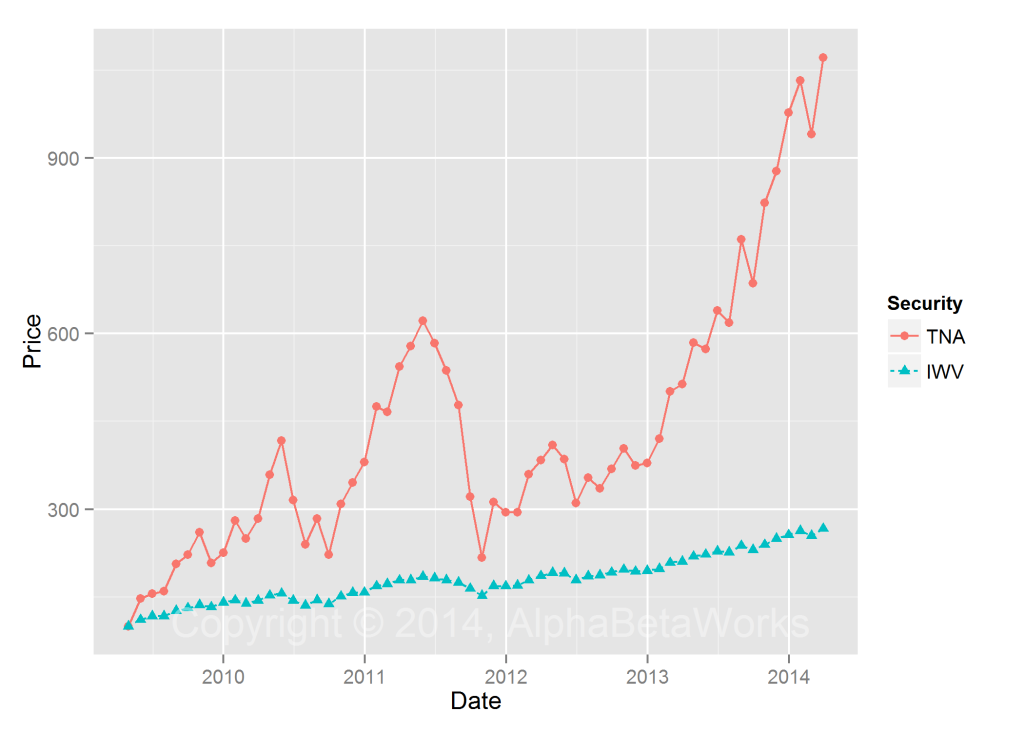

Recently, Paulson’s stock-picking performance has been mixed and αReturn flat. While most of the firm’s investments are equities, the large gains that made the firm famous primarily came from fixed income bets. Paulson’s long equity risk-adjusted performance (blue line below) is only slightly above average:

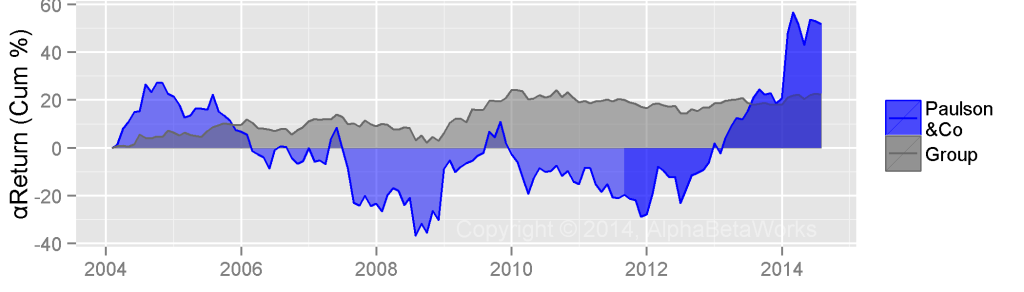

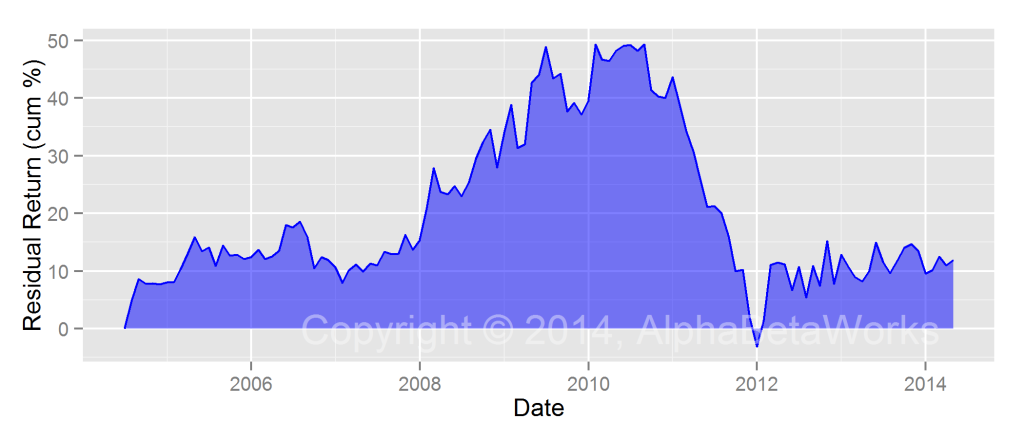

Industrials Sector Performance

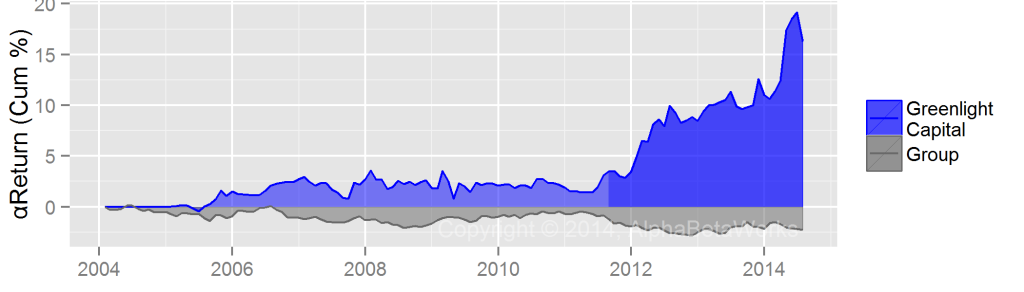

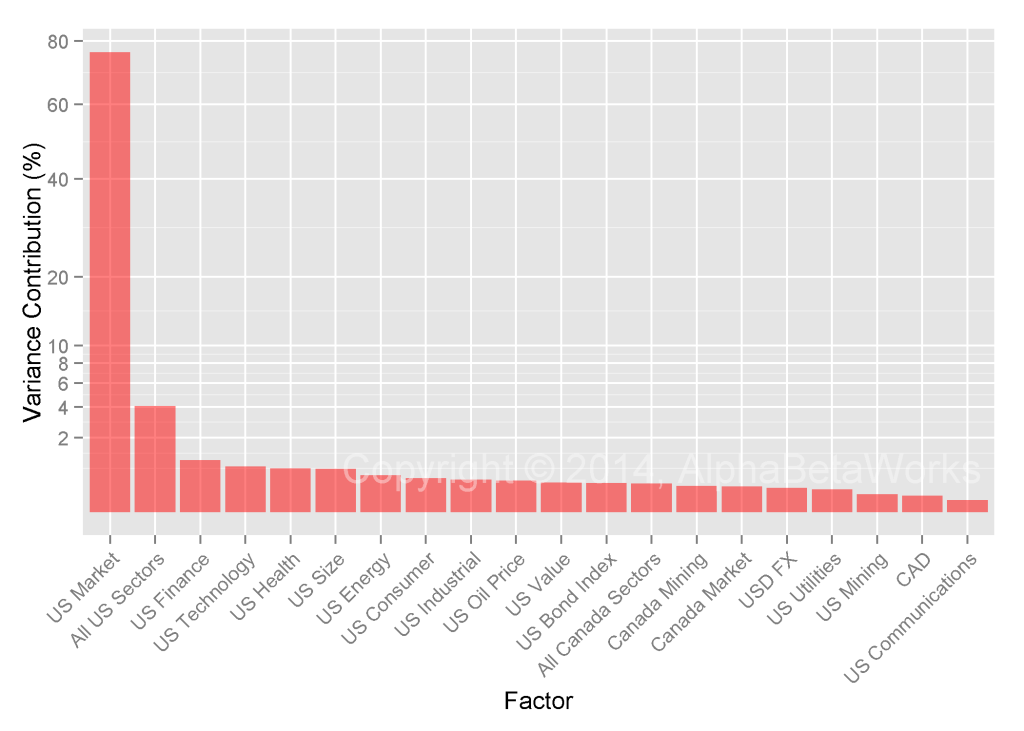

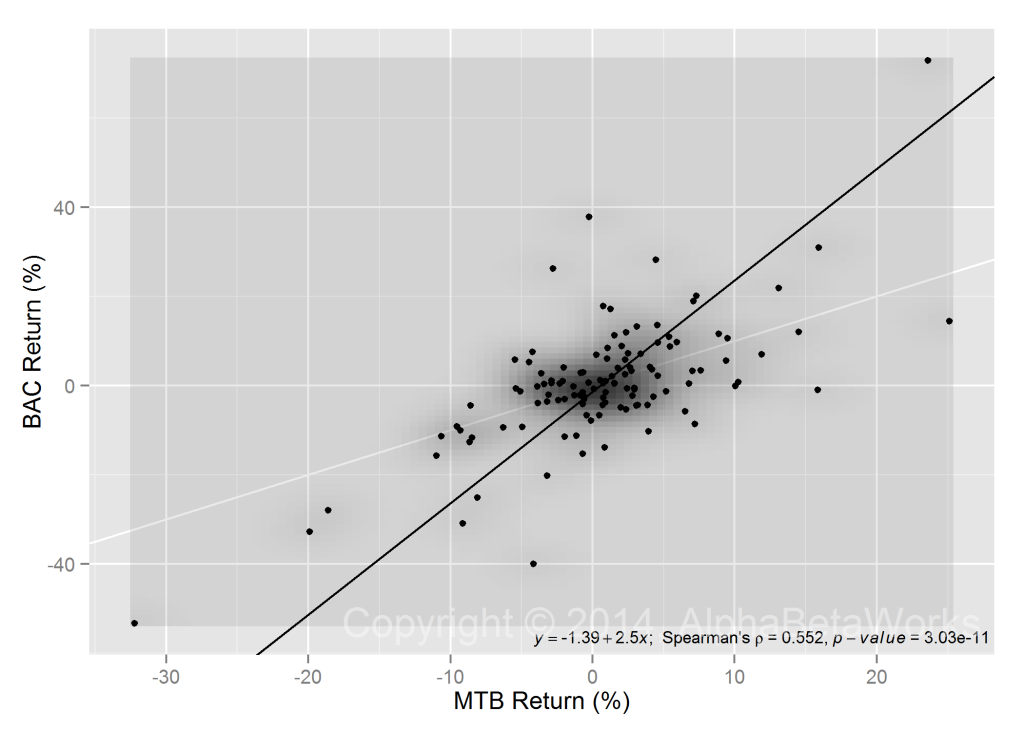

As we illustrated in our first post in the series, analyzing Greenlight Capital, most funds’ stock picking performance varies from sector to sector.While Paulson’s overall long stock picks have not generated positive risk-adjusted returns, industrials portfolio generated greater than 60% αReturn over the past three years. Said differently, if the market were flat for the past three years, Paulson’s long equity industrials sector picks would have gained over 60%.

Investors would be wise to pay attention to Paulson’s industrials picks.

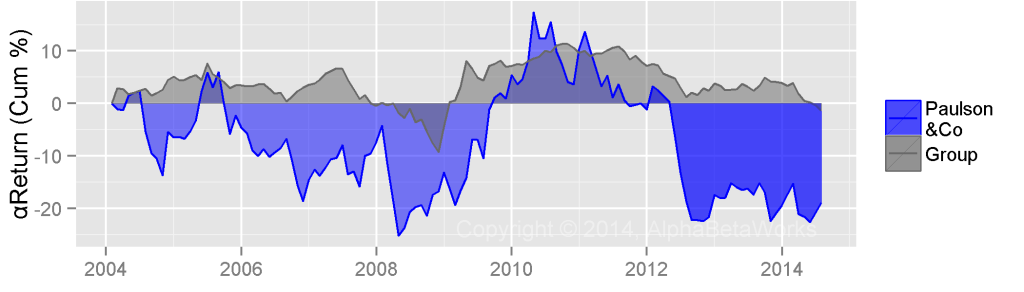

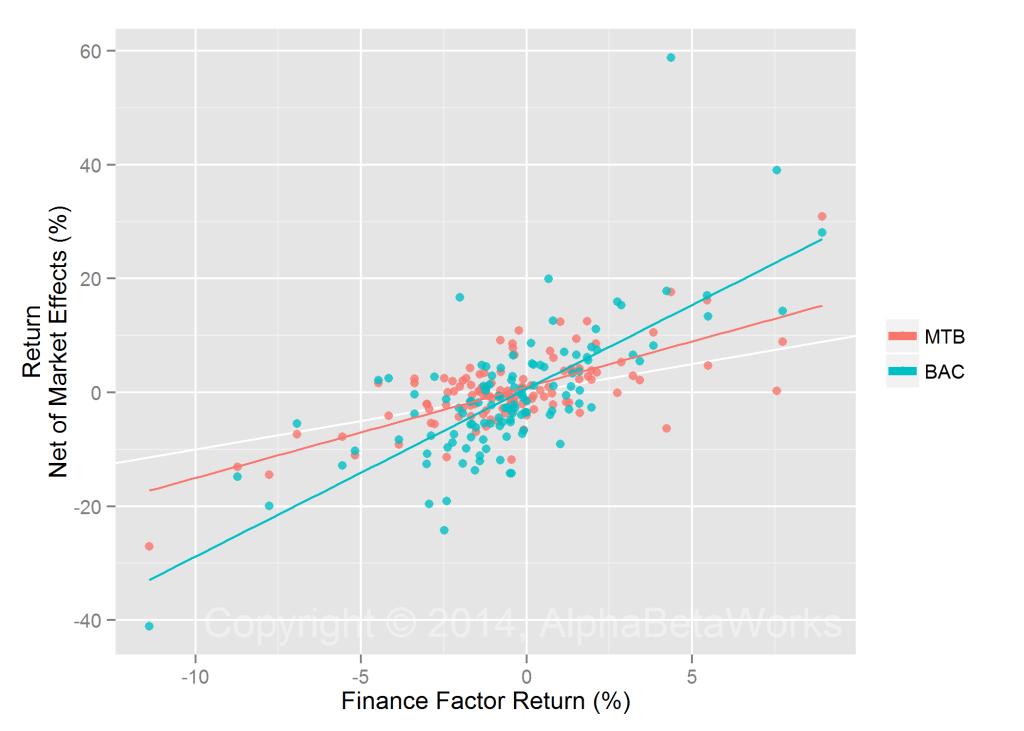

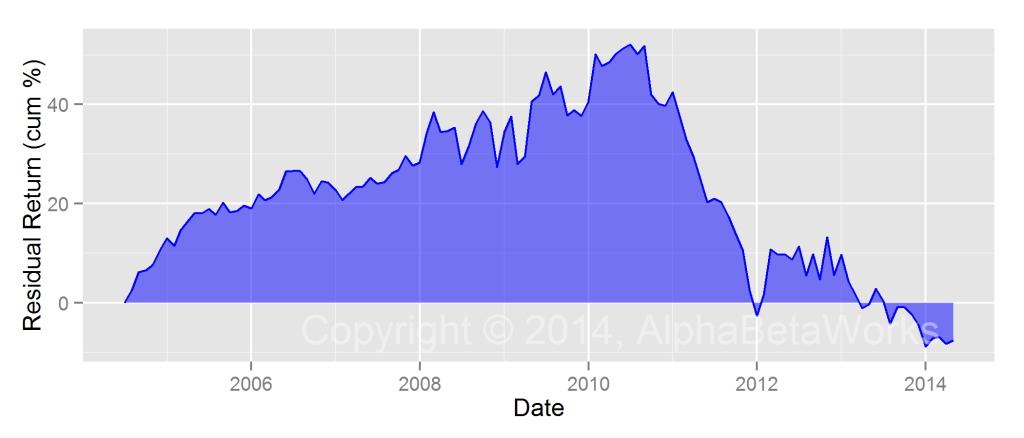

Consumer Sector Performance

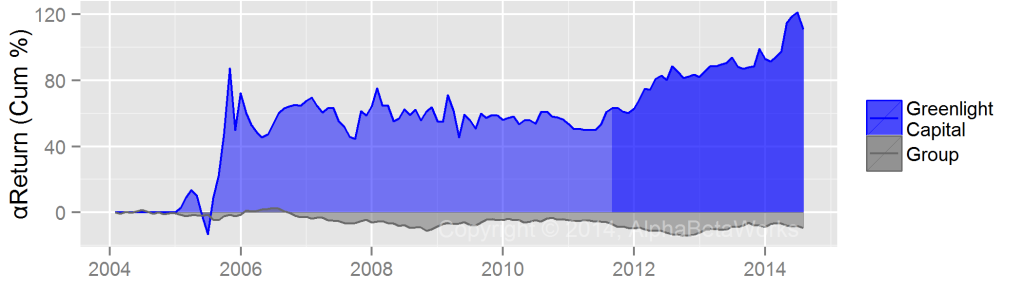

Investors may want to stay clear of Paulson & Co’s consumer picks. We estimate that if market were flat for the past three years, the consumer sector portfolio would have lost 20%:

Recent Holdings

Paulson & Co’s risk-adjusted performance in the industrial and consumer sectors results from numerous investment decisions over many years and not from a few outliers. The top holdings in the industrial sector, an area of skill, are:

| AAL | American Airlines Group |

| DLPH | Delphi Automotive |

| RKT | Rock-Tenn Company |

Based on Paulson & Co’s performance in this sector, these equities are likely to generate positive risk-adjusted returns in the future and positive returns in a flat market.

Paulson & Co’s top holdings in the consumer sector, an area of weakness, are:

| STAY | Extended Stay America |

| TWC | Time Warner Cable |

| HMHC | Houghton Mifflin Harcourt Company |

| MGM | MGM Resorts International |

| RLGY | Realogy Holdings |

Based on Paulson & Co’s performance in this sector, these holdings are likely to generate negative risk-adjusted returns in the future and negative returns in a flat market.

Conclusions

- Investors wrongly assume that outstanding investment managers are skilled in all areas.

- Most managers have areas of skill and areas of weakness.

- Paulson & Co’s recent industrial sector stock picking has been strong.

- Paulson & Co’s recent consumer sector stock picking has been weak.

- Investors following Paulson & Co should favor the firm’s industrial sector stock picks and should be skeptical of the firm’s consumer picks.

The insights above are primarily directed at those who indiscriminately follow the picks of prominent managers. A deep analysis of any company’s fundamentals may lead to different conclusions.

The information herein is not represented or warranted to be accurate, correct, complete or timely.

Past performance is no guarantee of future results.

Copyright © 2012-2014, AlphaBetaWorks, a division of Alpha Beta Analytics, LLC. All rights reserved.

Content may not be republished without express written consent.